On the upswing in household consumption in Spain

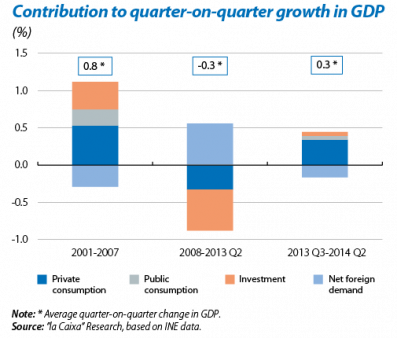

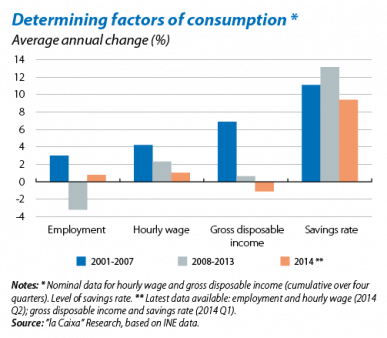

Private consumption is boosting Spain's economic growth. For the last four quarters it has advanced at an average rate of 0.6%, making it a key ally to the recovery. However, the sharp upswing in household consumption has not been accompanied by an increase in gross disposable household income (GDHI); in fact, this fell in 2013 to 1.8% and, in 2014 Q1, it was still falling, albeit at a slower rate (–1.1%). The increase in consumption has particularly occurred via a reduction in the savings rate. Specifically, between 2013 Q2 and 2014 Q2, this fell by 1.5 p.p. to 9.4%, an all-time low. Also of note is the marked rise in new loans granted for consumption, posting a 3.90% year-on-year growth rate in August (cumulative over 12 months). Consequently, if the factors supporting consumption remain the same, the rate of growth seen in the last few quarters is unlikely to continue. Let us analyse this in a little more detail.

GDHI is likely to progressively build up steam. Wage income, accounting for around 70% of the total gross disposable household income, will be helped by growth in employment, which we expect to be around 1% in 2014 while in 2015 it will probably rise to 1.4%. The outlook for non-wage income has also improved, partly due to the increase in the number of self-employed workers.

Although GDHI will benefit from the growing support of the labour market, household consumption is unlikely to maintain its growth rate in the first six months of 2014. By way of example, if its current rate of growth did continue, by 2016 the savings rate would be below 7%, a figure that does not seem very likely. The most reasonable scenario is for the rate of growth in consumption to moderate as those factors that have temporarily boosted it, such as taking decisions to consume that had been postponed during the crisis, gradually run out of steam. In fact, several indicators for 2014 Q3 already point to the growth rate for consumption easing. Retail sales in July and August, for example, recorded a 0.1% growth rate year-on-year while they had increased by an average of 0.6% in Q2.

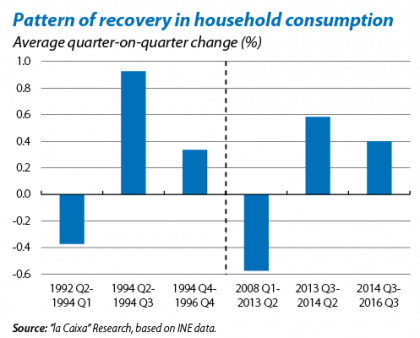

The pattern of recovery being observed in consumption is similar to the one occurring in the early 1990s. Specifically, in 1994 Q2, after two years with an average quarter-on-quarter growth rate of –0.4%, this increased by an average of 0.9% for two quarters, while in the next two years it advanced by 0.3%. Our scenario predicts that, in the coming quarters, the growth in household consumption will remain significant but slightly less than the levels seen in the first half of 2014, around 0.4% quarter-on-quarter, a figure in line with the expected recovery in the labour market.