The global expansion continues in an environment of uncertainty

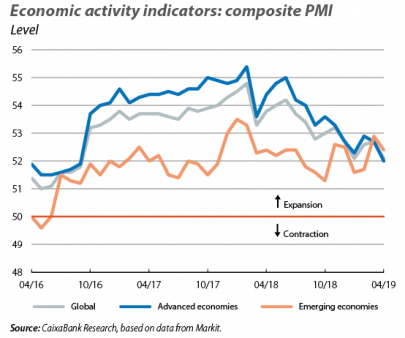

The global economy is advancing at a more moderate rate. This is reflected in indicators such as the global composite Purchasing Managers’ Index (PMI), which has remained slightly above 52 points for the past few months (52.1 points in April), a level below the 53.6-point average for 2018, but still safely above the 50-point threshold that separates the expansionary territory from that of contraction. Thus, indicators confirm CaixaBank Research’s macroeconomic scenario, which predicts a mild slowdown in global growth (from 3.6% in 2018 to 3.3% in 2019). Part of this moderation responds to temporary restrictions in some key economies (especially in the euro area), meaning that economic activity could improve as the year progresses. Nevertheless, as the following paragraphs on this month’s economic outlook point out, the current environment is demanding and major sources of uncertainty prevail.

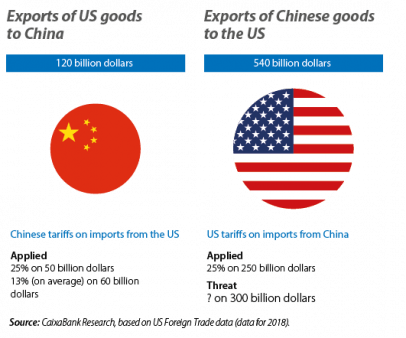

Trade negotiations between the US and China are stuck. In particular, just when it seemed that the US and China were close to reaching an agreement to steer their trade conflict towards a satisfactory conclusion, in May tensions raised again. On the one hand, the US announced a 10% tariff rise, bringing the rate up to 25% on Chinese imports worth 200 billion dollars, after which China responded with tariffs on 60 billion of imports from the US. Furthermore, Trump threatened to impose another round of tariffs (at 25%) on a further 300 billion of imports from China, which would cover the total value of Chinese goods imported annually by the US (see second chart). On the other hand, the escalation of tensions went beyond tariffs after the US added Huawei to the list of businesses requiring government “authorisation” to procure components and technology from the US. Without a doubt, these developments put pressure on China to strive harder to meet some of the US’ demands on technology transfer and intellectual property before a trade agreement can be reached – something which today seems unlikely to happen in the immediate future. However, they also underline the risk of tensions between the two countries continuing for longer than initially expected. In addition, the US postponed its decision on tariff measures in the automotive sector until the end of the year, which would particularly affect Europe.

In Europe, pockets of political uncertainty persist. On the one hand, although the European Parliament election resulted in a greater proportion of votes for Eurosceptic parties, support for them was lower than some analysts predicted and their share of parliamentary voted failed to reach the threshold needed to have a material influence on the political and institutional course of the EU. On the other hand, in the United Kingdom, the prime minister Theresa May announced her resignation, with effect from 7 June. Following her resignation, the Conservative Party leadership contest will begin and could extend into the summer. This will add to the existing difficulties to reach a consensus strategy on Brexit in the House of Commons before the new deadline of October 31.

