Solid growth in economic activity

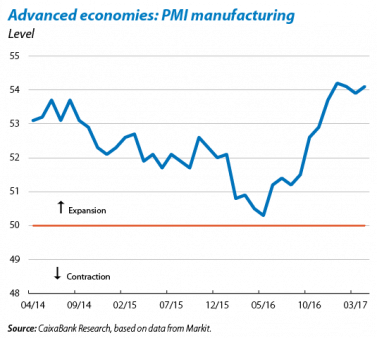

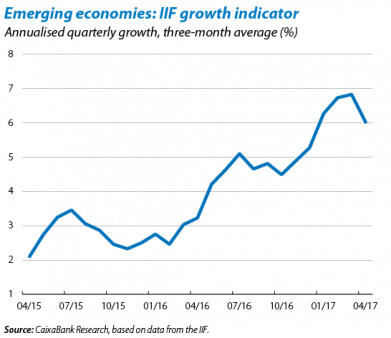

Global economic activity indicators continue to post sizeable increases in Q2. In April, the (PMI) business sentiment index for manufacturing for the advanced economies as a whole was comfortably in the expansionary zone at 54.1 points (above the 50-point threshold). The activity indicator for all the emerging economies produced by the IIF also continued to indicate a high trend of growth in spite of a month-on-month dip. All this endorses the CaixaBank Research scenario which predicts moderate acceleration in world growth from 3.1% in 2016 to 3.5% in 2017.

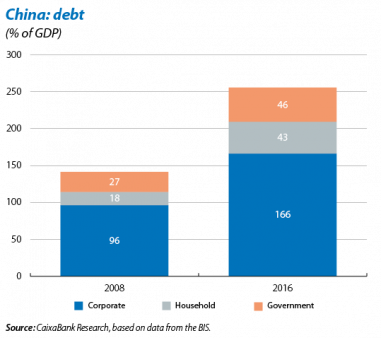

However, high uncertainty is tilting the balance of risks slightly to the downside. Among the strictly economic risks, high global debt has grabbed the limelight this month. Moody’s downgrading of China’s sovereign debt rating, due to the increase in the Asian country’s level of debt while its growth is actually slowing down, is a case in point. Regarding the political risks, this month has seen both positive and negative events. Emmanuel Macron’s victory in France, who beat Marine Le Pen in the presidential elections on 7 May, reduced uncertainty at a European and global level. But political uncertainty increased on the other side of the Atlantic, especially after controversies concerning President Trump and increasing doubts about the new administration’s ability to implement the promised reforms. The health reform bill finally passed by the House of Representatives will require significant adjustments to be approved by the Senate. The tax proposals presented at the end of April will also need to be changed considerably to appease the strong fiscal conservatism of a large part of Trump’s own Republican Party (see the Focus «Trump-style tax reform» in this Monthly Report).

OPEC’s agreement reduces one of the risks in 2017. OPEC and other large oil-producing countries (such as Russia) agreed to extend the oil production cuts until March 2018. This supports the CaixaBank Research scenario of an increase in the price of crude oil, albeit a very gradual one. Such a recovery will help both oil-exporting economies by relieving fiscal pressure, and importing economies since it reduces their deflationary pressures without hindering growth to any great extent.

UNITED STATES

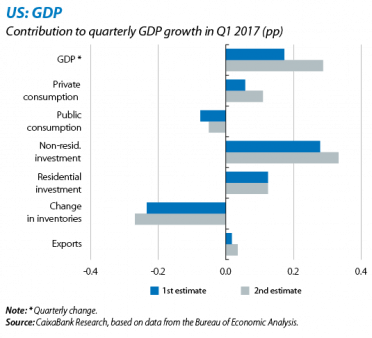

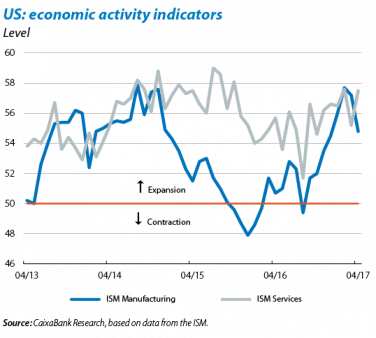

Q1 GDP growth was slightly upgraded although it was still lower than in Q4 2016. In Q1 the US economy grew by a moderate 0.3% quarter-on-quarter (2.0% year-on-year). This loss of steam was due to a notable slowdown in private consumption in spite of the previous month’s estimate being upgraded. Inventories also made a significant negative contribution to GDP growth, deducting even more in the second estimate: –0.3 pp from the quarter-on-quarter rate. However, the latest indicators point to GDP growth speeding up significantly in Q2. The Atlanta Fed’s GDP Now model forecasts 3.7% growth in annualised quarterly terms (compared with 1.2% in Q1).

The Fed is ready for another hike after keeping its benchmark rate target at 0.75% to 1.00% at its May meeting. The minutes from the last meeting revealed that most members of the Federal Open Market Committee believe «it would soon be appropriate» to take another step in removing some monetary stimuli. This points to a hike in the fed funds rate at its June meeting, as predicted by CaixaBank Research. The institution believes that the slowdown observed in Q1 was transitory. It also deemed that March’s lower inflation than expected was not significant and confirmed the strength of the labour market.

