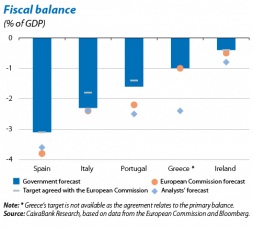

As its name suggests, the sovereign debt crisis originated in doubts regarding the public sector's solvency, based on an unsustainable finance model with revenue chronically below the level of expenditure. The average public deficit of Europe's peripheral countries (Ireland, Portugal, Spain, Italy and Greece) reached 8.7% in 2009. Given this situation, it was not only vital to adjust national accounts and achieve sustainable growth but also to restore international confidence as well as access to markets. Since then, fiscal consolidation has been carried out with relative success and, although there is still some way to go to achieve healthy public accounts, in 2014 the deficit of the peripheral countries fell to 4.2% and is expected to fall even further. In this Dossier we analyse the adjustment made in the res publica and the measures taken to determine whether these have been temporary (to «patch up holes») or are strengthening foundations of the house to avoid further structural imbalances in the future.

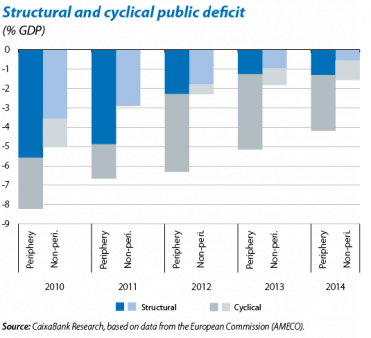

Soaring public deficits (see the first graph) were partly due to the economic cycle. The acute economic crisis suffered by the peripheral countries led to a reduction in public revenue (less tax revenue, fewer Social Security contributions, etc.) as well as a greater need for spending (unemployment subsidies, interest on debt payments, etc.). However, the structural deficit, i.e. the resulting deficit once adjusted for cycle-related effects and one-off measures,1 also reached high levels (5.6% in 2010). This highlights the fact that the model of cyclical revenue and structural expenditure was, given its very nature, unsustainable over the long term and needed to be corrected. One clear example is provided by the structural expenditure commitments taken in countries such as Ireland and Spain thanks to cyclical revenue from the real estate boom but which, once the latter had evaporated, could not be met. The reduction made in the structural deficit, which reached 1.3% in 2014, shows the considerable consolidation effort made by the peripheral governments although not all the reforms initially planned have actually been completed. Let us look at how this consolidation has been achieved; by increasing revenue or by reducing expenditure.

The measures undertaken to increase revenue in the fiscal area consisted mainly of changes in the tax system although action was also taken to reduce tax evasion. Albeit to differing degrees and with differing success, the peripheral countries implemented reforms in order to boost tax revenue and make taxation more efficient. To this end most of the countries increased both the taxable base and the rates of indirect taxes and eliminated some types of reduced rate VAT.2 Some countries, such as Portugal, attempted to carry out a fiscal devaluation, combining the VAT hike with a reduction in Social Security contributions to improve external competitiveness, but the measure was never implemented. Countries also had to resort to increasing income tax, corporate tax and other special taxes such as the tax on property or inheritance. Measures were also taken to reduce tax evasion, from the most traditional (increasing control by tax inspectors and their number, a tax amnesty, etc.) to other, more imaginative measures to discourage fraud (such as the chance for Portuguese consumers to take part in a lottery when requesting a receipt for purchases). For the moment these measures have only had a small effect on revenue.

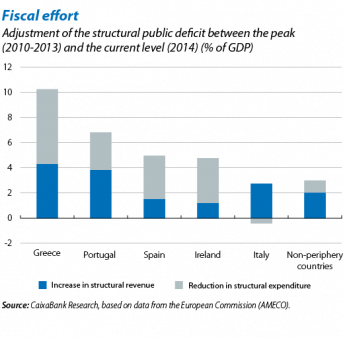

The adjustment in public expenditure was carried out, firstly, by reducing consumption both in terms of the overall running costs of public administrations and also by cutting spending on education and healthcare. Most countries chose actions that could be implemented quickly such as reducing civil service wages or reducing the number of civil servants, in particular temporary workers. The measures used to reduce the size of government were more difficult to implement although, to differing degrees, the number of entities was cut and expenditure became more efficient (by centralising procurement, for example). Another important part of the adjustment in expenditure was carried out by reducing transfers in pensions and unemployment subsidies, among other social benefits. The pension system reforms carried out reasonably successfully in Italy, Spain and Portugal are notable for being structural in nature since they include formulas that attempt to ensure long-term sustainability. In Greece, after several reforms and substantially decreasing the size of pensions, one condition for the country's third financial assistance programme is to implement legislation with measures to ensure a sustainable pension system in the future. Lastly, other items included in the cuts were public subsidies and investment. In Spain, Greece and Ireland most of the adjustment focused on expenditure (see the second graph) while in Portugal and particularly in Italy and non-periphery countries this was carried out more extensively via revenue.

The most beneficial outcome of this consolidation is the establishment of rules requiring stricter fiscal discipline. In Spain, for example, the Constitution has incorporated rules for public spending and a deficit limit to guarantee the public accounts are sustainable. Independent fiscal authorities have also been set up, such as the AIReF (or the Fiscal Advisory Council in Ireland), which analyse the credibility and risks of public accounts and call attention to them. At a European level, the joint supervision of public accounts has been strengthened as part of the European Semester with the aim of monitoring excessive deficits and ensuring they are corrected. The European Commission has established the path to be taken by fiscal consolidation in structural terms with medium-term budget targets to minimise the cycle's impact on fiscal consolidation.

There is still room to reduce the structural deficit even further by improving public sector efficiency although the peripheral countries have made significant progress in this direction, such as the reform of public administration in Spain and Italy. The aim is for structural reforms to be carried out that help to increase efficiency and reduce public spending by offering better services that are more in line with individual requirements. Nevertheless it is complicated to implement these reforms as there are many beneficiaries (the whole population) while only a limited number can be adversely affected (by reducing the size of a public body, for example). On the other hand new technologies can help to modernise the public sector by individualising the services provided and reducing their cost: the res publica should take advantage of all the potential they offer.

In conclusion, the crisis has forced a reform of public accounts that was long overdue. Although considerable progress has been made, such as the reforms of pension systems and the establishment of fiscal consolidation rules, some important changes still need to be made, in particular those that can substantially improve public sector efficiency.

Josep Mestres Domènech

Macroeconomics Unit, Strategic Planning and Research Department, CaixaBank

1. This category includes a whole series of measures with a temporary impact on public finances, both in terms of revenue (privatisations, licence sales, etc.) and expenditure (losses resulting from bank restructuring, etc.).

2. Lower VAT rates for certain products have traditionally been justified as a means of redistributing wealth although, according to the IMF, it is much more efficient to carry out this redistribution via social transfers aimed only at those who need them.