World growth to speed up in 2017

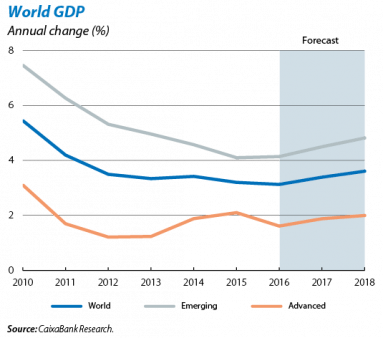

The scenario of faster global growth is firmly taking hold. The early part of the year has produced positive activity indicators at a global level. The macroeconomic data were slightly better than expected, both in the advanced and the emerging economies. This continued positive trend confirms the CaixaBank Research baseline scenario for 2017, with global GDP expected to grow by 3.4% (compared with the 3.1% growth estimated for 2016). These favourable forecasts are based on a monetary environment that is still very accommodative, the gradual recovery in oil prices and the consolidation of the emerging recovery, already discernible towards the end of 2016.

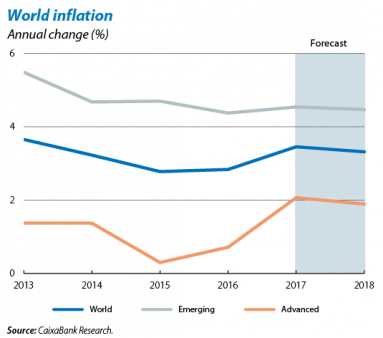

The balance of risks must also take into account higher inflation and certain political factors. In spite of this reasonably satisfactory outlook, risks are still high worldwide. Inflation figures for the beginning of 2017 were higher than expected in the advanced economies, justifying a slight increase in the forecast for global inflation in 2017. Should higher inflationary tensions continue throughout 2017, this risk might become significant as it would erode consumers’ purchasing power and change the monetary policies that are currently expected. The political uncertainty faced by some advanced countries could also disrupt the benchmark scenario. The first actions taken by the Trump administration in immigration and diplomatic relations have increased uncertainty in the US. Nevertheless, we have maintained our scenario, assuming a pragmatic application of Trump’s agenda thanks to the US system of checks and balances and the moderating influence by part of the Republican Party (there are Congress elections in November 2018 and a third of the Senate will be renewed, so the Republicans will not want Trump’s actions to spoil their chances). Europe is also keeping an eye on its electoral calendar, with elections in the Netherlands, France, Germany and probably Italy on the horizon.

UNITED STATES

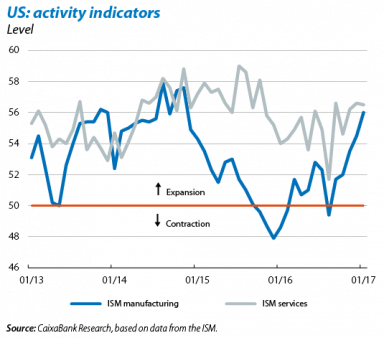

Waiting to Trump, the economy continues to accelerate. Donald Trump has yet to provide details on his government’s economic programme. The key months will be March and April as the US President is expected to present the budget proposal to be debated in Congress. This will provide more clues as to the scope of his proposals to cut taxes and increase spending on infrastructures, as well as just how much support he can expect from the Republican ranks. If the proposals are very ambitious, they might be opposed by colleagues from his own party. But this political impasse has not stopped the US economy from performing well, confirming its mature point in the cycle. For instance, business confidence indicators (ISM) for manufacturing and services remained well inside the expansionary zone in January, at 56.0 points and 56.5 points respectively (above the 50-point threshold).

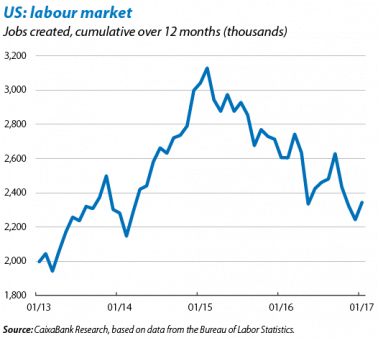

How much more can the US economy improve? The labour market is really buoyant. In January the unemployment rate remained almost the same at 4.8%. 227,000 jobs were also created, substantially more than expected, while wages rose by 2.5%, a considerable increase which suggests the US economy is strong. Its healthy labour market seems to confirm that the US economy is close to full employment, suggesting the fiscal stimulus announced by Trump may have only a limited positive effect, while the measures could end up making public debt soar and causing substantial inflationary tension.

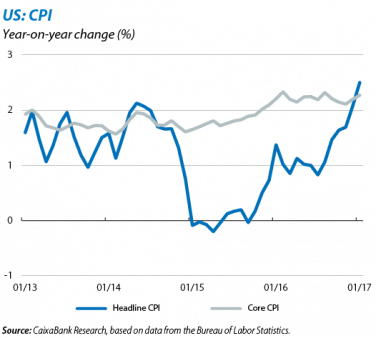

US inflation continues its upward trend. This was 2.5% in January, up 0.4 pps on the previous month, driven by strong growth in the energy component and particularly petrol (+7.8% month-on-month). Core inflation stood at 2.3%, 0.1 pp more than December. Given these figures, CaixaBank Research has revised upwards its inflation forecasts for 2017, from 2.5% to 2.7% for the annual average.

