The Spanish economy continues its gradual slowdown

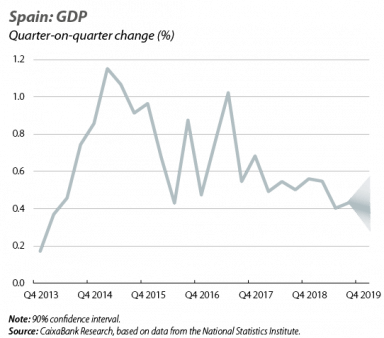

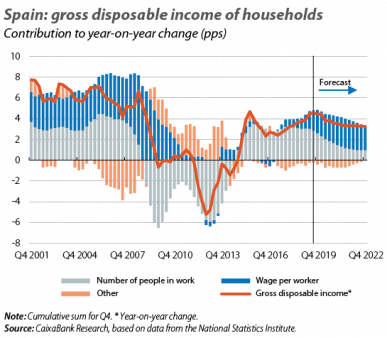

Spain continues to grow above the rate of its neighbours. The Spanish economy is experiencing a slowdown which reflects the moderation inherent to a more mature phase of the cycle (2019 will mark the sixth year of expansion) and the impact of a less favourable external environment. With just a month left before the year of the year, all the indicators suggest that GDP will grow by 1.9% in 2019, well above the 1.1% expected for the euro area as a whole. This is below the 2.7% average growth for 2014-2018. However, as argued in the article «The Spanish economy in 2020: things are not looking so bad» in the Dossier of this same Monthly Report, the risk of recession is estimated to be a contained 15%. Thus, in 2020 the economy is expected to maintain a growth rate of around 1.5%, driven by domestic demand and the growth in household disposable income. In addition, the Spanish economy is facing this slowdown with fewer macroeconomic imbalances than in the past. As such, according to our forecasts, the current account will end 2019 with a surplus of 1.6% of GDP, compared to the –9.4% deficit registered in 2007, the year prior to the Great Recession; household debt will stand at around 65% of GDP, whilst in 2007 it was almost 90%, and non-financial corporate debt will reach around 90%, whereas at the end of 2007 it exceeded 120%. The relative competitiveness of the Spanish economy has also improved dramatically since 2007 and the recent rise in labour costs is far from reversing this trend. Following on from this, the inflation gap with the euro area in 2019 is negative, standing at –0.4 pps, whilst in 2007 prices in Spain rose by 0.6 pps more than in the euro area. Nevertheless, there is still work to be done. For instance, the less favourable external environment removes a support factor for the improvement of the net international investment position (which has gone from –97.8% of GDP in Q2 2014 to –80.0% in Q2 2019). Similarly, the correction of public debt, which has made very slow progress in a period of strong growth (standing at 97.8% of GDP in Q3 2019, close to the peak of 100.9% registered in Q1 2015), will have fewer cyclical tail winds to push it along.

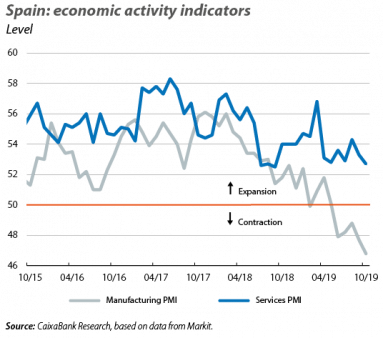

Healthy economic activity, albeit with the dichotomy between services and manufacturing. As we approach the year end, the latest available indicators point towards a similar level of economic activity growth in Q4 as in the previous quarter (when it stood at 0.4% quarter-on-quarter). However, this encouraging performance hides a differing trend between sectors. In October, the PMI index for the services sector stood at 52.7 points. Although in expansive territory (above 50), this is 6 decimal points lower than in September and 2.1 points below the average for 2018. In contrast, the manufacturing PMI remains at levels indicative of a contraction in the sector’s activity (46.8 points in October, 9 decimal points lower than in September and 6.1 points below the average for 2018), while the industrial production index has stagnated (+0.8% year-on-year in September) following the sudden drop in late 2018 and early 2019. Furthermore, the demand-side indicators are also exhibiting dichotomies. The strong performance of retail sales (3.9% year-on-year in September, excluding service stations) reflects the resistance of private consumption. However, car sales replicate the weakness of manufacturing and have failed to emerge from their rut (in the 12-month cumulative period up to October, they stood 6.6% below the figures for the same period last year).

