Expansionary monetary policies and monetary aggregates

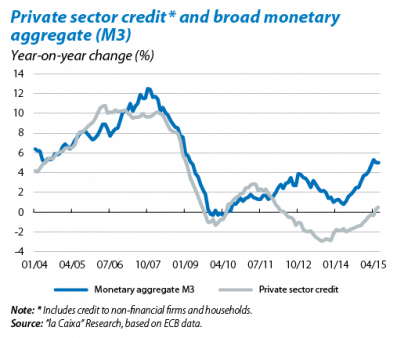

The ECB has implemented an ultra-expansionary monetary policy since the start of Europe's sovereign debt crisis in 2011. Given this situation, liquidity injected into the financial system has altered the historically close relationship between the evolution of monetary aggregates and credit to the private sector. While expansion in the ECB's balance sheet led to an increase in the money supply (M3 grew by 5% year-on-year in June), bank credit to the private sector fell notably and only achieved positive growth last May. This Focus looks at the factors behind the divergence between the trend in money and credit while the ECB's expansionary programmes were being implemented.

Monetary aggregates are one of the economic variables closely monitored by central banks as they provide information on the amount of money in circulation in an economy and therefore about their potential pressure on prices. There are different types of monetary aggregates according to the liquidity and maturity of the instruments included. The broadest variable published by the ECB is the M3 which includes physical money in circulation and the most liquid bank deposits, from common current accounts to savings accounts with maturities of less than two years.

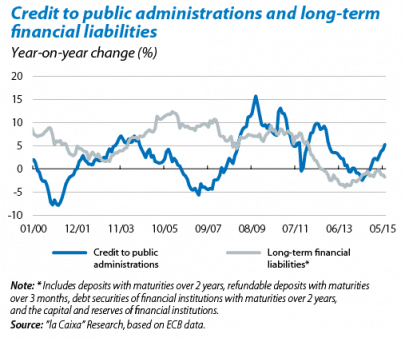

Historically the trend in private sector credit and money supply has been very similar, which seems reasonable given that these are, respectively, the two biggest items in the assets and liabilities on financial institutions' balance sheets. This relationship has weakened, however, since unconventional expansionary measures began to be implemented. As balance sheets always tally, to explain the increase in the money supply (liabilities) without any growth in bank credit to the private sector (assets), we must explore the trends in the rest of the items on banks' balance sheets. Two situations can be observed. The first consists of a change in the proportion of public sector financing compared with the private sector on the balance sheets of financial institutions. In other words, instead of the larger money supply being accompanied by an increase in private sector credit, it has especially been used to finance the public sector, either directly by the ECB buying government bonds or indirectly via the liquidity of LTRO used by many banks to invest in public debt. Moreover, during times of greater uncertainty, banks had to increase the proportion of liquid assets on their balance sheets, such as central bank reserves, and therefore had fewer resources available to grant credit.

The second situation comes from a change in the composition of liabilities in terms of their maturity.The drop in interest rates on long-term liabilities once QE started has encouraged a rebalancing of portfolios towards shorter-term products. Consequently a reduction has been observed in longer-term liabilities, partly replaced by liabilities with shorter maturities. The former are excluded from M3 whereas the latter are included.

In short, the factors that lie behind this divergence between monetary aggregates and private sector credit are temporary and it is likely that, as the economic recovery gets stronger and private sector deleveraging comes to an end, credit will grow again. It is also likely that the public sector, which has increased its debt in order to cushion the impact of the recession, will sort out its accounts over the coming years, which should reduce its financing needs. Given this situation, longer-term interest rates should also normalise sooner rather than later. In fact, indications of this happening can already be seen, yet another sign that the euro area's economic situation is getting back to normal, albeit slowly.