Uncertainty plays a key role on the global financial scene

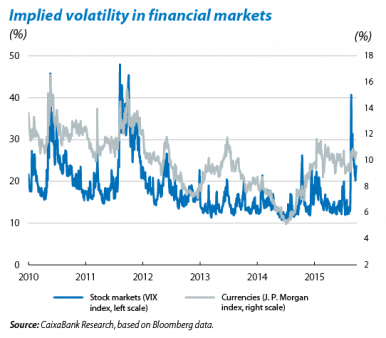

The persistence of doubts regarding the world economy is prolonging the correction beyond the summer. The commotion that appeared in international markets in August regarding China's slowdown and the yuan's devaluation has not vanished with the arrival of autumn. Doubts surrounding global growth increased given the decision of the Federal Reserve (Fed) to postpone the start of its normalisation of interest rates. Paradoxically, the caution adopted by the institution fuelled fears of a sharp slowdown in the world economy while the weak tone of activity in the emerging bloc, principally in China and Brazil, has not helped to boost investor optimism. Moreover the severe corrections seen in sectors such as automobiles and mining-energy are adding to the widespread markets instability.

Meanwhile risky assets in the euro area have shown greater resistance thanks to positive surprises provided by cyclical indicators and the ECB's accommodative stance. Although the global environment will still be fragile over the short term, the effect of the forces behind this risk-off will tend to reverse and the necessary wake-up call should be the realisation, sooner rather than later, that the world economy is not headed for a pronounced slowdown. At the same time the start of an upward cycle for US interest rates will put an end to one of the main sources of uncertainty over the last few years, despite the challenge it poses.

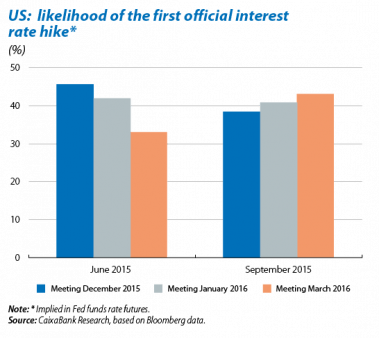

The Fed is cautious about the conditions of the external environment and has chosen to wait. Expectation was high regarding whether the Fed would start the first official interest rate hike in nine years. Finally the member of the Governing Council decided to wait, due largely to signs of weakness in the Chinese economy and summer tensions in financial markets. Growth and inflation forecasts were also revised slightly downwards, as was the expected level for the Fed fund rate. The caution shown by the institution and the fact that the external factor weighed heavily in its decision, unlike the Fed's typical modus operandi, triggered alarm bells regarding a severe decline in world growth. This circumstance has been reflected in a further delay in predictions for the first hike in the Fed fund rate, now expected in March. Nevertheless, the positive trend in the US economy has led us to keep our scenario unchanged from last month: with hikes starting in December and very gradual increases from then on.

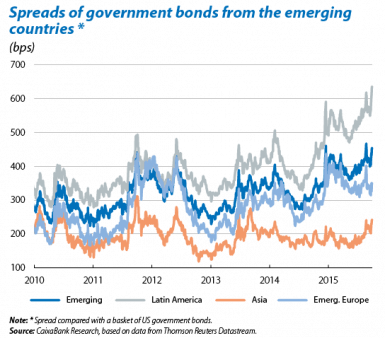

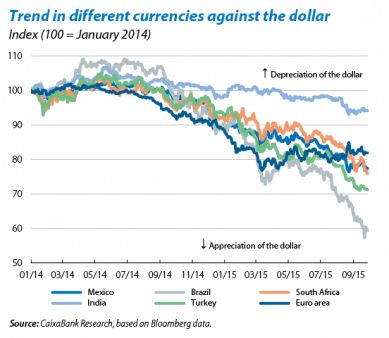

Emerging countries with weak economic fundamentals are increasingly being punished. The weakness of commodities, a less favourable external environment (the Fed's normalisation) and the slowdown in the Chinese economy are producing a very harmful cocktail for the performance of emerging assets, particularly in those countries with substantial internal imbalances such as Turkey and Brazil. In this last case the worsening macroeconomic outlook, difficulties in controlling the imbalance of public accounts and political instability have led the S&P ratings agency to downgrade its sovereign debt to BB+ (with Brazilian debt consequently losing its investment grade status). In addition to Brazil and Turkey, other countries facing a complex situation are Russia, South Africa and Malaysia. Although there are notable differences between the economies of the emerging bloc (India is a clear example of this), investor appetite for emerging assets is continuing to shrink, highlighted by the depreciation of currencies such as the Brazilian real, the Turkish lira and the Malaysian ringgit and continued increases in their respective sovereign spreads over the last few weeks. From a long-term point of view and looking at fundamentals, emerging stock prices and private debt are at reasonably attractive levels but the absence of positive catalysts in the short term will help to keep down the prices of such assets.

