The trend in credit has been monitored with some concern during the crisis and no-one has been satisfied with it. Financial institutions have seen their core business and therefore their main source of income shrink year after year while, for households and firms, the slump in credit has represented an additional handicap in an already difficult economic situation. However, credit finally seems to be taking a different course.

One of the key factors limiting the credit capacity of financial institutions over the last few years has been due to the regulation of the sector itself or, more specifically, to the changes occurring to this regulation. The start of the crisis highlighted the fact that the regulation of the time, known as Basel II, had not been able to prevent the collapse of a large number of banks, calling into question the solvency of the sector as a whole. The process quickly put in place to reformulate this regulation culminated with the start-up of Basel III in January 2014. Put very briefly, the overall principle behind this new regulatory framework is that banks should have a larger and better quality capital buffer to be able to handle adverse scenarios. The minimum capital requirements institutions must meet are to be raised gradually, going from a core capital of 2% of risk-weighted assets (RWA) to 7.0% by 2018. Moreover, this new framework requires banks to create an additional capital buffer during boom periods in the cycle which can be used, if necessary, during recessions. The new regulation therefore contains a very important principle, widely demanded both by the academic world and by the sector itself: it recognises that increasing capital is an expensive business for financial institutions and that, if they have to do so quickly, this might end up harming their capacity to grant loans. That is why the new regulation establishes that minimum capital requirements should increase gradually and that the additional capital buffer should be created during the expansionary phase of the cycle. The aim is to improve bank solvency in the long term without affecting their credit capacity in the short term.

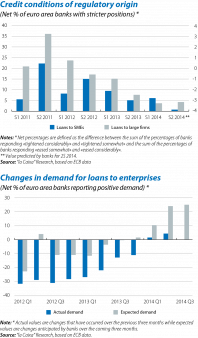

However, although the principle that lies behind this new regulation is well-intentioned, its application has had the opposite effect. The new regulatory framework has been applied too soon and during a situation of economic weakness, with continuing doubts regarding the solvency of some institutions. And, given that it is often difficult to determine the health of each institution sufficiently clearly, banks have been forced to rapidly increase their capital ratios in order to demonstrate their strength. In addition to market pressure, indices have also been published that encourage a comparison of whether institutions already meet the requirements coming into force in 2018. The report published by the Bank for International Settlements every six months shows that more than 80% of banks already meet these requirements, a high figure which has visibly risen over the last few quarters (as can be seen in the graph). In short, while economic activity was almost at a standstill and even in recession in some quarters, financial institutions were increasing their capital ratio, which has almost certainly worsened the drop in credit seen in the euro area as a whole.

Another aspect that has also hindered the recovery in banks' credit capacity is regulatory uncertainty, a widespread phenomenon in developed countries but especially acute in the euro area. Apart from the insecurity involved in constant redefining the sector's regulatory framework, the various stress tests carried out have been a significant source of further uncertainty. There are two reasons for this.

Firstly, although carrying out stress tests should, conceptually, be positive for confidence in the financial sector, they have been badly implemented. Theoretically, stress tests are useful for analysing whether banks could successfully handle a highly adverse economic scenario. Should this scenario come about, it is assumed that institutions can use their available capital to overcome it. In other words, it is not supposed that banks should maintain a level of capital above the legally required minimum in an adverse scenario because, if this were the case, institutions would implicitly be required, during periods of normal economic activity, to have a level of capital far above the regulatory minimum. Although this may seem paradoxical, this is actually what has happened in the euro area. Over the last few years the economic scenario has been similar to the one proposed for the stress scenarios carried out by the EBA in 2011. However, when this stress scenario actually materialised, instead of allowing banks to use their capital and liquidity margins to cushion the impact of the recession on their credit capacity, they have had to keep their capital ratios above the minimum required and, in fact, have increased them and have been subjected to further stress tests.

Secondly, significant methodological changes have occurred in the stress tests in terms of calculating the minimum capital banks must hold. The most notorious case occurred in the 2011 stress tests, when it was announced that the probability of public debt default was positive and, therefore, capital should be allocated for such an event.

Fortunately, it seems as if the negative regulatory impact on banks' credit capacity is coming to an end. One of the last elements that has yet to be clarified, the results of the examinations carried out by the ECB on banks before becoming their sole supervisor will be announced in October. The bulk of the evidence suggests that, in general, the outcome will be satisfactory. In fact, the bank lending survey already shows that, over the coming months, regulation and supervision will no longer be the factors limiting the credit granted.

An improvement in the credit capacity of banks could not come at a better time. Although the economic recovery is expected to be slow in the euro area, the demand for credit finally appears to be picking up. Given this situation, it is particularly important for banks to be ready in order to support economic activity. Credit must regain credit.

Oriol Aspachs

European Unit, Research Department, "la Caixa"