A calm finish to the year for international financial markets

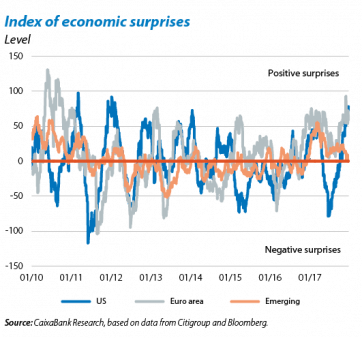

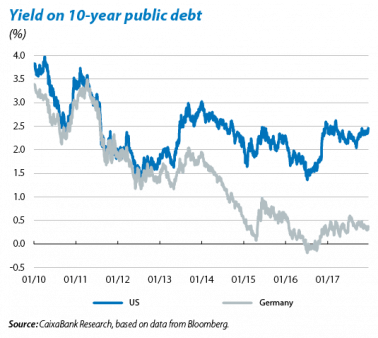

The markets end a good year with equanimity. In a positive macroeconomic scenario, which has achieved the acceleration in global growth forecast at the end of 2016, the tone of international financial markets was constructive. Overall, the year saw significant gains in stock prices, moderate increases in interest rates, a general depreciation of the dollar against major international currencies and a gradual rise in the price of oil. The Fed’s interest rate strategy is a clear reflection of this positive macrofinancial outlook. 2016 was an uncertain year with just one hike by the Fed. But the institution showed greater confidence in the macrofinancial scenario in 2017 and carried out three interest rate hikes (the last one in December). It also confirmed expectations of three further increases in 2018. At the beginning of 2017 markets were still rather sceptical about the Fed’s announced strategy. However, in recent months investors have been adjusting their interest rate expectations upwards. In December, financial markets ended the year with increases in US and German sovereign bond rates and moderate gains were made by advanced stock markets, while the emerging stock markets recorded gains despite some volatility and currencies continued to appreciate slightly against the dollar.

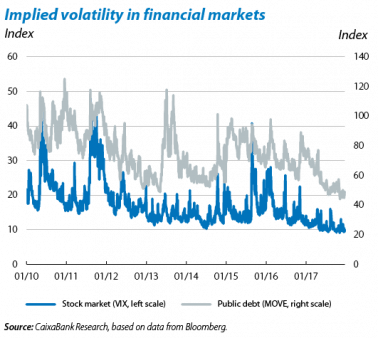

The maturity of the economic cycle and geopolitics will affect asset prices in 2018. At the same time as the macroeconomic scenario improved, 2017 saw an environment of very low financial volatility both in bond and equity markets. There was an episode of risk aversion related to France’s presidential elections in the first half of the year. However, after this the climate of low volatility was only disturbed by occasional surges in political uncertainty, especially following diplomatic tensions between the US and North Korea. Although these upswings were brief and contained, increasing geopolitical and commercial risks (the worsening cold war in the Middle East, tensions with North Korea and NAFTA renegotiations) will continue to be a source of potential financial instability. Another downside risk is that the US economy is entering a more mature phase of the cycle. Investors may therefore become more sensitive to the emergence of less favourable economic indicators or higher than expected inflation, especially given the doubts regarding the sustainability of high US stock market valuations.

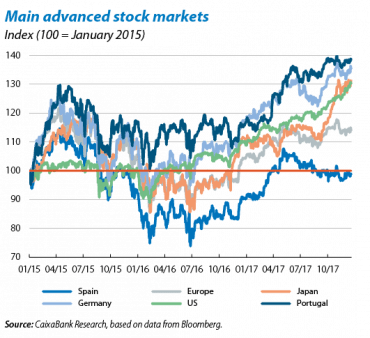

Gains subside in developed stock markets. In December, share prices rose slightly in the main advanced economies, led by the US stock market and investor optimism on the tax reform recently passed by the US Congress (which includes a cut in corporate income tax). The main stock markets of the euro area ended up with losses, however; more moderate in Germany and Portugal, and somewhat more pronounced in the periphery. But advanced stock markets had a very positive year overall. In the US, the S&P 500 index rose by nearly 20% in the year as a whole, outperforming its historical highs month by month (although doubts started to emerge regarding how long this could last). In Europe, the Eurostoxx 50 ended the year with a rise in value of around 6.5%.

The Fed ends 2017 with its third interest rate hike of the year. As expected, at its December meeting the Federal Open Market Committee (FOMC) raised the fed funds rate by 25 bp to 1.25%-1.50%. In contrast to the doubtful climate in 2016, when only one of the three expected hikes was actually carried out, in 2017 the Fed raised the benchmark rate three times (March, June and December), fulfilling the forecasts made in December 2016. The quarterly update of the Fed’s macroeconomic outlook also confirmed that the US economy should continue to grow above its potential in the coming years with forecasts that, according to Chair Janet Yellen, include the impact of the Trump administration’s tax reform. FOMC members therefore reaffirmed their willingness to continue gradually tightening the Fed’s monetary policy stance and repeated their intention to carry out three hikes in 2018 and two more in 2019, in line with the CaixaBank Research scenario. The market reaction to these announcements was relatively subdued although it should be noted that, since September, the number of hikes expected by the market for 2018 has gradually increased from one to two.

