A good year ends and another promising year begins

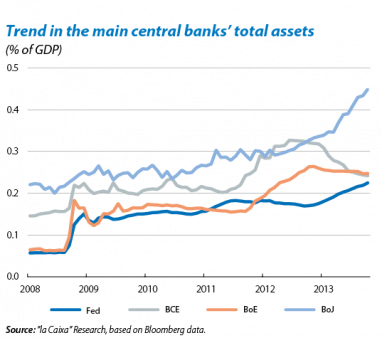

The markets enjoy a positive end to a year that has seen them steadily grow in solidity and stability thanks to the contribution of three broad factors. Firstly, the improvement in macroeconomic conditions; solidly in the USA and Japan, incipient in the euro area and tentative in the emerging economies. Secondly, the reduction in the number of tail risks that have posed a serious threat to global financial stability in the recent past (the euro area crisis, the start of tapering, the fiscal dispute in the USA, capital outflows from emerging countries, etc.). Thirdly, but no less importantly, the ultra-lax monetary policies of the bloc of developed countries. To a greater or lesser extent, we expect these favourable conditions to remain over the coming year, helping the good performance by risk assets to continue.

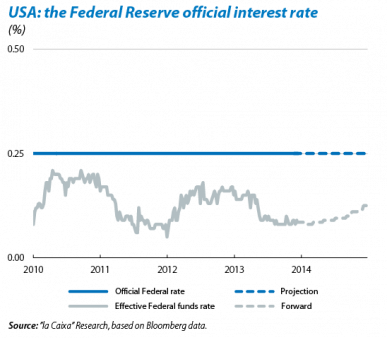

The Federal Reserve (Fed) has finally started its tapering. At its December meeting, the US monetary authority agreed to reduce the monthly volume of bond purchases as from January, from 85 billion dollars to 75 billion. The upward trend in activity figures over the last few months (in particular those for the labour market), as well as less fiscal uncertainty regarding the coming year, lie behind this decision. As had already been stated by the Fed's own members, the official announcement stressed that this reduction in purchases will be very gradual, that there is no set schedule and that the process depends on the trend in employment and inflation. The institution also intensified its forward guidance, indicating that interest rates would remain «exceptionally low... at least as long as the unemployment rate remains above 6.5%», which appears to postpone the first hike in official interest rates until mid-2015.

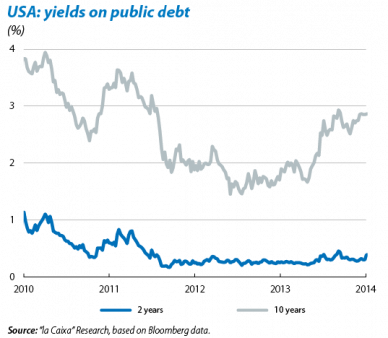

The financial markets react constructively to the Fed's announcement, in contrast to the environment of high uncertainty and volatility that had prevailed for several months concerning when and how tapering would begin. Most assets reacted positively with gains in the stock markets and highly contained increases in yields on US public debt. The yield on US ten-year government bonds has remained close to 3% while two-year bonds stand at around 0.4%. Along the same lines, the implied volatility indices of the S&P 500 and the treasuries fell (slightly) after the Fed's announcement.

In spite of this positive interpretation, we should remain cautious given the presence of some weak links. A positive reason lies behind the Fed starting its exit strategy: growth in the US economy appears to be solid and self-sustaining. It is not due to visible inflationary pressures or to any suspicion of bubbles having been formed in financial assets, although there are some signs of overheating in the US bond markets which would be advisable to cool down. In this respect, tapering is welcome. However, and as monetary normalisation progresses, we cannot rule out possible contretemps in investor expectations and sentiment which could lead to sharp upswings in interest rates, as happened during the summer. The list of candidates for those most severely affected is headed by some emerging countries with large external imbalances and a great dependence on foreign capital.

In the emerging bloc, the combination of «reforms – financial environment» will become more important. Once the USA starts to reduce its stimuli, the factors that attract capital towards the emerging economies will play a key role in minimising possible episodes of tension. The summer sell-off suffered by a large proportion of the emerging assets (particularly virulent in the BIITS markets) is unlikely to be repeated on the same scale thanks to the improved tone of economic activity in the emerging bloc itself, although we should still be vigilant. Countries such as Brazil, India and Indonesia must persevere with their implementation of reforms, as well as maintaining an appropriate direction in their monetary policy to contain inflationary pressures and gain credibility abroad. On the other hand, the outbreak of tensions in Chinese interbank interest rates occurring once again in December highlights a source of instability that should be monitored closely in 2014. Nonetheless we expect a financial environment in the emerging markets that, little

by little, will establish itself as a foundation for better growth prospects in 2014.

