The Spanish economy starts the year on the right foot

Economic activity remains strong in 2017. The temporary tailwinds propelling the Spanish economy over the past two years (expansionary fiscal policy, low oil prices and favourable financial conditions) will gradually diminish although they should not disappear entirely for some time yet (debt will continue to be refinanced at lower interest rates than a few years ago and oil is unlikely to reach the price levels of 2013-2014). Structural factors such as improved competitiveness and a slightly more flexible labour market should also help to boost growth. The CaixaBank Research GDP growth forecast for 2017 as a whole remains at 2.6%, clearly above average for the advanced economies.

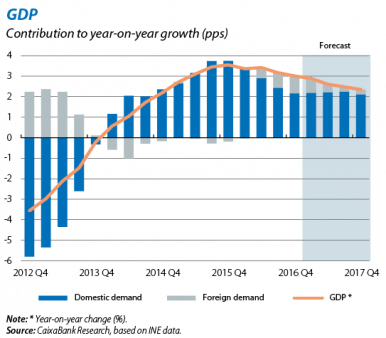

National account data for Q4 confirm the Spanish economy is doing well. GDP grew by 0.7% quarter-on-quarter (3.0% year-on-year) in 2016 Q4, in line with the CaixaBank Research forecast of 3.2% growth for the whole of 2016. The Q4 breakdown by component shows that domestic demand is slowing down gradually, contributing 2.2 pps to year-on-year growth in Q4 compared with 2.5 pps in Q3. Net external demand made a positive contribution of 0.8 pps in Q4 (0.7 pps in Q3). Strong exports and more subdued growth in imports are likely to keep the external sector’s contribution positive throughout 2017.

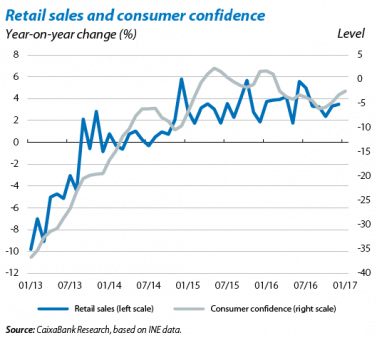

Private consumption remained strong in Q4 and shows no signs of tailing off. Private consumption grew by 0.7% quarter-on-quarter (3.0% year-on-year) in Q4. The positive trend in consumer confidence and retail sales suggest, in the early part of 2017, it will continue the same trend as the end of 2016. Job creation and the favourable credit conditions encouraged by the ECB’s accommodative monetary policy, as well as banks being more able to lend to households, will help consumption to remain strong throughout 2017.

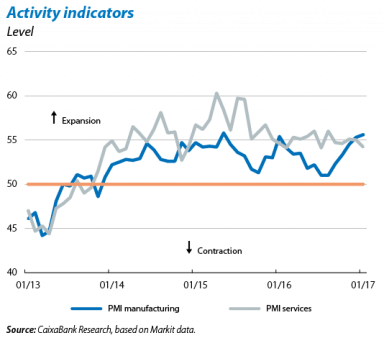

Business sentiment indicators are still high. The PMI for manufacturing and services stood at 55.6 and 55.0 points in January respectively, clearly in the expansionary zone and indicating that activity is performing well across a range of economic sectors. Consequently, the poor figure posted by investment in capital goods for 2016 Q4 (zero quarter- on-quarter growth) is expected to be temporary. Investment in construction, up by 0.7% quarter-on-quarter in Q4, is still increasing cautiously, far from the excesses of the past. Considering the good figures posted by new building permits, rising by 38% year-on-year in November, and the incipient housing shortage in some premium zones, this upward trend is expected to continue.

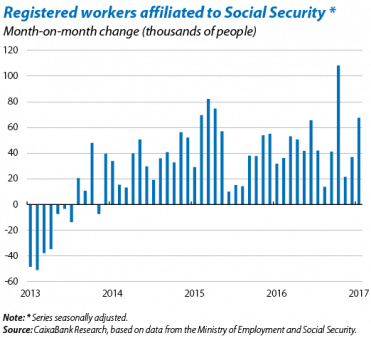

Strong economic growth is reflected in new jobs. According to national account data for Q4, equivalent full-time employment rose by 2.7% year-on-year, bringing the total 2016 figure to +2.9%, the equivalent of 463,000 full-time jobs, clearly reflecting the strong labour market in 2016. This remained strong in the first month of the year. In January, registered workers affiliated to Social Security rose by 67,460 (seasonally adjusted) and the job creation rate accelerated to 3.3% year-on-year (3.1% in December). In line with the trend in activity, we expect this job creation rate to moderate, although it will still be strong throughout 2017.

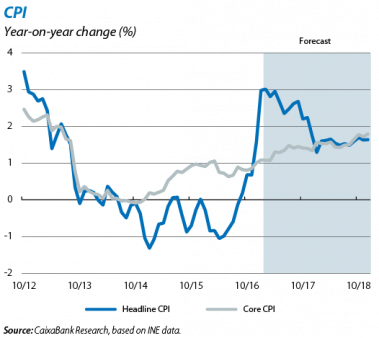

Thanks to the positive economic context, prices start the year with significant growth. Inflation rose to 3.0% in January and stayed at this level in February. This sharp price rise compared with one year ago is largely due to temporary factors. Electricity prices rose by 26.2% year-on-year in January while fuel prices continue to climb, following the trend in oil. Once these two effects diminish, the spike in inflation will gradually ease off in 2017. Core inflation will continue to rise steadily, however, supported by dynamic private consumption. This was up by 1.1% in January (1.0% in December).

