The earnings of Spain's listed companies exit the crisis

After several years of decline, the profits of Spain's listed companies have embarked on an upward trend. According to the Spanish Securities and Investments Board (CNMV), consolidated earnings went from –8.8 billion euros in 2012 to 25.08 billion in 2013, of which an astounding 92% correspond to Ibex 35 companies. Although this bottom line comparison is somewhat distorted due to extraordinary items, it does show the steady improvement in the business environment. On the one hand, due to factors related to the Spanish economy as a whole: the recovery in the rate of activity, easier financing conditions for both the public and private sector and lower reserve requirements (particularly relevant for banks). On the other, thanks to strong growth in the turnover of companies in international markets, as well as the processes of deleveraging and equity reinforcement, started in previous years, also appearing to continue.

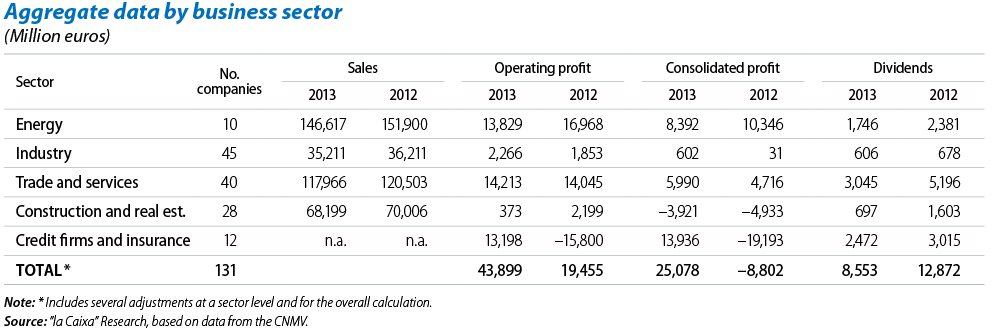

At a sector level, more than half the aggregate earnings for the year came from financial firms, followed by industry and trade. It is useful to highlight some particular sector-related aspects influencing this trend in earnings. In the case of financial firms, net earnings rose to almost 14 billion euros, helped by the reduction in reserves, which were so high in 2012 they resulted in an overall operating loss that year. In the industrial sector, although the different sub-sectors have seen differing trends, the improvement in earnings has been due to an adjustment in operating costs (reductions in workforce, sales of assets, etc.) and financial costs (mainly by restructuring debt). The opposite situation can be found in the energy and construction sectors. In the former, in addition to falling electricity demand in Spain and the adverse impact of macroeconomic variables (such as the price of Brent oil and currency exchange rates), there was also the sector's new regulatory framework for Spain. In combination, these factors meant that, in 2013, net earnings for the sector were considerably lower than the previous year. The drop in earnings for construction was also notable and the reasons underlying this downward trend were the decline in construction work, the slowdown in cement production and slump in property sales.

2013's business scenario was still being affected by an adverse environment for sales, with these falling by 2.8% year-on-year for listed non-financial firms. Shrinking domestic demand, the reduction in activity in most energy and industrial sub-sectors, fluctuating exchange rates for the emerging currencies and the particular situation of some companies lie behind this drop in sales. However, there is a very important positive aspect that is encouraging: the considerable, solid increase in business generated abroad. Since the start of the crisis in 2009, foreign sales have become increasingly important, offsetting the deficit in local turnover. In 2013, Ibex companies produced 62.3% of their income outside Spain (almost 260 billion euros) compared with 61% a year ago.

Another relevant aspect has been the effort made by companies to maintain high dividends for their shareholders. The dividends paid out overall by listed firms in 2013 were lower than in 2012 but the yield dividend for Spain's stock market was still one of the highest in the world. This is the result of increasing shareholder payments through scrip dividends.