Strong growth rate towards a more mature phase of the cycle

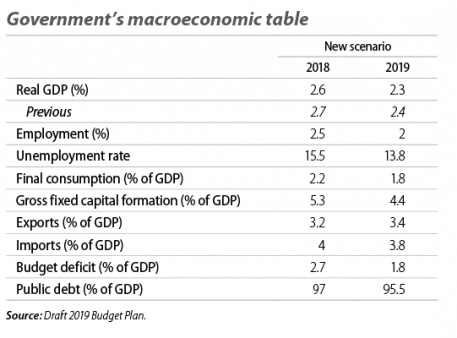

The economy is moving towards a more mature phase of the cycle. Last month, at CaixaBank Research we revised the scenario slightly, reducing the growth forecasts for 2018 and 2019 by 0.2 pps (down to 2.5% and 2.1%, respectively). This revision was to reflect the revised historical GDP series produced by the Spanish National Statistics Institute (NSI), the increase in downside risks in the international environment and the slowdown in growth as the economy moves into a more mature phase of the business cycle. Similarly, the update to the Government’s macroeconomic table, which is included in the draft Budget Plan for 2019, also reflect this shift of the economy towards a more mature phase of the business cycle. In particular, the Government has lowered its GDP forecast by 0.1 pp, down to 2.6% for 2018 and to 2.3% for 2019, relatively in line with the scenario envisaged by CaixaBank Research. Furthermore, the draft budgets sent to Brussels maintain the commitment to reducing the deficit down to 1.8% in 2018 (a reduction of 0.9 pps, which includes a 0.4-pp correction in the structural deficit).

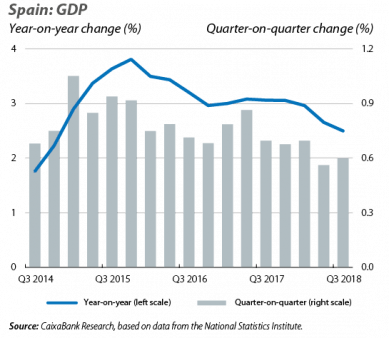

The economy continues to show steady growth in Q3. According to the NSI’s first estimate, GDP growth remained at 0.6% quarter-on-quarter and at 2.5% year-on-year in the third quarter of the year (the same figures as in Q2). Thus, the Spanish economy registered a higher growth rate than that of the main economies of the euro area, but slightly lower than that registered in recent years. This reinforces the view of a gentle slowdown as the economy moves towards a more mature phase of the cycle. By component, domestic demand remained the main driver of the economy (contribution of 3.0 pps to year-on-year growth), while private consumption rose by 0.6% quarter-on-quarter following a slight glitch in Q2 (0.1%). Growth in investment, meanwhile, remained at a solid 1.0% quarter-on-quarter (an encouraging figure that follows the strong 3.5% of Q2). External demand, on the other hand, had a negative net contribution (–0.5 pps, following –0.8 pps in Q2), although this was in line with expectations due to the global trade tensions and the slowdown of the euro area.

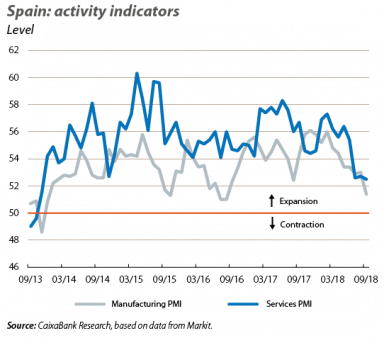

The activity indicators underpin a gradual slowdown. On the supply side, the manufacturing and services PMI indices stood at 52.4 and 52.6 points on average in Q3, respectively, slightly lower than in Q2 (average of 53.7 and 55.8 points, respectively). Industrial production, with a year-on-year growth of 1.2% in August and of 0.7% in July, appears to have advanced in Q3 at a rate similar to the 0.9% registered in Q2. Finally, on the demand side, retail sales in Q3 fell by 0.4% year-on-year after stagnating at the Q2 average.

