Spain’s inflation differential with the euro area: historical trend and outlook

Spanish inflation is rising. In December, it increased by 0.8 pps to 1.5%, far exceeding euro area inflation (1.1%),1 and the projections for 2017 also expect this differential to increase substantially. This raises the spectre of a return to the first decade of the euro, when Spain’s inflation was repeatedly higher than inflation in the euro area, resulting in a considerable loss of competitiveness. So are there reasons to be concerned about this widening gap in inflation? In principle, the answer is no.

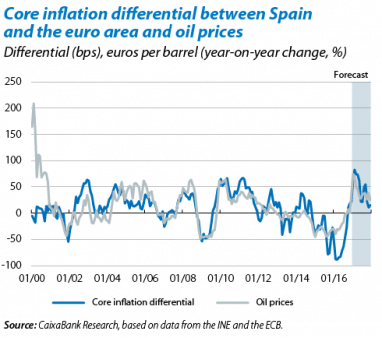

The difference between Spanish and euro area inflation is determined by three fundamental factors: relative unit labour costs, the cyclical position of each economy and oil prices, which have more impact on Spanish inflation because the country is a heavier consumer of hydrocarbons. The relative importance of each factor has gradually altered over the last few years.

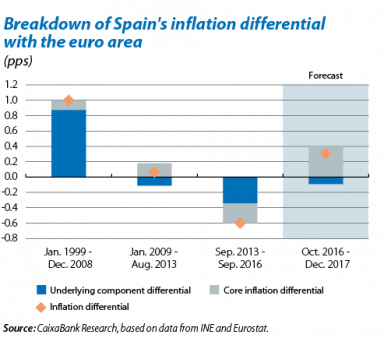

The trend in the inflation differential in the first 18 years of the euro’s life can be divided into three different stages: the inflationary decade, the adjustment period and the recovery stage. In the inflationary decade (1999-2008), Spain’s inflation was, on average, 1 pps higher than inflation in the euro area. Although rising oil prices in this period helped to widen the gap between inflation rates, most can be explained by the difference in core inflation, which does not include energy (see the first graph). Prices in Spain grew faster due to a higher increase in unit labour costs, which rose by 17% compared with euro area countries, and also due to the overheating of the economy in this expansionary phase.

The adjustment in the inflation differential that occurred between 2008 and early 2013 was characterised by price correction caused by the Great Recession, which was more severe in the case of the Spanish economy, and by the considerable adjustment in labour costs in relative terms, partly helped by the country’s labour reform. However, headline inflation was still higher in Spain than in the euro area due to rising oil prices.

In September 2013, the inflation differential became negative: the adjustment in relative labour costs continued and the cyclical position of the Spanish economy was still weaker than the euro area’s position. But an additional factor was the slump in oil prices, down by 16% year-on-year between 2013 and 2016.

In 2017 oil prices will continue to be the dominating factor for the inflation differential but in the opposite direction. In contrast with the inflationary period, this year the inflation differential is expected to be positive again, entirely because of oil. This is important, as the effect of oil will be temporary and, consequently, if wage trends continue the same, the inflation differential will revert to type in 2018.

1. The year-on-year change in the HICP was 1.4% in Spain in December. The article’s assessment and conclusions remain the same with both price indicators.