The IMF’s keys to global financial stability in the medium term

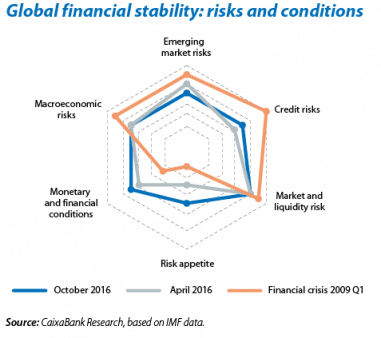

Just a few days ago the International Monetary Fund (IMF) published its latest Global Financial Stability Report. In this report the institution systematically and exhaustively analyses the trends and state of different markets, as well as providing a future projection which reviews the keys risks facing the global financial system. The panorama outlined on this occasion has both positive and negative aspects. First of all, the IMF believes that the overall health of the global financial system has improved and that risks have abated, at least slightly. It notes the progress made in terms of cohesion and confidence in safety nets which has helped markets to adjust to Brexit concerns relatively smoothly and avoid potential spillovers. Nevertheless it stresses the possible adverse consequences of two challenging issues: the low level of both growth and interest rates and the high level of leveraging in emerging countries.

The IMF points to several reasons for the persistent drop in interest rates. Not only have short-term interest rate expectations declined significantly but central banks’ bond purchases have also narrowed the spread between short and long-term rates, known as the term premium. This situation may also have been caused by the higher demand for long duration assets by pension funds and insurance companies, as well as by the increase in demand for safe assets in general. One important consequence of these flatter yield curves, which the report does not examine in detail on this occasion, is the pressure on prices for different financial and real assets. This can make it difficult for investors to estimate the different risk premia incorporate within such assets and thereby adjust the return-risk ratio of their portfolios. According to the IMF, the slowdown in global average growth (2.1% since 2008 compared with 3.0% between 1982 and 2008), persistent low inflation and increased uncertainty have resulted in a long period of low interest rates and low yields on assets as a whole. This scenario produces a dangerous effect: it gradually erodes the capital and solvency buffers which banks have worked so hard to establish over the last few years, especially because it reduces interest margins. The report notes that a continued decrease in the profitability of financial intermediaries could end up deteriorating the provision of credit. According to calculations made by the report, the situation of the financial sector will not be resolved via a cyclical recovery in the economy but needs structural reforms. It does acknowledge, however, that progress has been made and also suggests some actions that should be taken in the future: revising the legal framework to handle non-performing loans more readily (and/or addressing recapitalisation processes that are not financed by taxpayers), rationalising banks so that only the most operationally efficient remain in the sector and taking measures to be able to handle a more competitive environment due to changes in technology (fintech) and consumer habits.

On a more optimistic note, the report believes that the emerging economies now have the opportunity to resolve their high leverage levels, especially regarding corporate debt. The IMF refers to the upswing in flows of financial investment received by these economies, notably improving corporate bond yields. This is creating an appropriate environment to carry out the work of corporate deleveraging, which would also create positive externalities since almost 80% of corporate debt is on the balance sheets of banks in the respective countries, thereby improving their solvency.

In conclusion, the IMF’s diagnosis states that the foundations for global financial stability have improved to some extent but predicts a lengthy period of painful convalescence for the banking sector in developed countries, as well as prescribing a quick therapy for the emerging countries to redress their corporate balance sheets.