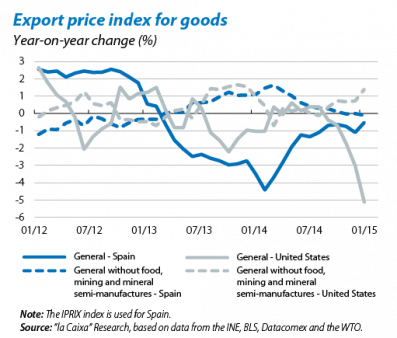

In real terms, Spain's goods exports continued to grow at a good rate in 2014: they increased by 4.6%, only slightly below the figure of 5.8% one year ago. However, nominal exports grew by a moderate 2.5% in 2014 (5.2% in 2013). The fall in the price of exports explains the difference between real and nominal exports. The fall in the price of exports of goods is becoming a worrying situation, as it reduces earnings by the export sector at a time when its support for economic growth is essential to ensure its sustainability.

In an environment in which the Spanish economy is gaining in competitiveness, the fall in export prices as this probably reflects the effort being made by exporters to contain costs and squeeze margins. Nonetheless, this trend has become stronger in the last few quarters with export prices accumulating a drop of 4.4% since June 2012. This intensification has largely been caused by the sharp drop in mineral prices (particularly metals) and in products made from these minerals, as well as foods. Specifically, the price of exports from the metal mining sector has fallen by almost 20%, while the sector of products made from these minerals has experienced a 7% drop. These are significant reductions considering that both sectors represent, in total, 13% of all Spanish exports of goods. Along the same lines, also of note is the recent drop in the price of processed food (down 3.2% year-on-year in January 2015), which also accounts for around 14% of Spain's exported goods.

In this respect, the price of exports from other countries with an export situation that is comparable to Spain's, i.e. with the mining, metal or agrifood sectors representing a significant share, should have suffered a similar reduction. This is the case of the United States, where export prices have also been falling for several quarters, pushed down by the drop in price of mining and agricultural products.1

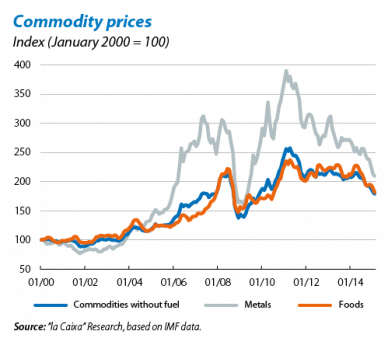

This trend in the price of minerals and food is related to the end of the so-called «commodities supercycle», a global phenomenon occurring throughout the 2000s which pushed up the price of minerals and farm products to all-time highs. This supercycle was supported by growing demand from China and other large emerging economies as well as by financial factors such as low interest rates, encouraging investors to search for higher returns from alternative assets.

Far from being an isolated occurrence, the fall in export prices seen in Spain is the consequence of a global phenomenon: a slowdown can also be seen in the rate of growth of export prices at a global level, going beyond the recent drop caused by the slump in oil prices. As commodity prices gradually stabilise, exports in nominal terms are therefore likely to grow again at the same rate as real exports, fostering more balanced and thus more sustainable economic growth in the long term.

1. The sharpest drop in US export prices in the last few months has been due to the slump in price for certain agricultural and mining products, which have a considerable relative weight in the US.