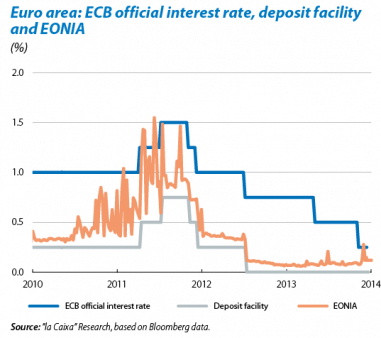

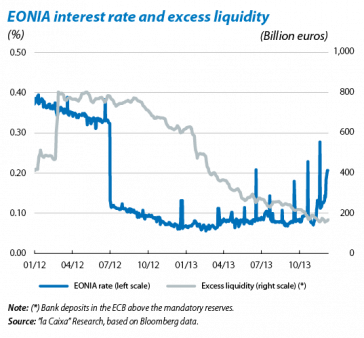

For its part, the European Central Bank (ECB) remains vigilant regarding any upswing in monetary interest rates. The increases in the EONIA and Euribor rates of the last few weeks are due to the sustained fall in excessive interbank liquidity in the euro area which, in turn, can be explained by two factors. Firstly, an underlying factor related to the improved macroeconomic and financial environment of the EMU, encouraging financial institutions to repay their ECB loans taken out in an emergency. Secondly, a temporary factor related to the upcoming asset quality review (AQR) on banks by the ECB with data from December 2013, encouraging institutions to restrict interbank operations. In this context, the ECB will not hesitate to act if this episode of higher monetary rates extends into 2014. Regarding LTROs that are very long term, Mario Draghi himself stated that these would be conditioned on the granting of credit in the real economy, to discourage carry trade strategies with public debt.

A productive end to the year in Europe's institutional sphere. After months of tough negotiations, European leaders have reached an agreement to create the Single Resolution Mechanism as part of the future banking union. With a view to 2014, once the bank asset quality review has been completed, confidence and transparency in the banking sector are likely to be stronger, perhaps giving a definitive boost to resolving this crucial area in the euro area crisis (see the Focus «Financial stability in the EMU: cautious optimism»).

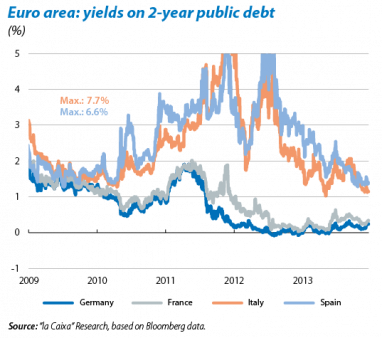

Periphery public debt faces a headwind in 2014. The trend in the sovereign debt of bailed-out countries observed throughout 2013 was encouraging. The combination of advances in pan-European integration with the progress made in reforms and an improvement in activity at a local level brought about a favourable climate in the last part of the year in Spain, Italy and Portugal. In this respect, investors' level of rejection towards countries such as Spain or Italy has fallen significantly, encouraging a slow but firm reduction in sovereign risk premia. In principle, this process is likely to continue in 2014, although too much complacency or reformist fatigue pose the major risks, threatening to cut short this process. For its part, the yield on German debt should follow a slightly upward trend throughout 2014 due to the progressive withdrawal of stimuli in the USA and the growth trend exhibited by Germany's underlying macroeconomic fundamentals.

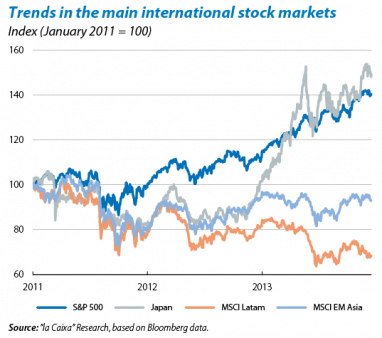

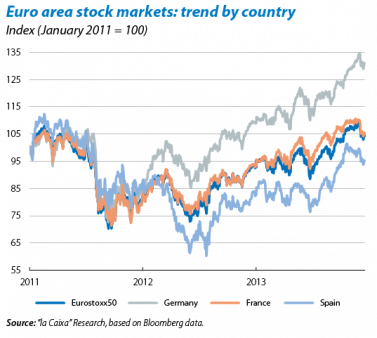

More good than bad news on the international stock markets. The year we have just left behind was characterised by a sharply contrasting performance by developed and emerging stock markets. Among the first, of note were the gains of close to 25% in the American S&P 500, the German Dax and Japanese Nikkei, the first two reaching record highs. The Ibex 35, for its part, managed to pick up steam towards the end of the year, ending 2013 up by 20%. Meanwhile, the stock markets of emerging countries performed poorly on the whole, hindered by economic dips and capital outflows. With a view to 2014, the outlook for European and Spanish equity is moderately upward thanks to the steady improvement in macro indicators, the contained trend in interest rates and the recovery in corporate earnings, as well as the improvement in the financial environment as a whole. All this from an attractive starting point in terms of valuation ratios (while these are less favourable in the USA). Similar factors to these should also help the emerging stock markets to make up ground in 2014.

The euro remains strong against the dollar and yen. Towards the end of 2013, the European currency rose above the level of 1.35 dollars, largely due to the wider spread in short-term interest rates between the EMU and the USA after these rose in the euro area. However, as this temporary factor is likely to disappear, and given the slow but inexorable advance of tapering, the euro is likely to depreciate moderately against the dollar in the coming months. On the other hand, the announcement by the Japanese authority of a new package of fiscal stimuli has led to further depreciation in the Japanese currency against the euro and the dollar.