The emerging economies are showing disparate rates of activity

The dip in the final part of the first quarter is being overcome. Globally, March's activity indicators were worse than expected, raising doubts as to how the world's economy would develop in the future. However, the positive tone of April's figures has tended to dissipate these doubts to a large extent. We therefore maintain our main forecast scenario which predicts a slight improvement in 2013 compared with 2012 and a more clearly expansionary 2014.

UNITED STATES

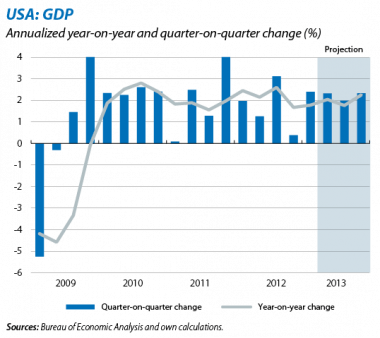

GDP picked up in the first quarter, supported by private consumption and stocks. Nonetheless, the advance (0.6% quarter-on-quarter, 1.8% year-on-year) was somewhat lower than expected due to the sharp drop in public consumption. We expect growth to moderate in the second and third quarters, anticipating greater impact from the automatic spending cuts resulting from the sequester. Nevertheless, the breakdown of the GDP figure, with private consumption significantly better than forecast and business investment maintaining part of the expected recovery, has led us to maintain our forecasts, predicting growth of 2.0% and 2.8% for the whole of 2013 and 2014, respectively.

In absolute terms, private consumption contributed 90% of the first quarter's economic growth but will tend to lose some of its dynamism as its recovery is largely due to a temporary rise in income combined with smaller savings. Nonetheless, favourable financial conditions and the underlying resistance shown by the latest indicators point to growth of around 2.0% in annual terms.

Business investment lost part of its upswing in the previous quarter but should improve, bolstered by corporate earnings that posted another record high in December 2012 (12.7% of GDP), albeit still below their pre-crisis levels. Regarding residential investment, we expect this to continue making a positive contribution to growth, benefitting from the reduction in the surplus housing supply. We also expect the lower contribution by stock accumulation to be offset by smaller cuts in government consumption.

Employment provided a pleasant surprise in April with an unexpected fall in unemployment to 7.5%, although its recovery is still slow and represents the greatest risk to growth. One of the factors hindering its performance is the low activity rate (the proportion of people working compared with the population aged over 16, which is 58.6%), which is still 4.8 percentage points below its figure at the start of the crisis due to the larger number of discouraged workers who are not counted as unemployed. The historically high proportion of long-term unemployed, who find it more difficult to find employment, is an additional burden.

Indicators on the up at the beginning of the second quarter. March's activity figures were weaker than expected. However, April's figures, which were positive in general, suggest that the underlying trend is still one of recovery. It is worth noting the good tone of retail and consumer goods and consumer confidence in April, confirming the strength of consumption. This trend is being supported by the absence of appreciable inflationary tensions. The slight cloud for these positive figures was provided by business confidence which dropped a little in April.

JAPAN

Japan leaves the recession behind by growing 0.9% quarter-on-quarter in the first quarter, 3.5% in annual terms, becoming the advanced economy with the most growth; all boosted by the expansionary policy of Prime Minister Shimzo Abe, which has become known as Abenomics and is based on three pillars: monetary expansion, more public expenditure and structural reforms. The advance in the first quarter was based on sturdy private consumption (which will continue to benefit from fiscal stimuli throughout 2013) and on exports that were up by 16.0% quarter- on-quarter in annualized terms, encouraged by the yen's depreciation.

Our growth forecast for the whole of 2013 rises from 1.4% to 1.6% as, although the figure was in line with our expectations, this was accompanied by an upward revision of the two previous quarters. Our scenario expects this expansion to continue in 2014 since the effects of the Bank of Japan's quantitative easing, which will double the monetary base between February 2013 and December 2014, should continue until well into the coming year. Similarly, the yen still has some room to depreciate further, which will continue to benefit exports. However, if nothing alters the situation, in April 2014 the tax levied on consumption is meant to go from 5% to 10%, a measure that goes against the expansionary logic of Abenomics and which we therefore do not expect to be applied in its entirety.

The data for the second quarter confirm that the recovery is continuing. The trend in consumer confidence, which in April exceeded the average figure for the first quarter, confirms that household spending could maintain a similar growth rate to that of the first quarter. Exports also look like they have continued to thrive, as demonstrated by April's good figures. Nonetheless, the recovery in domestic demand is also boosting imports.

EMERGING ECONOMIES

The emerging economies are showing disparate rates of activity. Although the latest indicators suggest that March's dip in activity has tended to reverse in April overall, the actual tone of activity is different depending on the region in question. East Asia is still the most dynamic region on the globe, as shown by China's good figures in April (international trade, industrial production and retail sales). Nonetheless, some countries such as Korea and Taiwan are losing international competitiveness due to the appreciation of their currencies against the Japanese yen.

Latin America is suffering doubly from its dependence on the USA and China. Although both the US and China have moved away from their relatively weak figures in previous quarters, the slight dip suffered by both economies has affected those Latin American economies that depend the most on China's purchases of raw materials (the situation of Brazil, for example) and those linked to the US manufacturing cycle (which would be the case of Mexico).

The latter's GDP figures for the first quarter were disappointing at 0.8% year-on-year. Although this figure is affected by unfavourable base and calendar effects (without these the resulting rate would be 2.2% year-on-year), we believe it has also been hit by the USA's minimal growth in the fourth quarter of 2012.

With regard to Brazil, its first quarter growth was a little less than forecast, advancing 1.9% year-on-year due to consumption and exports performing worse than expected. Nonetheless, the significant rise in investment should also be noted, namely 4.6% year-on-year, a good sign of future growth.

Given this situation, those emerging countries with the lowest rates of activity continue to bolster their economies via expansionary policies. In particular, many of them (such as India, Turkey and Korea) have cut their official interest rates in the last few weeks, a trend we expect to continue in the short term. The situation of inflation, relatively contained in some of these economies thanks to the drop in international energy prices, is helping monetary policy to prioritize growth. Brazil stands out among those countries outside this trend. In spite of the slowdown in its economy there are still inflationary tensions, a situation that has led to the reference rate being raised by 50 basis points, up to 8%. This increase was greater than expected although we believe there will be at least one other rate hike this year.

In addition, some countries realize that, in order to support sustainable growth, they need to maintain or boost their agenda of structural reforms. In this respect, the most ambitious example at present is probably Mexico. After approving labour, education and telecommunications reforms, at the beginning of May the guidelines were presented for banking reforms whose main aim is to boost private credit. In the opposite direction is the case of India, whose growth has slid down towards the 5% zone (4.8% year-on-year in the first quarter of 2013), far from its 8% growth rate of previous years, which reminds us that sustainable growth in activity depends crucially on furthering the structural reforms that are pending (infrastructures, regulatory, financial, etc.) and on containing public debt (66.8% of GDP in 2012).