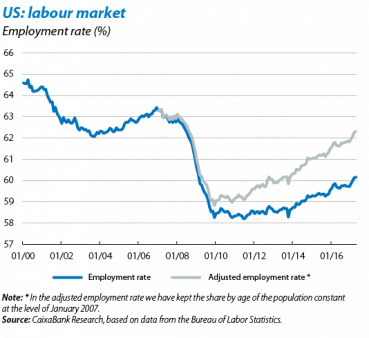

The fact that the US economy is close to full employment suggests the Fed will continue with monetary normalisation. April’s labour market figures were strong: 211,000 jobs were created, the unemployment rate fell slightly to 4.4% and wages rose by a considerable 2.5% year-on-year. Some claim the US labour market still has significant room for improvement given the low employment rate. However, a large proportion of today’s lower levels (compared with pre-crisis figures) are due to the ageing of the working-age population (see the chart). The CaixaBank Research scenario assumes two additional hikes in the fed funds rate in 2017 (June and September), an announcement that reinvestment from its bond portfolio will stop by the end of 2017, and three further hikes in 2018.

JAPAN

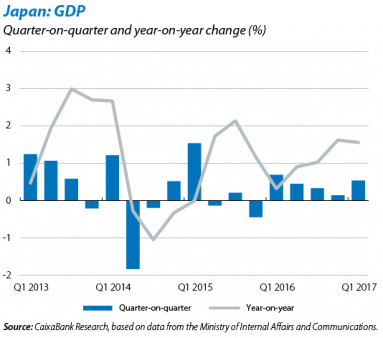

The latest figures from Japan are relatively encouraging. In particular, Japan’s GDP was surprisingly good in Q1, up by 0.5% quarter-on-quarter (1.6% year-on-year). With this advance, Japan has now enjoyed five consecutive quarters of positive figures, the longest growth strech in 11 years. Once again growth was supported by the contribution from exports which, in turn, were helped by a weak yen. Private consumption also performed well in the first quarter. But this is still too weak, in spite of a healthy labour market (2.8% unemployment). Japan’s sluggish prices are undoubtedly affected by this weak consumption, a reminder of the dangers entailed by deflationary pressures. Japanese inflation rose slightly in April, up to 0.4%, but is still very low.

EMERGING ECONOMIES

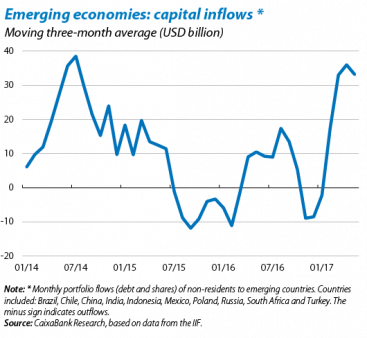

Uncertainty has yet to affect portfolio flows towards the emerging countries. In spite of controversies surrounding President Trump and the Fed’s normalisation strategy, the emerging economies enjoyed significant inflows of foreign capital in April and May. In both months, inflows totalled USD 21 billion according to IIF figures, representing four consecutive months above USD 20 billion, the best record since 2014.

But China’s rating downgrade is a warning sign of the risks still in play. Moody’s downgraded the country’s sovereign credit rating from Aa3 to A1 due to its high and growing level of debt. In the past 8 years, debt has risen by more than 100 points of GDP from 250% of GDP in 2016, mainly due to the heavy debt of its corporate sector. This situation is not limited to China but can be applied to numerous emerging economies. It is therefore a significant source of risk should financing costs increase.

Nevertheless, China is still moving towards a soft landing. April’s economic activity data moderated but remained strong. Industrial production grew by a considerable 6.5% year-on-year, 0.4 pp more than the average over the past two decades but lower than March’s figure (7.6%). Retail and consumer goods increased by 10.7%, a slight slowdown compared with the previous month (10.9%). Inflation stood at 1.2% in April, a modest figure although slightly higher than in March (0.9%).

India grew less than expected but this is merely temporary. In Q1 2017, GDP increased by 6.1% year-on-year, significantly lower than the 7.0% posted the previous quarter. Pending more detailed figures, it appears that demonetisation, the withdrawal of the highest denomination banknotes carried out in November 2016, has had a delayed effect on the economic growth figures. This is a temporary dip, however, as recent figures suggest India’s economy is recovering and moving away from its monetary shock once and for all.

Emerging political uncertainty came from Brazil while Russia’s economic growth accelerated. Possible proof of criminal practices allegedly involving Brazil’s current President, Michel Temer, has sparked another episode of political uncertainty in the country. But the Brazilian parliament is unwilling to get rid of yet another President. As the influence of the PT (the party of Lula and Rousseff) has been strongly eroded, the government is likely to remain in place until the presidential elections in 2018. The latest figures still point to a very slow exit from the recession (0.7% growth in 2017 after –3.6% in 2016). Meanwhile Russia, the other large emerging country in a recession in 2016 (–0.2%), has seen its rate of GDP growth speed up moderately. GDP increased by 0.5% year- on-year in Q1 2017 compared with the 0.3% of the previous quarter. Pending a breakdown by component, economic activity indicators suggest that the trends observed towards the end of 2016 are still in play: less deterioration in domestic demand combined with a positive contribution by exports. The CaixaBank Research scenario for the Russian economy therefore predicts 1.3% growth in 2017 as a whole.