Interest rates and inflation expectations on the rise, stock markets on hold

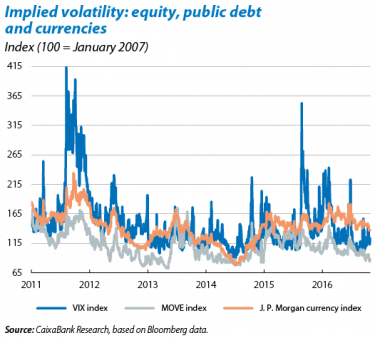

Markets remain calm in a complex environment. The main focuses of attention are still the monetary policy actions that will be carried out by the main central banks in the short and medium term; political risks; the strength of the macroeconomic situation and the resilience of Europe’s banks. The last month has seen positive signs on each of these fronts, albeit to a greater or lesser extent. The market is digesting the more than likely fed funds rate hike in December without any huge problems. Moreover, the rise in sovereign yields this hike will bring about is benefiting bank share prices, which made considerable gains in October. On the macroeconomic front, the figures published have tended to reinforce a scenario of acceleration in the emerging and US economies, in line with the forecasts by CaixaBank Research. Nevertheless the risks remain relatively high, also on all these fronts. In the short term, and in the political sphere, all eyes are on the outcome of the US elections and Italy’s referendum; while as far as monetary policy is concerned the market is anxiously awaiting the ECB’s meeting in December, when it will have to decide whether to extend its quantitative easing programme (QE) in the euro area.

The ECB is keeping quiet about the future of QE until December. The meeting last 20 October of the Governing Council (GC) of the ECB did not provide any significant news and the parameters of the ECB’s monetary policy remained unaltered: the refi rate held steady at 0.0%, the marginal lending facility rate stayed at 0.25% and the deposit facility rate at –0.4%. However, investors’ attention focused on the adjustments that might be announced in QE. Officially QE will continue until March 2017 but the bulk of the evidence available suggests this will be extended. The question was, and still is, how long and with which tools. Specifically, Mario Draghi stated that the GC had not discussed any prolongation of the programme but acknowledged that it would continue to assess possible adjustments to ensure appropriate implementation up to March 2017, or beyond if necessary. He also noted that he believed an abrupt halt to asset purchases was unlikely. Lastly, he pointed out another element that could influence the decision to extend QE, namely the updated economic forecasts carried out by the ECB in December. The baseline scenario maintained by the markets is still an extension to the programme although there is a lot of uncertainty regarding how this will be done and for how long. Given this situation, the next GC meeting, set for 8 December, has been highlighted on the agendas of all market analysts and agents and, whatever the decision taken by the ECB, it will have to be explained in great detail so as not to damage the authority’s credibility and bring about another upswing in volatility.

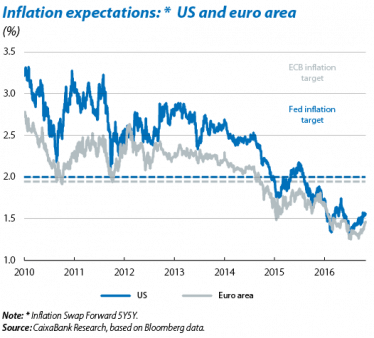

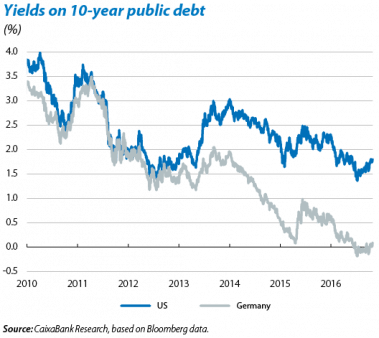

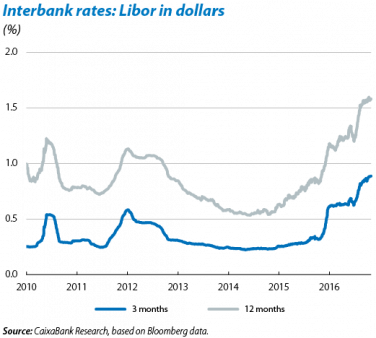

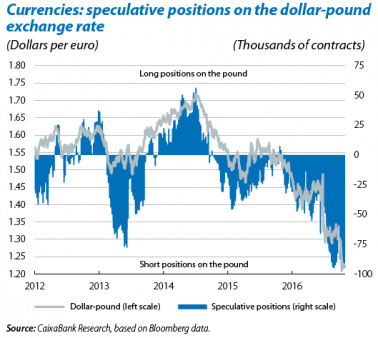

Meanwhile the Fed is duly preparing the market in advance for its next interest rate hike in December. The winds are blowing in the Fed’s favour as all indicators support another hike. Both business indicators and those for prices point to inflation continuing to rise over the coming months and this has helped inflation expectations to recover notably in the last few weeks. Given such indicators, the Fed is allowing the market to adjust asset prices assuming the next interest rate hike will be in December. Moreover, the market is also pricing the Fed’s greater tolerance of a possible upswing in inflation. All this is pushing up sovereign debt yields and the return on US bonds rose by 23 bps in October to 1.83%. The recovery in the monetary market is also considerable although in this case part of the increase in yields is also due to certain technical adjustments in how this market operates. As is customary, the change in expectations regarding the Fed’s actions is also affecting assets in the euro area with increases in yields on bonds and the European monetary market, albeit to a lesser extent. For example, the German 10-year bond stood at 0.16% while the 12-month Euribor rate rose to –0.07%. The other side of the coin has been the drop in bond indices, in particular those with longer maturities. In the US and in the euro area, the indices for sovereign bonds with maturities between 1 and 10 years lost 0.65% last month on average while those with maturities longer than 10 years, which are more sensitive to interest rate changes, have fallen by 4%.