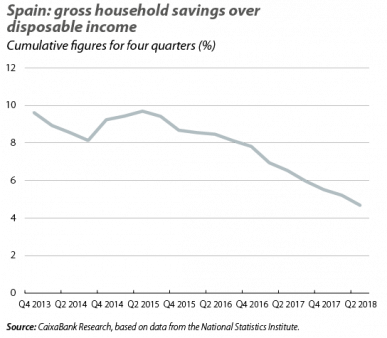

Savings rates remain low, while wages show strong growth. In particular, the household savings rate stood at 4.7% in Q2 2018 (cumulative figure for four quarters), 0.5 pps below the figure for the previous quarter. This decline reflected a divergence between nominal consumption, which maintained a growth rate of around 4% in the second quarter of the year, and gross disposable income (GDI), with a growth of 1.9%. All in all, looking ahead to the next few quarters, we expect the savings rate to stabilise with the recovery in the labour market. Evidence of this is the fact that the most important component of GDI, wages, grew at a similar rate to nominal consumption (3.8% year-on-year in Q2 2018), suggesting that other more volatile components are temporarily responsible for the lower growth in GDI.

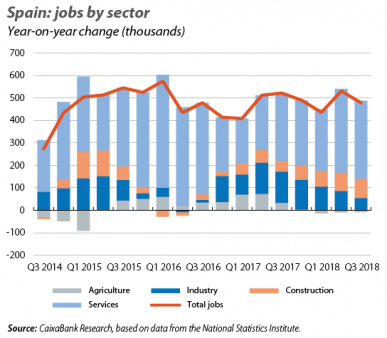

Positive trend in employment in Q3. The latest data from the labour force survey (LFS) reflect strong job creation in Q3 and a marked reduction in the unemployment rate, which fell from 16.4% in Q2 to 14.6% in Q3 (the lowest level since Q4 2008). In particular, employment growth in Q3 stood at 2.5% year-on-year and 0.5% quarter-on-quarter. Although slightly lower than the growth rate in Q2, this still represents an increase of 478,800 people in work over the past 12 months. By sector, the good performance of the service sector, with 346,900 jobs created over the last four quarters, offset the more modest increase in jobs in the industrial sector (+55,000 people in work). Lastly, in contrast to these encouraging growth rates, the LFS data indicate that the rate of temporary employment stood at 27.4%, the same level as last year and well above the rate of the main economies of the euro area. Over the coming quarters, the trend of growth in the labour market is expected to continue, but it will lose some momentum in line with the expected slowdown in the Spanish economy.

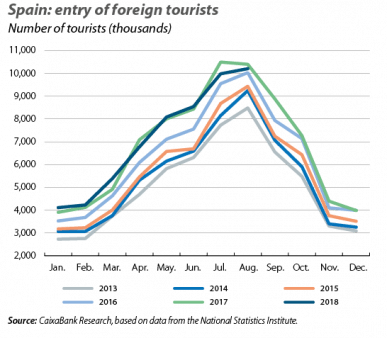

The foreign sector slows down. The current account surplus stood at 1.2% of GDP in August (12-month cumulative figure), slightly below the figure registered in July this year (1.3%) and in August 2017 (1.9%). This moderation mainly reflected a deterioration in the trade balance of energy goods (affected by the persistence of higher oil prices) and a slowdown in exports of non-tourist services. Also, in 2018 we are seeing a normalisation of tourist flows, following an extremely positive 2017. In particular, August this year saw 1.9% fewer tourists arriving than in August 2017. This slowdown was to be expected, considering the gradual recovery of some of the main tourist centres along the southern and eastern Mediterranean coastlines. Nevertheless, despite the lower numbers of tourists arriving, their total spending increased by 1.8% year-on-year. This could be a reflection of the trend of tourists from countries with a lower spending profile being gradually replaced by those from countries with a higher spending profile.