US

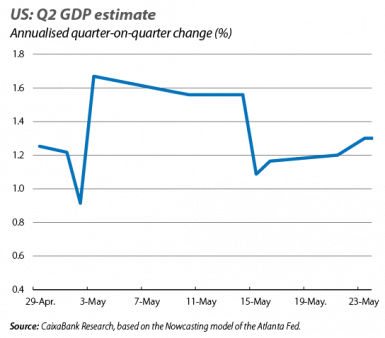

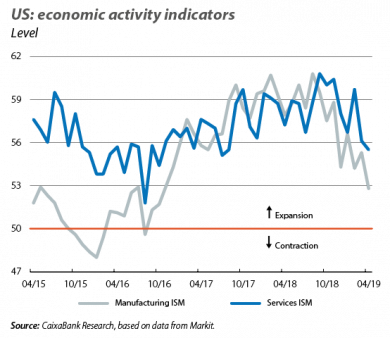

The indicators point to a lower rate of growth in Q2. In particular, GDP Nowcasting models of the various federal reserves place growth for Q2 between 1.0% and 1.5% (in annualised quarter-on-quarter terms). This confirms that, beyond the surprise of Q1 (3.1% annualised quarter-on-quarter growth, supported by short-term factors such as inventories), the US economy is moving towards a gradual moderation in its growth rate due to the very maturity of the cycle and the fading of the fiscal stimulus. All in all, with one month to go until the end of the quarter, it is still too early to accurately assess the magnitude of the slowdown. In fact, some economic activity indicators that have been published during the month provided a positive surprise. These included the manufacturing indices for the month of May developed by the New York Fed and the Philadelphia Fed, which showed considerable increases. In addition, the consumer confidence index developed by the Conference Board rose to 134.1 points in May (129.2 in April), much higher than expected and well above the average for 2018 (130.1). Finally, in the field of labour, 263,000 jobs were created in April, a high figure in a context of full employment. In addition, the unemployment rate fell to its lowest level in 50 years (3.6%) and wages rose by 3.2% year-on-year.

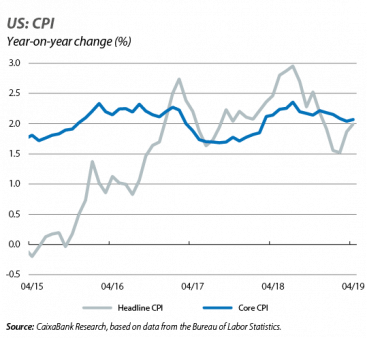

Inflationary pressures remain contained and support the patient strategy of the Fed. In particular, inflation in the US rebounded slightly in April and reached 2.0%, 1 decimal point above the figure for the previous month, partly driven by fuel prices. Core inflation, meanwhile, stood at 2.1% (2.0% in March). Looking ahead to the coming months, we expect core inflation to remain at the current levels, in line with the Fed’s target rate.

EUROPE

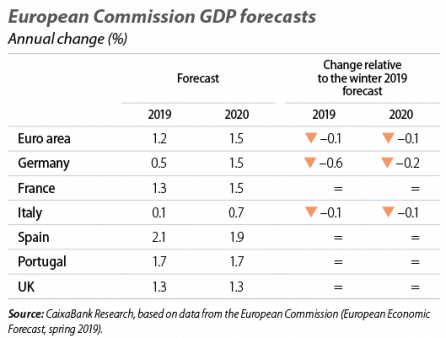

The expansion continues at a moderate pace. Despite higher than expected growth in Q1 (0.4% quarter-on-quarter and 1.2% year-on-year), euro area growth will remain at moderate levels (slightly above 1.0% year-on-year), in the context of a slowdown in global economic activity that is particularly affecting trade and manufacturing. This is reflected in the latest update of the economic scenario by the European Commission. In particular, in its spring forecast update, the institution downgraded its growth forecast for the euro area for 2019 by 1 decimal point, down to 1.2%, and down to 1.5% for 2020 (very similar figures to CaixaBank Research’s forecasts). Despite this downward revision, and as the Commission points out, the pace of activity could pick up slightly starting in the second half of the year, reaching rates more in line with the bloc’s potential (1.4%). Such an upturn would be driven by the gradual fading of temporary restrictions, such as the automotive sector’s slow adaptation to the new emission standards and some pockets of political uncertainty.

Germany and the UK grew more than expected in Q1. Economic activity in Germany recovered from the bump in the second half of 2018 (–0.2% in Q3 2018 and 0.0% in Q4 2018) and grew by 0.4% quarter-on-quarter (0.7% year-on-year), thanks to the positive performance of domestic demand. GDP growth in the United Kingdom, meanwhile, rose to 0.5% quarter-on-quarter (0.2% in Q4 2018), despite the high uncertainty surrounding Brexit that was experienced in Q1.