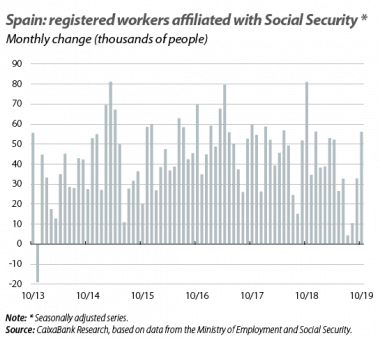

Gradual slowdown in the labour market, in line with the lower growth of the economy. The number of people registered with Social Security rose by 2.3% in October (2.4% in September), representing an increase of 436,920 in the number of people who have registered in the past 12 months. Over the same period, the number of people in unemployment fell by 77,044. By sector, Social Security affiliation in the industrial sector registered a moderate pace of growth of 1.2% year-on-year, 1 decimal point lower than the figure for September, while growth in affiliation in the construction sector slowed to 3.7% year-on-year, 4 decimal points lower than in September. Affiliation in the tourism and services sectors, meanwhile, maintained its growth rate at 2.7% and 2.8% year-on-year, respectively.

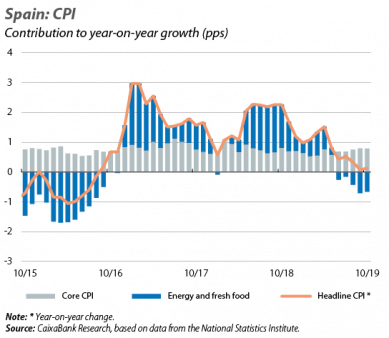

Inflation at moderate levels. In November, headline inflation stood at 0.4% year-on-year, marking the beginning of a recovery compared to the figures of previous months (0.1% in September and October). This improvement particularly reflects the fading of the base effects of the oil price, as the indicator now compares the price in November 2019 (around 56 euros per barrel) with that of November 2018 (58.03 euros), well below the 70 euros registered in October 2018. Thus, as this effect fades over the coming months, headline inflation will draw closer to core inflation, which remains at a moderate 1.0%.

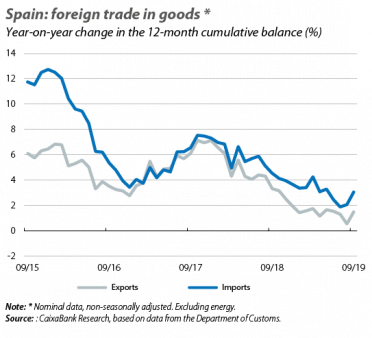

The deterioration of the foreign surplus continues. In September, the balance of trade in goods deteriorated, driven by the balance of non-energy goods. As a result, the trade deficit stood at 2.8% of GDP (12-month cumulative figure). This represents a 0.29-pp deterioration compared to a year earlier, which is entirely attributable to the worsening of the balance of non-energy goods. In particular, non-energy exports grew well below non-energy imports (1.5% year-on-year on a 12-month cumulative basis, versus 3.1%).

The price of housing stabilises. The price of housing according to valuation appraisals grew by 0.1% quarter-on-quarter in Q3 and by 3.1% in year-on-year terms, repeating the figures of the previous quarter. This is a somewhat lower growth rate than expected, implying that the slowdown in the sector could end up being more pronounced than anticipated. The slowdown in housing prices is taking place within a context in which demand is also showing some regression, although it remains high. The supply-side indicators are also registering a certain slowdown. That said, once again, it should be mentioned that they are still growing at a healthy pace and above that of the economy as a whole. Looking ahead to the coming quarters, the moderation in the sector’s growth looks set to continue. Nevertheless, this should not be interpreted as a sign of weakness, but rather as a normalisation towards more sustainable growth rates following the strong upswing experienced during the recovery.