The three strong points of Spain’s tourism industry

2017 looks like being another record year for Spain’s tourism industry. The country received 46.9 million international tourist arrivals in the first seven months of the year, 11.3% up on 2016 and 49.4% more than in 2010. Tourism expenditure is also growing at a faster rate. However, the terrorist attempts of 17 August in Barcelona and Cambrils, at the height of the season and in emblematic tourist spots, have aroused concerns regarding the potential consequences for the sector. The aim of this Focus is to highlight three strong points in Spain’s tourism industry that could help to maintain its role as the driving force of the country’s economy.

The first strong point is that a substantial part of the sector’s health is due to the quality of the tourism on offer. Demand factors such as the euro area’s economic recovery and instability in rival destinations such as North Africa and the Middle East, in addition to an upward trend in global tourism, are boosting Spain’s tourism significantly and cannot be ignored. However, it is equally true that Spain boasts a highly competitive sector. According to the latest biennial report on the travel and tourism industry produced by the World Economic Forum (WEF) in April 2017,1 Spain once again leads the ranking of 136 countries, ahead of France, Germany, Japan and the US.

The travel and tourism competitive index rates the performance of each country according to 14 pillars which, in turn, are divided into 90 individual indicators. Every country is given a score for each pillar and indicator and a ranking out of 136 economies based mainly on surveys carried out with people in the industry. Within the different pillars, Spain not only ranks highly in the classic areas of natural and cultural resources but also scores well in those in investment and institutional quality, such as infrastructure and safety and security. This last aspect, security, is particularly important at present and represents the country’s second strong point.

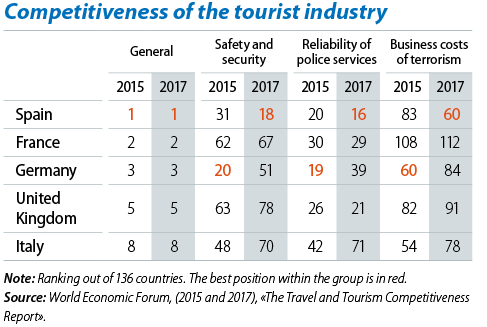

In the WEF report, the pillar of safety and security includes five indicators that rate the costs of crime and violence, homicide rate, cost and incidence of terrorism and police reliability. It is interesting that the large European countries (France, Germany, United Kingdom and Italy) all have notably worse scores in safety and security than would be expected given their overall ranking (see the enclosed table). They score even lower in terms of the business costs of terrorism. Spain has a relatively good position (18th in overall safety and security and 60th in the business costs of terrorism). Although the international perception of Spain’s security may have worsened after the recent terrorist attacks, this might be offset by the positive perception of police effectiveness. By way of example, deterioration in perceived security in France and the UK between 2015 and 2017 was contained, in spite of the terrible attacks occurring in those countries.

A third strong point of Spain’s tourism industry is the European origin of its visitors. Taking France as a case in point, foreign tourist arrivals in the region of Gran Paris fell by 8.3% in 2016. By origin, most of this drop occurred among Japanese, Russian and Chinese tourists (41%, 28% and 13%, respectively). These groups seem to be more sensitive to changes in perceived safety and security and accounted for 12.6% of all foreign tourists visiting Gran Paris in 2015. In Spain, however, they only account for 2.6% of foreign tourist arrivals (data from July 2017, cumulative over 12 months). In short, Spain’s tourism industry has strengths that lead us to be optimistic about it continuing to perform well in the future.

1. World Economic Forum, (2017), «The Travel & Tourism Competitiveness Report».