Monetary normalisation in the US: the Fed's new toolbox

After the summer holidays the US Federal Reserve (Fed) is going to take on a complex task: starting to raise the official interest rate after more than six years of it being frozen close to 0%. This will be the first important move in terms of monetary normalisation since the announcement of tapering of bond purchases in 2013, which shook the financial markets. So as not to repeat this situation, the Fed will have to calculate very carefully the date and size of each interest rate hike and precisely word its announcements. But it will also be vital for the mechanisms used in these operations to work smoothly and effectively. There are reasonable doubts hovering over the process due particularly to two factors: the huge amount of excess liquidity in the banking system and the far-reaching regulatory and competitive changes in the financial system taking place over the last few years. Given this challenge, the Fed has designed new tools to intervene in the money market.

Traditionally the Fed has used open market operations (OMOs) to control the volume of bank reserves and guide the interest rate at which banks lend overnight (known as the Fed funds rate or market rate) towards the Fed's desired level (the Fed funds target rate or official rate). However, the Fed's policy of expanding its balance sheet after the financial crisis erupted (mainly via bond purchases) has pushed bank reserves up to a level that is much higher than normal or indeed necessary. In practical terms, this huge excess of reserves makes OMOs less effective: to raise the Fed funds rate the Fed would have to sell such a large number of bonds (and thereby absorb reserves) that the disruptive side effects on financial markets would be devastating. Action via other means is therefore required.

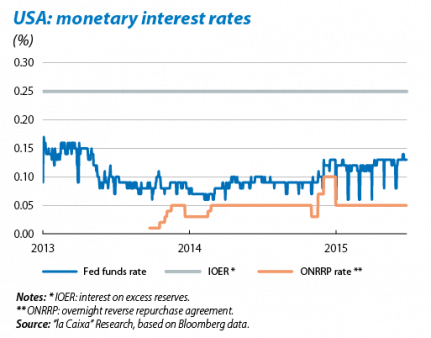

In September 2014 the Fed outlined a new strategy to further monetary normalisation and announced that its main instrument would be the interest rate paid by banks on excess reserves (IOER). This tool should help the Fed to set an interest rate below which each bank is not willing to lend money to other financial institutions; in other words, the IOER should act as a lower limit for the Fed funds rate. But evidence over the last few years has shown that the IOER does not provide, per se, the desired degree of control over the market rate and, since 2008, the Fed funds rate has been systematically below that of the IOER. The reason is that non-banking financial institutions have become relatively important in the US financial system (hedge funds, money market mutual funds and public mortgage agencies such as Fannie Mae and Freddie Mac). As these institutions cannot access a Fed reserve account, they are ready to lend funds at interest rates below the IOER. With the aim of resolving this problem, the Fed has made use of an additional tool, the overnight reverse repurchase agreement (ONRRP), via which non-banking financial institutions can provide overnight funds to the Fed (with securities from the Fed's bond portfolio as collateral). Consequently, ONRRP users have no incentive to lend money at interest rates below those offered by the Fed. Tests carried out since September 2013 show that the ONRRP rate has effectively acted as a lower limit for the short-term market interest rate. The Fed has also prepared two complementary tools designed to temporarily withdraw liquidity from circulation: the term deposit facility (TDF) to convert bank reserves into term deposits, and term reverse repurchase agreements (TRRP) for other financial institutions.

Although, in theory, the combined use of all these tools should be enough on paper to adjust short-term interest rates there are doubts regarding the possible effects on financial stability. One initial fear is that the money market could atrophy as a result of the Fed's hegemonic role. There are also concerns about financial institutions hastily redirecting investments towards the safety of the ONRRP should they foresee an episode of financial stress, which would drastically reduce private sector financing and accentuate the initial tensions.

In short, the Fed has enough tools to effectively raise interest rates on paper. However, there are still doubts regarding the ease of this process and even more so the possible side effects. The US monetary authority should keep a close eye on the details of the implementation and successfully handle its bigger toolbox.