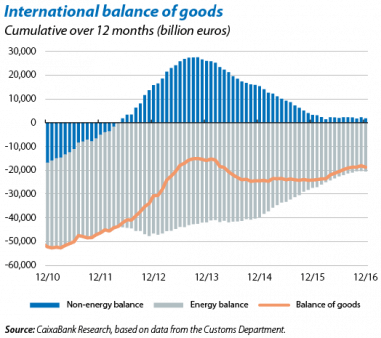

The current balance will remain positive in 2017. Exports of Spanish goods slowed down slightly in the last part of 2016 although recent gains in competitiveness (with lower unit labour costs than our trading partners) and notable geographical diversification have ensured this slowdown is less marked than for the advanced economies on average. The increase in non-energy imports resulting from dynamic consumption has gone hand-in-hand with a larger energy imports bill due to higher oil prices. Nevertheless, the limited slowdown in exports, good outlook for the tourism industry and the moderate nature of oil price increases will help to maintain a positive external balance in 2017. Customs data for December confirm these trends, with goods exports up by 1.7% year-on-year (cumulative over 12 months), boosted by a 2.8% increase in non-energy exports. Meanwhile imports fell by 0.4% year-on-year due to a fall in energy imports (down by 23.7% due to base effects), a dip that will ease throughout 2017. The current account surplus for 2016 as a whole was 2.0% of GDP. This surplus will continue in 2017 albeit to a lesser extent, around 1.6% of GDP, especially because of rising oil prices.

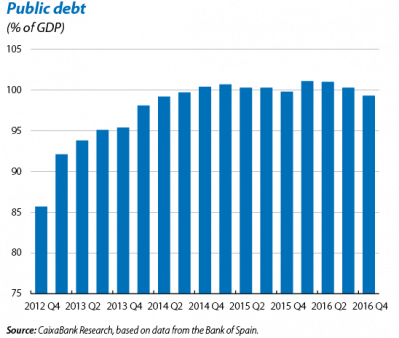

Spain’s good economic performance should help to reduce its large public debt. In 2016, public debt totalled 99.3% of GDP (99.8% in 2015), a high level that warrants continued efforts to strengthen the country’s national accounts. As a consequence of the budget measures adopted by the government in December 2016, the European Commission improved its budget deficit forecast for 2017 to 3.5% of GDP (previously 3.8%). But it still believes these measures are not enough to achieve the agreed deficit target of 3.1% of GDP. In its annual report on Spain, the IMF also stated that the fiscal deficit is too high as a result of the relaxation carried out over the past two years. It has recommended resuming gradual but credible fiscal consolidation measures. In this report, the IMF suggests maintaining the structural reforms carried out, continuing improvements in productivity and increasing the size of SMEs.

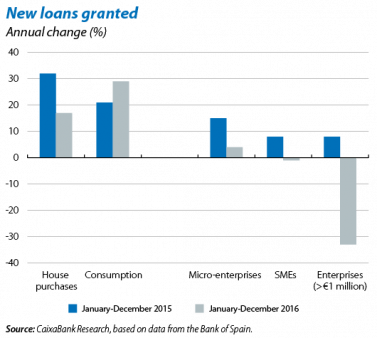

Banks are in a more solid position, helping the economy to grow. The number of new loans granted to households and small enterprises rose sharply in 2016. Regarding households, new consumer loans accelerated in 2016 as a whole, up by 29.0%, while mortgage loans also advanced considerably but less than in 2015. Loans to SMEs also continued to rise. However, loans to large enterprises fell sharply on account of these firms opting to issue corporate bonds. This improved flow of credit is supported by the higher quality of bank assets. The NPL ratio stood at 9.1% in December, with a cumulative improvement of 4.5 pps since the peak of December 2013. The downward trend in non-performing loans has therefore consolidated, falling by 13.5% year-on-year in December. In the medium term, this drop in the NPL ratio will continue to be boosted by the improvements seen in economic activity and the labour market, as well as sales of non-performing portfolios.

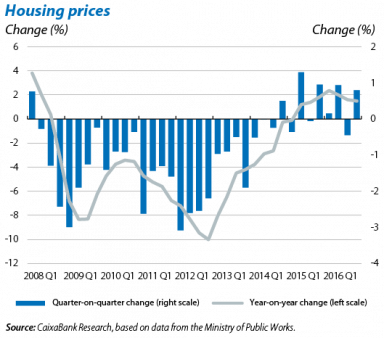

Better flows of mortgage loans boost the new upward cycle in the real estate sector. Another sign of the economy’s good performance is the increasingly unquestionable recovery in the real estate sector. Valuations of non-subsidised housing have seen positive growth in year-on-year terms for the past seven quarters. They rose by 1.5% year-on-year in 2016 Q4 (0.8% in quarter-on-quarter terms), bringing the average increase in 2016 to 1.9%. House prices are expected to continue rising over the coming months, boosted by demand and the shortage of housing in some prime zones.