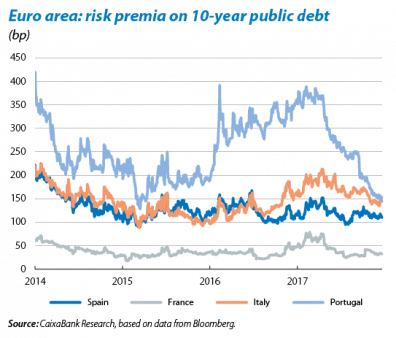

The ECB starts 2018 with a stronger outlook for the euro area. Following important announcements in October (extension of the asset purchase programme (QE) from January to September 2018 at a monthly rate of EUR 30 billion), the December meeting of the ECB’s Governing Council (GC) kept its monetary policy parameters unchanged. The GC concentrated on updating the macroeconomic scenario for 2018-2020 and the ECB upgraded the euro area’s growth prospects, as it had already done several times in 2017. In the first half of 2017, these upward revisions led investors to expect the reduction in QE announced last October. The current greater optimism about the new macroeconomic scenario has also boosted expectations that net asset purchases will end in the second half of 2018. However, the updated economic scenario also assumes a very gradual recovery in inflation. The GC therefore repeated principal payment reinvestments mean that the ECB will maintain its market presence for a long time. The ECB’s announcements were received without significant gains or losses and sovereign risk premia in the euro area remained relatively stable. The notable exception was Portugal, whose risk premium fell below Italy’s (for the first time since January 2010) after Fitch raised its rating from BB+ to BBB.

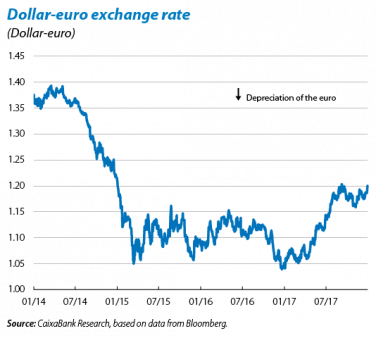

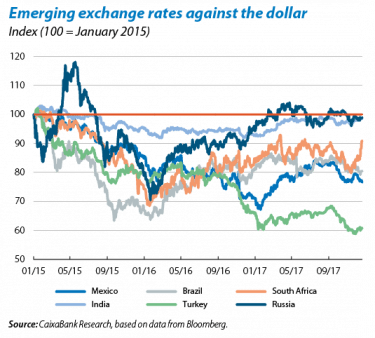

The dollar slows down its depreciation against the euro. Following November’s depreciation (2.2%, from USD 1.16 to 1.19 per euro), the euro/dollar exchange rate stabilised in December at around USD 1.18 per euro, supported by investor optimism due to the Trump administration’s tax reform and the Fed’s commitment to gradually tightening its monetary policy stabce. Nevertheless, the dollar depreciated further in the last week of the month to USD 1.2 per euro. For the year as a whole, the dollar depreciated by more than 12% against the euro. Most of the emerging bloc’s currencies also continued to appreciate against the dollar. In December, the most notable example was South Africa, where the rand appreciated by more than 10% against the dollar in response to the election of Cyril Ramaphosa as the new leader of the African National Congress (the candidate who promised to fight corruption the most). At the other extreme, the Mexican peso depreciated again (–5.2% against the dollar) as a result of uncertainty surrounding the NAFTA renegotiations.

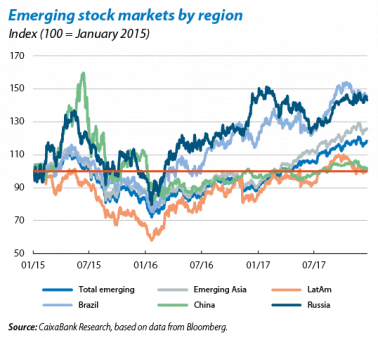

Emerging markets are advancing more moderately. After a volatile November, emerging stock markets saw more moderate gains in the last month of the year. The MSCI emerging markets index rose to just above 3%. There was a slightly bigger rise in Latin America than in emerging Asian economies (where the stabilisation of the Chinese stock market, falling by –2.2% in November, stood out). Over the year as a whole, however, progress was considerable and clearly greater than in 2016. The MSCI emerging index rose more than 30% (+8.6% in 2016), led by emerging markets in Asia (MSCI regional index +40.1% in 2017, compared with 3.8% in 2016) and, especially, with a better performance by the Chinese stock market (+6.6% in 2017 compared with –12.3% in 2016).

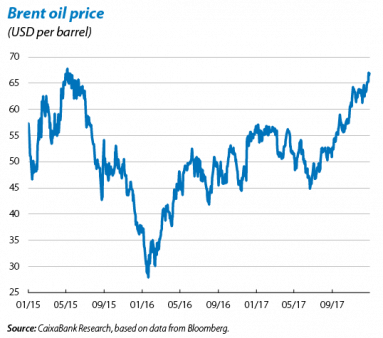

The price of oil stabilises. In the first three weeks of December, the price of a Brent quality barrel slowed down the upward trend shown throughout October and November, fluctuating around USD 63, although in the last week it rebounded to over USD 66. This occurred after OPEC announced on 30 November that it would extend its agreement to cut crude oil production until the end of 2018. This agreement, initially announced in November 2016, helped oil prices to recover, finally stabilising, in the first half of 2017, at around USD 50-55 per barrel. Investor credibility was also achieved due to the strong commitment shown by production cuts throughout the year. The renewal of this agreement for 2018 will therefore help oil prices to remain stable around the current level. However, possible increases in US shale production could limit any upward trend in oil prices.