Spain: a year of transition

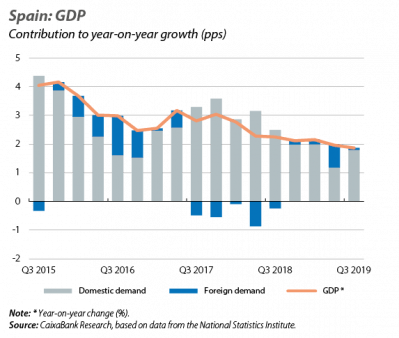

A gradual moderation of growth. With the data available from three of the four quarters of the recently-ended 2019, all the indicators suggest that the growth of the economy for the year will have stood at around 1.9%. While this is a more contained rate than the previous year (2.4%), it remains well above the average growth anticipated for the euro area (1.1%). This moderation of growth can be put down to the fading of the cyclical boost offered by the initial phase of the economic recovery and the deterioration of the global trade environment. The latter – a product of elements such as the trade dispute between the US and China, uncertainties over Brexit and the difficulties of Europe’s automotive sector (due to the introduction of new regulations and the technological change that the sector is going through) – has had an impact on Spanish exports of goods and services through the demand channel, but it is not a sign of declining competitiveness in relative terms. Thus, the slowdown that we can see largely represents the process of growth converging towards levels more in line with the economy’s potential growth. Over the coming year, we expect this process of convergence to continue and the economy to grow at a rate of around 1.5%.

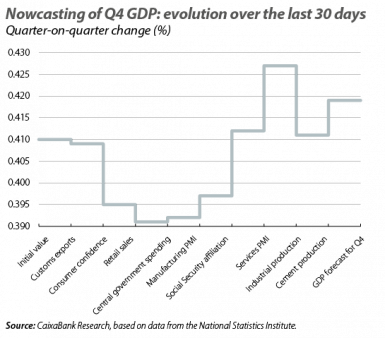

Economic activity maintains a good tone in the closing stages of the year. The performance of the indicators over the past month has been mixed. On the one hand, consumer confidence in November fell by 1.2 points down to –10.3 points, while industrial production in October dropped by 1.3% year-on-year (+0.6% in September). In contrast, both the manufacturing and the services PMI for November showed a slight improvement and rose by 0.7 and 0.5 points, respectively, reaching 47.5 and 53.2 points. Once we incorporate the full set of indicators into the Nowcasting model for short-term GDP projections, we obtain a forecast of 0.4% quarter-on-quarter growth for Q4 2019, similar to the figure for the previous quarter. In addition, this rate would be consistent with our forecast for annual growth of 1.9% for 2019.

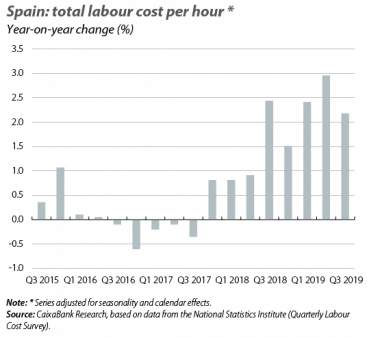

The gradual slowdown of the labour market takes a respite in November. In particular, affiliation with Social Security increased by 2.3% year-on-year, the same growth rate as a month ago, albeit below that of November 2018 (2.9% year-on-year). As such, despite the slowdown in the economy, the pace of job creation remains strong and will continue to provide support for the growth of incomes and consumption. On the other hand, the growth in incomes is expected to be increasingly supported by a gradual recovery of wages, which the data have been showing for several quarters now. Whereas in 2017 wages per effective working hour remained stagnant (–0.1% annual growth), in 2018 their growth rose to 1.5%, while in Q3 2019 it accelerated up to 1.9% year-on-year.

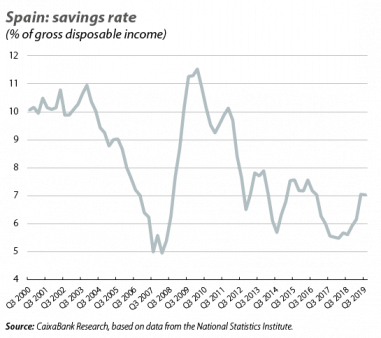

Saving remains stable in Q3. The steady pace of job growth and the recovery in wages have been reflected in the growth of households’ gross disposable income, which in Q3 2019 stood at 4.2% year-on-year. Furthermore, consumption grew at a significant – albeit somewhat more modest – rate of 2.6% year-on-year. The savings rate thus stood at 7.0% of gross disposable income (four-quarter cumulative figure), 1.4 pps higher than in Q3 2018 and similar to the figure for the previous quarter. Although the recovery of the savings rate from its lows of last year (5.5% at its lowest point) has meant lower growth in consumption, it also constitutes an improvement in households’ financial buffers, thus making the economy more resilient.

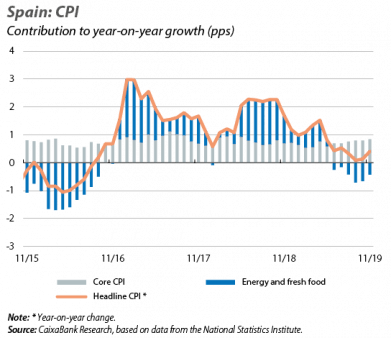

Inflation rebounds in December. The consumer price index (CPI) rose to 0.8% in December (0.4% in November) as the base effects of the oil price continue to fade. In particular, the price of oil in euros went up in December by 13.0% year-on-year, compared to a fall of 5.2% in November, thus ending the downward effect that energy prices have had on the CPI in recent months. In January we do not expect the base effects of the oil price to play any part, but we do anticipate that headline inflation will continue to fall more in line with core inflation, which in November remained at a moderate 1.0%.

The general government accounts show a slightly larger deficit than expected. With data up to Q3 2019, the consolidated general government deficit, including local corporations, stood at 1.5% of GDP, 3 decimal points above the figure for Q3 2018. This result was mainly due to the deterioration in the accounts of the autonomous community regions, although it was also partially influenced by the effect of tax settlements. By component, the consolidated revenues of the general government (excluding local corporations) up until October rose by 3.8% compared to the same period in the previous year (4.3% in September). This was mainly driven by social contributions, which grew by a vigorous 7.9% year-on-year. Consolidated expenditure, meanwhile, increased in the same period by 4.9% due to increases in the remuneration of public sector employees and social benefits that were agreed in 2019. As a whole, the data up to Q3 reinforce our forecast that the deficit will end up slightly above the 2.0% target.

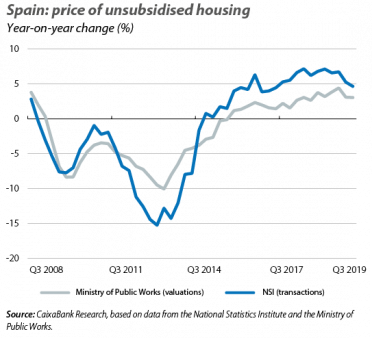

The price of housing grows more than expected in Q3. The transaction prices published by the National Statistics Institute rose by 1.6% in quarter-on-quarter terms (more than in the previous three quarters), although in year-on-year terms they slowed down to 4.7%. While in Q4 they may pick up slightly due to a base effect related to the poor figure registered in Q4 2018 (quarter-on-quarter growth of 0.4%), overall the indicators continue to point towards an underlying slowdown, in line with the slower pace of growth in the economy.