The yield curve, growth expectations and probability of recession

There has been less clarity on the direction of US economic policy since Donald Trump was elected. The expansionary fiscal policy and less regulation in some industries that have been promised by the new President have fuelled a more optimistic view of growth prospects. But several factors suggest more caution should be taken, at the very least. These include an unemployment rate close to its all-time low with presumably little room to fall further, increased protectionism and the delicate normalization process to be carried out by the Fed over the coming quarters.

One indicator often used to gauge the cyclical position of the US economy is the one produced by the Federal Reserve Bank of New York based on the yield curve for Treasury bonds. Short-term interest rates are affected by the monetary policy implemented by the Federal Reserve. But long-term interest rates mostly reflect expectations of future trends in the short-term rates. When investors expect growth and inflation to speed up, the spread between long and short-term interest rates tends to be wide. When the spread between long and short-term yields is narrow or even negative, the opposite tends to happen.

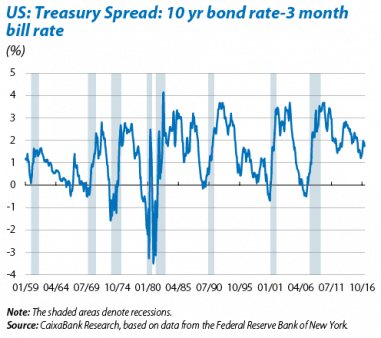

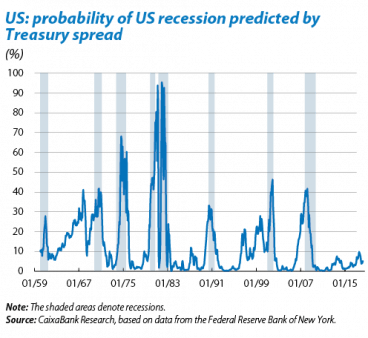

Using the spread between the interest rates on the ten-year Treasury note and the three-month Treasury bill, the New York Fed has estimated the probability of a recession in the US in the next 12 months. As shown by the charts below, the eight recessions in the US since 1960 have coincided with a narrowing of the spread between long and short-term interest rates, a pattern captured by the Fed’s model. But it is also true that, on occasion, the yield curve has flattened out and finally no recession occurred, as in 1967 and 1999, although in this last case a recession finally arrived in 2001.

Applied to the current situation, the predictions offered by the yield curve and the New York Fed’s model are relatively optimistic. The spread between interest rates is currently around 1.70 pp, 0.3 pp higher than its historical average. It is therefore not surprising that the New York Fed’s model predicts a relatively low probability of a recession, namely 5.2%.

But a close eye should be kept on the New York Fed’s model over the coming quarters. FOMC members expect monetary normalization to continue, planning to increase the federal funds rate by 1.25 pp up to December 2018. The short end of the yield curve is therefore likely to increase. Given this scenario, the response of long-term interest rates will provide valuable information on the conditions underlying the US economy.