The macroeconomic situation bolsters expectations of hikes by the Fed. The current macroeconomic environment, with a larger upswing in US inflation than expected and good activity figures, endorses the CaixaBank Research interest rate scenario which predicts three hikes in 2017. The market is now discounting between two and three hikes in 2017, spurred on by the macroeconomic data and the recent hawkish messages delivered by the Fed.

JAPAN

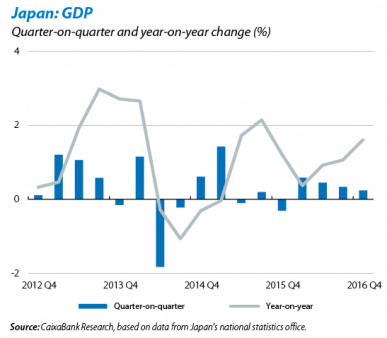

Japan is looking weak again. GDP grew by 0.2% quarter- on-quarter in 2016 Q4 (1.6% year-on-year), a slowdown compared with the first three quarters of the year. The annual average for 2016 is now a modest 1.0%. By demand components, GDP growth was driven by exports and non-residential investment. These Q4 figures, slightly higher than predicted, justify a technical revision of the 2017 GDP forecast from 1.0% to 1.1%. But this adjustment should not conceal the fact that the Japanese economy is still very delicate, hindered by weak domestic demand and too-low inflation, as confirmed by its sluggish private consumption (with zero growth in Q4) and the absence of appreciable wage rises.

EMERGING ECONOMIES

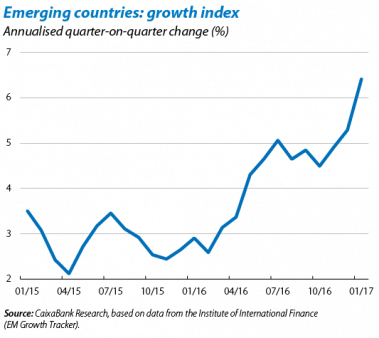

The emerging countries have started 2017 on the right foot. The activity indicator across all emerging countries produced by the IIF reveals their good situation. In January growth across emerging markets was 6.4% (annualised quarter-on-quarter), up 1.1 pps from December. Nevertheless, this indicator contrasts with the IIF growth forecast for the emerging economies in 2017 Q1, which is much lower (the forecast for annualised quarter-on-quarter growth in 2017 Q1 is 3.8%). One reason for this divergence is that the activity indicator in January did not capture certain downside risks, such as the temporary slowdown in the Indian economy in Q4.

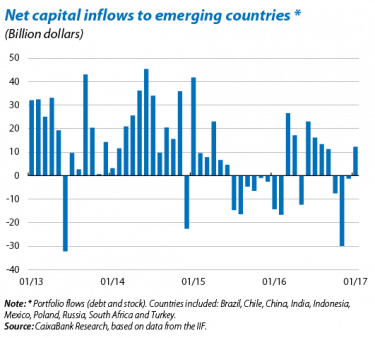

Capital flows reflect the emerging honeymoon period. In the final part of 2016, the emerging economies had suffered large net withdrawals of capital which intensified with Trump’s victory in November’s presidential elections. This trend changed in January, the first month, according to IIF estimates, that these economies posted notable foreign capital inflows (debt and equity) totalling 12.3 billion dollars. Flows were particularly strong towards emerging Asia (8 billion dollars) and Latin America (3.2 billion dollars).

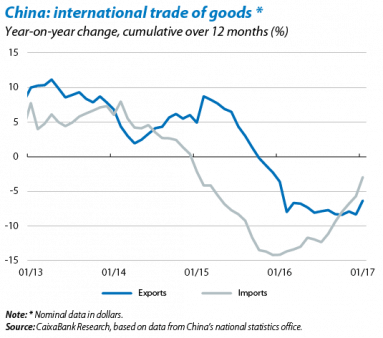

China: no news from the front. Fewer economic indicators are released during the festivities for the Chinese New Year and the little data announced could not clarify the immediate outlook to any great extent. Of note were the international trade positive figures, although these must be interpreted with caution as Chinese traders significantly increased their exports in January prior to the holidays, which lasted from the end of January to 11 February. In spite of the better activity indicators over the past few months, we have maintained our scenario of a gradual slowdown in GDP in 2017 and 2018, with downside risks resulting from the complex financial situation faced by the Asian giant.

India keeps its brilliant record almost spotless while Mexico attempts to weather the storm. The Indian economy underwent a slight slowdown in 2016 Q4 with 7% growth, slightly lower than the 7.4% reported in the third quarter. Nevertheless, this figure is surprisingly high as the consensus of analysts and the IMF expected substantially less growth due to the negative effects of the withdrawal of large denomination bank notes, a surprise announcement by Modi’s government at the beginning of November in order to curb the shadow economy. The resulting contraction in money supply, caused by delays and complications in exchanging these bank notes efficiently, has hindered activity and trade much less than expected in an economy where only 40% of the population has access to banks. Meanwhile Mexico, with its revised GDP figure for Q4, finally produced quarter-on-quarter growth of 0.7%, 0.1 pp more than the initial estimate from the end of January. This figure, lower than the 1.0% in Q3, confirms the slowdown in the Mexican economy given the uncertainty shock caused by the US trade policy. Nevertheless, the forecasts had been more negative, suggesting the country’s strong activity before this shock is helping to cushion its effects, at least for the moment.