The ECB is focusing its attention on monetary conditions in the euro area

September witnessed satisfactory outcomes for the markets on several key fronts, resulting in good performance overall. The decision taken by the Federal Reserve (Fed) to delay the start of its exit strategy, events calming down in Syria and the continuation ensured by the outcome of the German elections lie behind this constructive trend. Moreover, the good news provided by activity coming from the emerging block, mainly China and Brazil, has helped to boost optimism among investors.

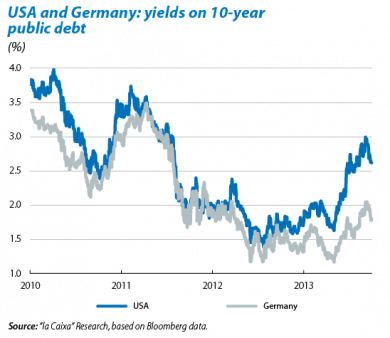

Contrary to all expectations, the Fed has postponed its withdrawal of monetary stimuli. The deterioration observed in the financing conditions of the US economy (in particular the upswing in mortgage rates) is the main reason for this unexpected decision taken at its meeting on 18 September (see the Focus «The Fed delays the start of its exit strategy»). The debt markets' reaction has been brusque, giving rise to sharp falls in the internal rates of return of treasuries and, by extension, international bonds in general. Yields on ten-year public bonds from the USA and Germany have left the zone of two-year peaks reached at the beginning of the month and have closed at 2.6% and 1.8%, respectively.

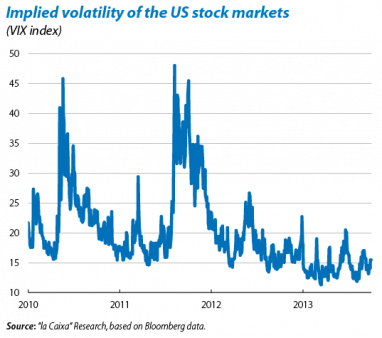

The arguments wielded by the Fed are in line with its previous messages which pointed to a very slow normalisation of monetary policy in order not to undermine the economic recovery. Consequently, its meeting to be held in December will most likely announce the start of a reduction in stimuli. However, there is considerable uncertainty regarding this issue given that two exceptional issues have been added to the usual factors related to the economic and financial situation: namely the replacement for Ben Bernanke at the head of the Fed and the budget dispute between Republicans and Democrats. This leads us to believe that the markets may still be afflicted by volatile episodes, although presumably these will not last as long nor be as intense as the ones observed over the last few months.

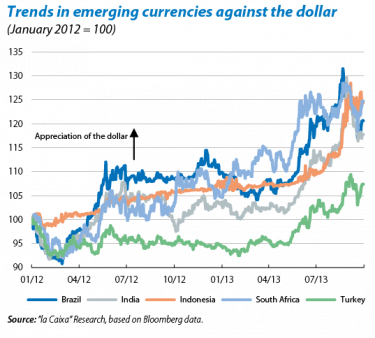

Financial turmoil in the emerging block is diminishing thanks to capital flows gradually getting back to normal. After tensions worsened in August, particularly in the foreign exchange market (see the Focus «Emerging currencies:

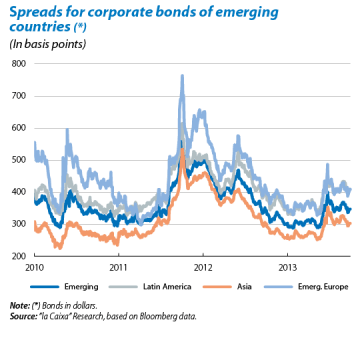

overly punished?»), the currencies of the hardest hit countries corrected some of their losses against the dollar in September. Emerging stock markets recorded significant advances while the spreads measuring the risk of default, both sovereign and corporate, tended to shrink. The Fed's decision has contributed to all this. Also important were the satisfactory macroeconomic figures published by China, which have helped to improve the perceived risk for emerging economies among international investors. Apart from exogenous factors, in a large number of the emerging countries (such as India, Indonesia and Brazil) monetary policy has remained biased towards restriction in order to slow up capital outflows.

However, instability may not have ended in those countries whose economic foundations are not so solid. The so-called group of «the fragile five» (Brazil, India, Indonesia, South Africa and Turkey) are still vulnerable to global liquidity conditions (largely conditioned by the pace adopted by the Fed), as well as the volatility of international capital flows (whose behaviour is closely related to investor sentiment and the global appetite for risk). This could lead to volatility in the short term, although the trend should move towards a slow but sustained path towards normalisation in the financial environment for the emerging regions as the economic pulse improves (which is starting to be seen in Brazil and China) and structural reforms progress.