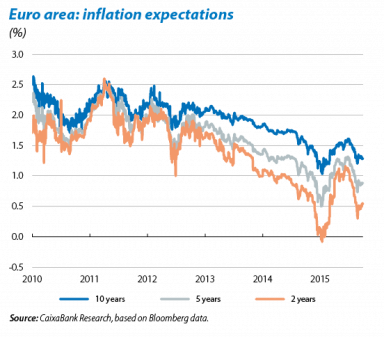

The ECB focuses its attention on strengthening its accommodative stance after the events of the summer. At its September meeting, the Governing Council of the ECB revealed its determination to employ all the tools possible to counteract any possible risks from the slowdown in the Chinese economy and market volatility, with Mario Draghi putting particular emphasis on the possibility of introducing adjustments to the ECB's asset purchase programme (QE) if necessary. In fact, the ECB President announced it would raise the limit placed on central banks for acquiring a single bond from 25% to 33%. Draghi's categorical tone was justified given the ECB's downward revision of quarter-on-quarter forecasts for growth and inflation and the European supervisor pointed out that risks for the region's macroeconomic situation are still downwards, particularly in the case of inflation due to the slump in oil prices. Nonetheless the ECB is unlikely to significantly increase the scale and scope of its expansionary measures at present.

Treasuries fluctuate depending on the Fed's messages. Yields on US public debt were volatile both before and after the Federal Open Market Committee's meeting on 17 September. In the monthly calculation, the bond curve fell as a result of this new scenario with yields on 10 and 2 years dropping to 2.11% and 0.68%, respectively. Fluctuations have taken centre stage with substantial upswings in the days prior to the meeting but stabilising afterwards, towards the end of the month, at levels similar to the beginning of the year.

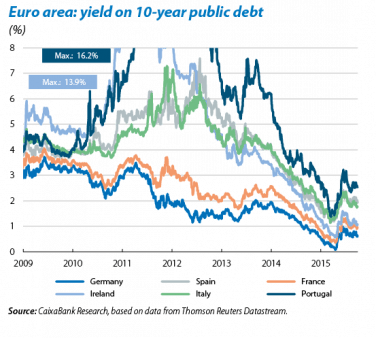

European periphery debt has followed US bonds and is wary of the situation of the world economy. European sovereign debt had a relatively calmer month than its American cousin but experienced a similar upswing in yields prior to the Fed's decision. From a broader perspective, European sovereign bonds have also been hit by the volatility caused by uncertain global growth but the ECB's message regarding a possible enlargement of the QE programme helped to stabilise the region's sovereign yields. On the other hand Spain's risk premium has continued to move up and away from the Italian premium, possibly reflecting the greater political risk perceived by investors.

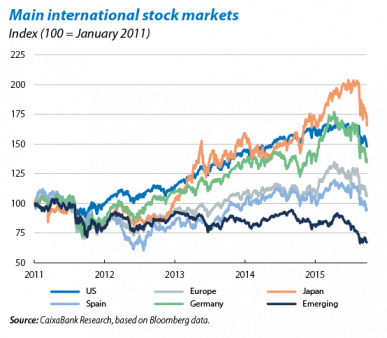

International stock markets are still battling their own particular problems. Developed stock markets have been hit by the uncertainty regarding world growth due to the Fed's decision to postpone its first official interest rate hike. As from the beginning of the month, US, European and British stock markets had managed to achieve gains of 4.2%, 2.3% and 1% respectively before the Fed's decision but the reversal of this trend in the second half of the month ended up affecting most developed indices. These events have relegated to second place the flow of good news concerning business activity in Europe, whose outlook continues to be more favourable than in the US.

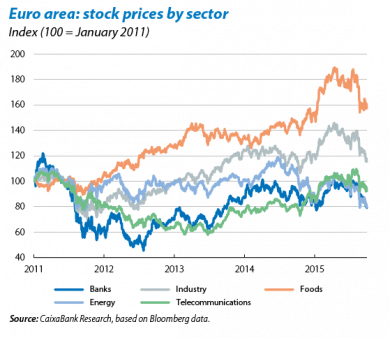

Cyclical sectors have been particularly hard hit. Specifically the automobile and mining-energy industries have come under the microscope this month. The former has seen losses due to the news regarding the manipulation of harmful emissions. Although this circumstance only affected the company in question at the beginning, its effects ended up spreading to the rest of the automobile industry. In the case of the energy sector, the correction of the last few months has intensified given the slump in shares of one of the main companies in the mining sector. Both developments have occurred at a rather unfavourable time for equity markets. The unwillingness shown by investors to take positions in this kind of asset does not seem to have decreased in the short term, particularly given weak outlook for US corporate earnings.

The foreign exchange market is at the mercy of higher interest rates and weak emerging economies. The euro has remained slightly above 1.10 dollars, the lower limit of the currency's value over the last year. However we expect Europe's currency to continue to weaken as the Fed's actions become clearer. Among the emerging currencies, countries that export commodities such as Brazil, Mexico, Turkey and South Africa have been particularly affected by weak commodity prices.