What is behind Portugal’s low inflation?

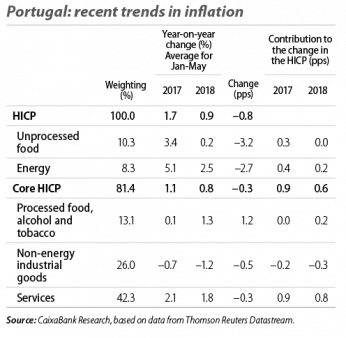

In the first half of 2018, the inflation figures have been well below those of the first half of 2017: for example, the average rate of inflation between January and May 2018 was 0.9%, 0.8 pps lower than the figure for the same period in 2017 (1.7%). What is the reason for this slowdown, which is especially surprising at a time when the economy is gaining strength?

Part of the explanation is related to oil prices, which rose sharply between early 2016 and 2017 (by around 50% between January 2016 and January 2017), before continuing to rise but at a slower rate (by around 20% between January 2017 and January 2018). Therefore, among the components of the consumer price index (CPI), energy prices rose by 5.3% year-on-year on average between January and May 2017, but only by 2.7% over the same period in 2018.

However, the fluctuation of the euro exchange rate since mid-2017 has also played a key role. The appreciation of the euro reduces the cost of foreign imports and translates into inflation in two ways. On the one hand, it directly affects the CPI by making imported goods destined for final consumption cheaper. On the other hand, it also reduces the price of intermediate goods, which decreases production costs and thus has an indirect impact on the CPI.

According to estimates by the European Commission,1 in Portugal, the impact of an appreciation of 1% in the nominal effective exchange rate causes a 0.1 pp reduction in headline CPI and a 0.09 pp increase in core CPI. In fact, of all the countries analysed, Portugal is the one where the impact is estimated to be highest. Given that in May the nominal effective exchange rate (relative to the country’s 61 main trading partners) had appreciated by 3.2%,2 this would explain a slowdown in inflation of 0.32 pps.

The trends observed in the different components of the CPI corroborate the hypothesis that the appreciation of the euro has played an important role in the recent changes in inflation, given that there has been a greater slowdown of inflation among the volatile components (unprocessed food and energy) than in the core components. Firstly, the imported portion of the unprocessed foods component is higher in Portugal than in the euro area as a whole, which helps to explain why the appreciation of the euro has had a bigger impact in Portugal.3 Secondly, the transmission of the appreciation of the euro is stronger in the case of energy prices, since these are largely determined in international markets and are denominated in dollars (recall that the euro has appreciated 15% against the dollar since the beginning of 2017, a much more marked appreciation than in the effective exchange rate).4

Core inflation, meanwhile, has been less affected. This is because a large part of its components – such as services, which account for more than 50% of the index – cannot be imported, while Portugal’s imports of processed food from outside the euro area are negligible. However, the core index also includes non-energy industrial goods, a considerable portion of which are imported. Indeed, over the past few months, this component has contributed to the drop in inflation. This component is also influenced by structural forces which have contained inflationary pressures at the global level, such as globalisation and technological advances that have made it possible to reduce production costs.5

All in all, the strong appreciation of the euro in the second half of 2017 explains much of the slowdown in inflation witnessed in Portugal over the last few months, particularly in terms of its impact on the volatile components. However, over the next few quarters, as this underlying effect fades, the core components will drag inflation upwards due to the buoyancy of economic activity and the recovery of the labour market.

1. European Commission (2014), «Quarterly Report on the Euro Area», vol. 13, n° 3.

2. In relation to July 2017.

3. In Portugal, imports of unprocessed foods represent 0.8% of GDP (0.6% in the euro area as a whole) and 21% of them come from countries outside the EU.

4. 78% of imports of energy goods (oil and natural gas) originate outside the EU and they represent 3% of GDP (65% and 2.2%, respectively, in the euro area as a whole).

5. Economic Bulletin of the Bank of Portugal, June 2018.