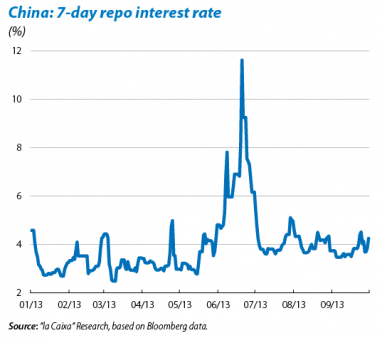

The liquidity conditions in China remain under control. The Chinese central bank has intensified its intervention in the money markets, injecting liquidity with the aim of avoiding episodes of tension such as the one last June. In spite of a turbulence-free interbank market, liquidity has become less abundant compared with the first part of the year, as the authorities had warned, based on their intention to stop any bubbles from forming. Ensuring the financial sector is stable is crucial for the Chinese economy's current process of changing its model of growth. This transition looks complex so that the latest financial imbalances could lead to instability in the short and medium term.

With regard to Europe, Angela Merkel achieved a resounding victory in the German elections. The Christian Democrat coalition (CDU/CSU) won 41.5% of the votes, its best result for more than 20 years. However, a new partner must be found to form a stable government after the bad performance by the Liberal party, which did not achieve parliamentary representation. In this respect, the Social Democratic party (SPD) looks like the most probable alternative for a pact. In terms of resolving the euro crisis, this suggests that leadership will be reinforced, continuing the current strategy (fiscal discipline and structural reforms) but with slight changes in favour of solidarity between countries and pro-growth policies. Investors have welcomed these electoral results, expecting the «grand coalition» to be formed, as well as the German Constitutional Court approving the ECB's bond purchase programme.

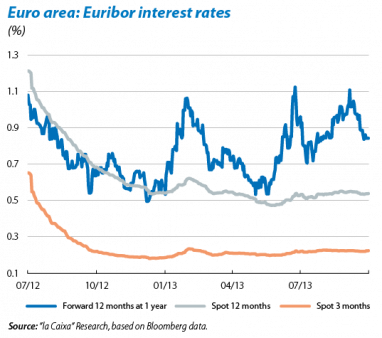

The ECB is focusing its attention on monetary conditions in the euro area. As banks have repaid early the funds obtained via the long-term refinancing operations (LTRO) held by the ECB in 2011 and 2012, the level of «surplus liquidity» is now very close to the appropriate minimum set by the ECB. This is tending to push up monetary interest rates, a circumstance that is worrying the ECB given that it would penalise the fragile, tenuous recovery in economic activity. Mario Draghi himself has stated that the bank is discussing the possibility of injecting more long-term liquidity to put a stop to this threat, though neither does he rule out cutting the official interest rate.

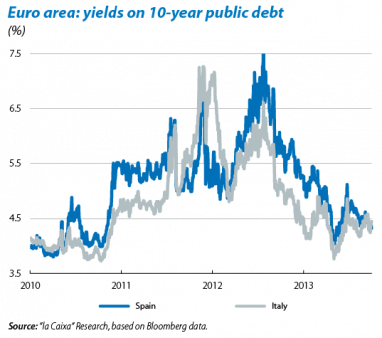

The sovereign debt markets in the periphery continue to show progress, with a leading role for Spain. Spain's risk premium performed well throughout September, benefitting from the buoyant global environment and local economic stabilisation. The spectre of instability reappeared towards the end of the month after another episode of political crisis in Italy, but only fleetingly. In clear contrast with events in 2011 and 2012, this kind of setback no longer has a devastating effect thanks undoubtedly to the progress achieved in strengthening the EMU and in correcting economic imbalances. In this respect, it is particularly important for the Spanish government to meet its public deficit target for 2013 to ensure the improvement continues that has been seen in financing costs over the last few months.

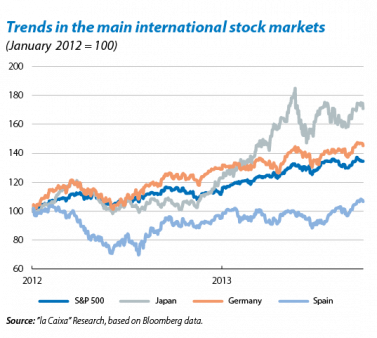

Stocks are performing well in the USA, Europe and Japan with the support of several factors: monetary (the Fed's decision to delay its withdrawal of stimuli and the ECB's expansionary stance), economic (the activity figures for

China and the euro area), geopolitical (a positive shift in the Syrian conflict) and business (corporate earnings and M&A operations). As a reflection of the above, the SP 500 and Dow Jones indices once again reached all-time highs in September, followed by a slight correction at the end of the month which should be seen as a temporary consolidation phase. For its part, the Japanese Nikkei has seen strong gains, almost non-stop. On the old continent, both the Eurostoxx 50 and the Ibex 35 have advanced solidly in the monthly figures, in both cases reaching a two-year high. Of particular note is the banking sector's good performance. In Europe, and particularly in Spain, potential gains are high if the economic recovery picks up and the euro area's debt crisis continues to develop positively.

The Fed's decisions are strengthening the euro, which has appreciated up to 1.35 dollars, the upper limit in the range that has prevailed for months now. The euro will probably remain within this range but is likely to depreciate again once the Fed starts to reduce its monthly debt purchases. Looking at commodities, of note is the moderation in Brent oil prices to 108 dollars due to the solution of the Syrian conflict, also remaining within its range of fluctuation over the last few months (100-110 dollars). Performance has been mixed in the metal segment with copper seeing gains due to China's improved activity.