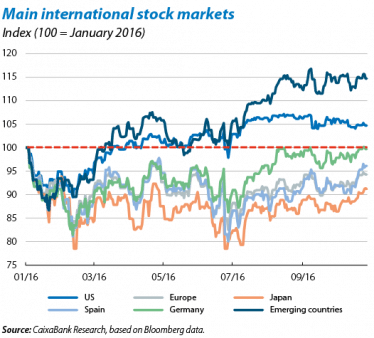

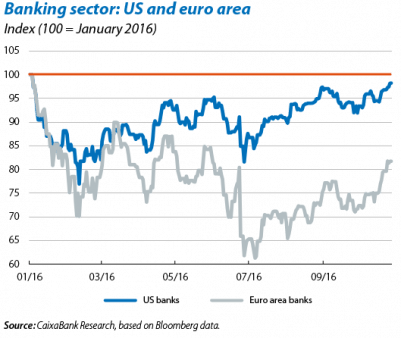

Equity is benefitting from the improved macroeconomic environment and a good earnings season. Regarding this last factor, it should be noted that, in general, the earnings reported by the main US and European firms have been higher than expected. Specifically, the earnings of the 276 S&P 500 companies that have published their accounts posted a year-on-year increase of 3.4%. In Europe, where almost half the Eurostoxx companies have reported their Q3 earnings, profits were up by 33%, thanks especially to the strong improvement in the consumer sector and the good performance by banks. Eurostoxx increased by 1.1% in the month of October. The improved returns for the banking sector are largely due to steeper sovereign curves as this is expected to have a positive effect on the industry’s margins. The S&P 500 Banks subindex posted a rise of 4.7% in October while the gain made by its European peer was 12.8%.

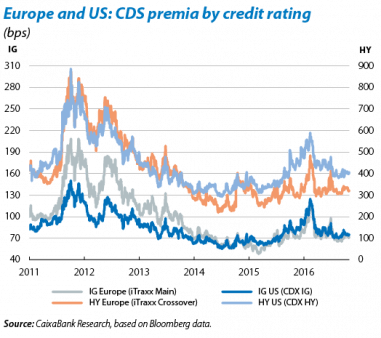

The credit market remains stable. This situation can be seen on both sides of the Atlantic and in different types of assets. For example, CDS premia, both investment grade and high yield corporate bonds, have moved sideways without any huge fluctuations. Without doubt one of the main factors underlying this pattern is the belief that the monetary policy of the main central banks will remain highly accommodative for a long period of time. Given this situation, one of the surprises in the last few months has been the slowdown in the rate of issuances in euros. This is partly due to the upswing in political uncertainty in the euro area and is therefore seen as a temporary phenomenon as the ECB’s monetary policy will continue to be highly accommodative in the coming quarters. Nevertheless, apart from favourable financial conditions, the crucial element still lacking for any sustained improvement in the credit market is a more vigorous recovery in corporate investment which, to date, is still more tentative than usual. In this respect, of note is the good trend posted by corporate investment in the US in Q3, with 0.3% growth quarter-on-quarter in real terms, a figure that has encouraged investors to a certain extent.

Emerging markets are taking a break in their upsurge. The MSCI Emerging Markets index only advanced by 0.2% in October but from January to October this year it has already accumulated an increase of 14%. As described in more detail in the Focus «Stock markets in the emerging countries: the turn of domestic factors» in this Monthly Report, two factors are driving the emerging markets. On the one hand, the Fed maintaining its expansionary monetary policy (compared with what had been expected a few months ago). The second factor is the improvement in macroeconomic conditions. The first factor is expected to disappear in the next few months. In fact, the sovereign yields of the main emerging countries have seen a slight upswing in the last few weeks, as will probably be the case for the yields on corporate bonds in the next few months, although these are still stable at present. The big question is whether the second factor can take over from the first. This should be the case according to CaixaBank Research forecasts and those of analysts on the whole, but the risks are high. At any rate, it must be remembered that the emerging bloc is still highly heterogeneous. On its weaker side we find countries such as Brazil and Russia which are still in recession, although they are now starting to see some light at the end of the tunnel. China is in the middle, immersed in the process of changing its production model, involving a gradual slowdown in growth, but the underlying risks are still significant (real estate boom, corporate debt, etc.). On the positive side is India, which is enjoying an enviable growth rate in excess of 7%.