It's no news that tourism is one of the pillars of the Spanish economy, in addition to being one of the driving forces behind its incipient recovery. Its share of GDP accounted for 10.9% in 2012, a year which saw a turning point after the continual slide in international tourist arrivals due to the 2008 crisis, while employment directly or indirectly related to tourism also enjoyed an 11.9% share of the total in 2012. Moreover, Spain is a key player on the international tourism stage. According to the latest report by the World Tourism Organization, in 2012 it ranked third in terms of international tourist arrivals (behind France and the United States and equal with China) and second in terms of revenue (behind the United States). Considering the industry's undeniable importance and future, this article aims to analyse the recent growth in international tourists and investigate whether these new visitors are different and better for the country in economic terms.

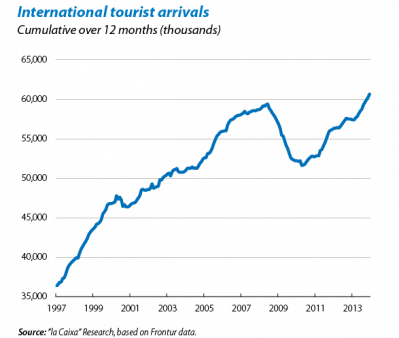

In the last few decades, the number of international tourist arrivals has risen almost non-stop. Only during the years of the great crisis, namely 2008 to 2010, there was a significant drop in visits. Since then, the pace of growth has picked up and almost returned to its levels prior to the recession: specifically, between 2011 and 2013, international tourist arrivals grew at an annual rate of 4.0% on average, a figure very close to the 4.3% recorded between 2005 and 2007.

However, although these may appear to be similar patterns of behaviour at first sight, a slight change can be observed regarding the origin and habits of these new foreign visitors. The tourists visiting Spain today are still mostly European and the United Kingdom, Germany and neighbouring countries of France and Italy are still the countries providing the most tourists, slightly above 50% of the total. However, non-European tourists are gradually gaining ground and now account for a notable 9% of the total number of visitors, 3 p.p. more than in 2007. Particularly worthy of mention is the role played by Russian tourists. In spite of representing only 2% of all visitors, their increase between 2011 and 2013 was substantial, accounting for an appreciable 16.0% of the overall rise in tourist arrivals in this period. In other words, out of every 100 additional international tourists who visited Spain between 2011 and 2013, 16 were Russian. Given this nationality's prevalence among the new tourists, we can understand the concerns being expressed about the Ukraine's political conflict getting worse and Russia suffering sanctions at the hands of the international community.

Just as the number of tourists is rising, so is their average daily expenditure. While this was 91 euros on average between 2005 and 2007, in the period between 2011 and 2013 it rose to 106 euros. This is partly due to the larger share of non-European tourists, whose expenditure has grown more than that of the Old Continent over the same period. Another sign of the greater purchasing power of these new tourists is the increase in the proportion of visitors staying at hotels, who typically spend more. Specifically this has gone from 63% of the total on average between 2005 and 2007 to 65% currently. We should also note the good performance by cultural tourism, going from a share of 51.3% in 2010 to 53.9% in 2012. As argued in the article in this Dossier entitled «Recipes for success in the tourism industry: different ways to reach the same destination», this tourism category tends to be more profitable and has high growth potential.

Lastly, we should also examine the trend in domestic tourism. For obvious reasons, Spaniards' expenditure on tourism also shrank due to the economic recession. The number of journeys made both within and outside Spain between 2011 and 2013 was 3.6% lower than in the period 2005-2007 but the slump in domestic travel was substantially greater, namely 4.8%. Households with fewer resources were particularly hard hit, precisely those who tended to go on holiday to destinations within Spain. It is revealing that the kind of accommodation gaining most share during this period was the family's own residence and that of relatives, compared with a reduction in rented accommodation and stays at camping and caravan sites.

However, in the last few months domestic tourism has started to look like it is picking up: in 2013 Q4 there was already a 5.5% annual increase for national trips, an upward trend that has continued in 2014 Q1 with a rise of 2.9%. Seeing as Easter fell in April this year, this figure is especially encouraging.

Endorsing this upward trend, the latest projections by the World Tourism Organization suggest that, between 2010 and 2020, international tourist arrivals to the Mediterranean countries will grow at a rate of 2.6% annually. Consequently, if Spain manages to keep hold of its market share among the region's countries, in 2020 it could receive 72 million international tourists, 12 million more than in 2013. Moreover, as we have seen, these new tourists, with their greater purchasing power and more sophisticated tastes, should be more beneficial for the country from an economic point of view. The industry's future is promising and, given the current state of the economy as a whole, such an opportunity should not be wasted.

European Unit,

Research Department, "la Caixa"