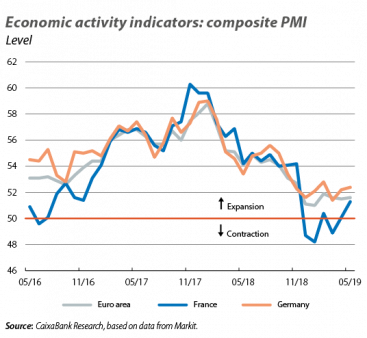

The economic activity indicators offer mixed signals. On the downside, the composite PMI index for the whole of the euro area remained virtually flat in May (51.6 points), well below the average for 2018 (54.5 points) but still within expansionary territory (above 50 points). In addition, the breakdown by sector showed that the manufacturing PMI continues to point to contraction (at 47.8 points), reflecting the fact that the drags on the foreign sector and on manufacturing have not yet dissipated. On the upside, the economic sentiment index (ESI) elaborated by the European Commission rose to 105.1 points, after 12 months of declines. Similarly, consumer confidence for the whole of the euro area also picked up in May, reaching –6.5 points (–7.0 points in Q1). On the whole, the indicators suggest that economic activity will maintain a moderate pace in Q2.

REST OF THE WORLD

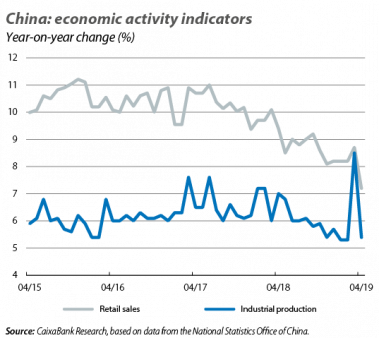

China: lower than expected economic activity indicators. In April, there was a moderation in the growth of industrial production down to 5.4% (8.5% in March). Retail sales also followed a similar trend, with year-on-year growth of 7.2% (8.7% in March). Chinese exports, meanwhile, fell by 2.7% year-on-year (+13.8% in March). This figure was worse than expected and well below the average for the last 12 months (5.9%). These indicators suggest that the fiscal stimulus measures implemented in Q1 are having a short-lived effect and that, in the absence of new stimulus measures, China’s economy will continue to slow down over the coming quarters.

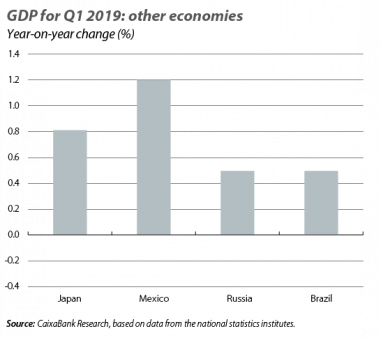

Japan exceeds expectations once again. Japan’s GDP showed solid growth in Q1, standing at 0.5% quarter-on-quarter (0.8% year-on-year), above the already considerable 0.4% registered in Q4. However, despite the growth rate exceeding most analysts’ predictions, the breakdown by component showed that the growth was supported by short-term factors (such as inventories). In contrast, private consumption (–0.1%) and non-residential investment (–0.3%), which are pillars of domestic demand, proved weak.

Among emerging economies, Mexico and Russia lose momentum. On the one hand, Mexico performed worse than expected in Q1, with a quarter-on-quarter GDP contraction of –0.2% (growth of 1.2% in year-on-year terms). Although part of this weakness is attributed to disruptions in the industrial sector, the trend in the most recent indicators suggests a more contained rate of economic activity. In addition, Brazil’s GDP contracted in Q1 (–0.2% quarter-on-quarter, the first negative figure since 2016). The Russian economy, meanwhile, grew by 0.5% year-on-year, significantly below the previous quarter (2.7%), partly due to the detrimental impact of the rise in VAT at the beginning of the year. This figure confirms the slowdown that was anticipated for 2019, with the persistence of geopolitical uncertainty (with the threat of new international sanctions), and the return to growth rates that are more in line with the country’s potential.