Inflation expectations for 2016-2017: a sustained rise

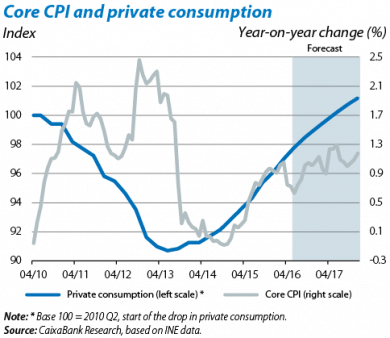

Inflation has embarked on a recovery which will gain in strength in the second half of 2016 and the first few months of 2017. This will take the general CPI into positive terrain as from August and to above 2% temporarily in 2017 Q1. Although the general index was still posting negative rates of change in June, accumulating 29 months of negative or zero inflation, inflation’s recovery had already started to improve in October 2014 when core inflation ended its downward trend, supported by the improvement in private consumption. Over the coming months, this upward direction will consolidate thanks to a combination of two factors: oil prices and the sustained dynamism of the economy.

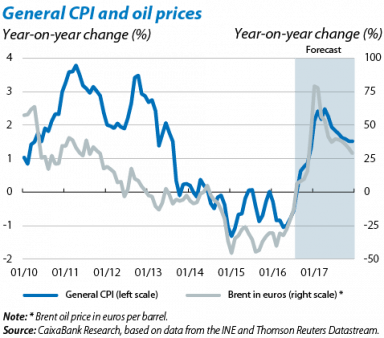

The first factor, and also the most easily observable, is the disappearance of the base effect of the sharp slump in oil prices last summer. Whereas, in February 2016, the price of Brent oil in euros had fallen by 40.3% year-on-year, in June this drop had already been reduced to half (–20.5%). According to our forecasts, the year-on-year rate of change for the price of crude oil will become positive in August and continue rising up to values in the order of 50% by April 2017, when we expect crude to reach around 59 euros a barrel. Note that this upward movement of the year-on-year rate of change does not require any sharp rise in the price of oil compared with its current level (around 45 euros per barrel) as this is already far above the average for 2016 Q1 (32.6 euros). This trend in oil will push the energy component of the CPI (which accounts for 11.4% of the total CPI) from a year-on-year drop of 11.7% in June to double-digit positive increases by the end of the year. So unless there is a drastic change in the oil price trend, the contribution made by the energy component to general inflation will exceed 1 pp in 2017 Q1. If the oil price remained at 45 euros per barrel, this contribution would be 0.6 pps in 2017 Q1.

The upward effects of the second factor, namely growth in the Spanish economy, are gentler but more sustained and significant for the medium-term trend in inflation. The recovery of the Spanish economy is gradually consolidating with growth in GDP expected to reach around 3% in 2016 and more than 2% in 2017. This notable rate will help to close the output gap (the difference between an economy’s observed GDP and the potential GDP achieved if all its production resources were used). A positive output gap is generally associated with an increase in inflationary pressure as the production resources available are in shorter supply. In this respect, the forecasts by the European Commission point to the output gap going from –8.3% in 2013 to –1.5% in 2016 and a positive figure of 0.3 in 2017. This greater use of production resources can also be seen in more tangible activity indicators such as industrial capacity utilization, now at a level above its historical average. The improved labour market will also support a sustained rise in the core CPI. Although it is true that the labour market is still far from full employment (the unemployment rate is close to 20%) and substantial pay rises are therefore unlikely in the short term, the strong job creation rate (2.4% year-on-year in Q2) is supporting a recovery in the aggregate disposable income of households and this is helping to boost private consumption (3.6% year-on-year in 2016 Q2), a trend which will continue throughout 2017.

The upshot of all this is that, in the next few quarters, the CPI will see a notable upswing due to the effect of oil prices while the core CPI, which provides a better indication of the economy’s position in the cycle, will gradually approach the ECB’s target.