The tumultuous life of the price of oil

The spectacular drop in oil prices over the last few years has revived an interest in studying the factors that determine this important variable for the global economy. The insight provided by past experiences helps us to understand the forces in play.

The conceptual framework for determining the price of oil is none other than the law of supply and demand, although there are also some additional elements particular to this market. On the supply side it is useful to highlight six elements. The first is the fact that crude oil is essentially a finite resource although new, very large reserves have continuously been discovered. Second, the cost of extracting oil varies greatly between regions (due to geological factors) and over time (due to technological innovations). Third, a lot of oil reserves are located in geopolitically conflictive countries. Fourth, some of the major producers have set up a cartel (OPEC) and one of them (Saudi Arabia) enjoys a dominant situation thanks to its huge reserves and low extraction costs. Fifth, price elasticity of supply is quite low in the short term as a lot of investment and time are required to increase production capacity and because variable costs are small compared with fixed costs; however, medium-term elasticity is notably larger. Sixth, the number of barrels extracted per day falls quickly after the initial start-up (a decline due to geological and engineering reasons).

There are four main distinctive features regarding demand. First, the fact that short-term price elasticity of demand is low because oil is mostly used in transport, an almost essential service for which, at present, there is no large-scale replacement source of energy; however, price elasticity is slightly higher over the medium to long term (as a result of changes in consumer habits and also technological innovations in energy efficiency and in replacement sources of energy, etc.). Second, income elasticity is low for the lowest and highest income brackets but high for intermediate income brackets (households whose income is below a certain threshold cannot afford a vehicle while fuel consumption is not very sensitive to variations in income among high-income households). Third, both crude oil, petrol and other refined products can be stored long-term on land so that demand for stocks due to precautionary or speculative reasons can be met (organised futures markets also facilitate financialisation). Fourth, oil consumption causes significant negative externalities (contamination and climate change), making it a target for public policies (taxation, etc.) and social activism.

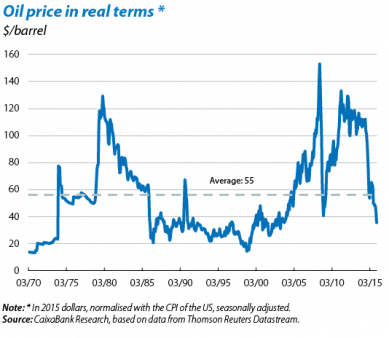

The combined influence of these elements and their interaction with macroeconomic variables (such as the intensity and composition of international growth, exchange rates, etc.) have shaped demand, supply and consequently the price of crude oil over time. The first graph shows the trend since 1973 in the price of a barrel of Brent oil in real terms; i.e. expressed in dollars but always with the same purchasing power as in 2015 (in this case in line with the CPI in the US). There are three notable stylized facts.

Firstly, there is hardly any noticeable long-term upward trend in the real price, which would have been expected given that oil is a finite resource. Although this is not shown in the first graph, it is worth noting that, since the end of the 19th century (when the use of oil became significant) and up to 1973 (the date of OPEC's embargo in response to the Yom Kippur war), the real price has remained quite stable within a relatively narrow band of 12 to 35 dollars at 2015 value. This performance is in line with the market's features during that long period (which some call the «golden age» of oil): a sensation of abundant, easy extraction (think of the oil fields in Texas and Arab countries), strict regulations aimed at controlling the price and a predominance of long-term contracts between the parties. The shock in 1973 marked an abrupt shift towards a new regime characterised by the perception of oil being a critical natural resource for the world economy to function, with high risks regarding its continued supply, facing growing extraction costs and, especially worrying, the more or less distant but unavoidable exhaustion of reserves (peak oil). However, in actual fact new sites have constantly been discovered, to the extent that, contrary to expectations, the number of reserves proved viable has grown over the last four decades. Firstly due to the discovery of conventional fields in new locations (Russia, Venezuela, Nigeria, etc.) but also thanks to achievements in extracting oil from non-conventional reserves (deepwater, oil sands, shale oil, etc.). Moreover, although it is much more complex to exploit non-conventional sources, improved technology and processes have managed to keep costs appreciably lower than expected. These factors explain the absence of an upward trend in the real price over the last four decades. A more recent addition to these factors is the issue of climate change which ultimately creates a growing perception (among producers and consumers) that it is unlikely to be viable to burn all known reserves of fossil fuels, which means a large proportion of them might remain underground (stranded oil).

If there is one thing that distinguishes the performance of the real price of crude oil since 1973 compared with its «golden age» it is the huge increase in instability. In fact the second notable stylized fact is the presence of two large movements in the medium term (which we could classify as super-cycles) and the third is the appearance of a large number of different short-term fluctuations.

The emergence of these two super-cycles can be reasonably explained by the interaction of three factors: in the background, the prolonged spread of abnormally intense demand by transport; in addition, changes in OPEC's power in the market and, as a catalyst, the interaction between short and medium-term elasticities. The first super-cycle is famous because its upward phase started suddenly with the aforementioned embargo in 1973, an event ushering in a period during which OPEC determined and managed to regulate supply (helped by Iran's revolution in 1978). But the contribution made to this super-cycle by demand was also very important: in the second half of the 1960s and 1970s there was a huge boom in the number of automobiles in the US and Europe, fuelled by the development of the middle classes and by Babyboomers reaching working age. In fact this context of strong structural demand helped the cartel to maintain strong internal discipline. Moreover, given that short-term elasticities were very low, for some time the price of oil shot up above its long-term equilibrium level (with an extra boost from the Iran-Iraq war in 1980). But this situation also sowed the seed for its decline insofar as it created incentives to moderate fuel consumption, improve engine efficiency, find alternative sources and look for new sites. When this happened and the price started to fall (with the added factor of the 1981 Volcker Recession in the US), discipline within OPEC started to diminish, accentuating the fall in the price. For a time Saudi Arabia tried to sustain the price by sacrificing its production but, once it realised that these changes in supply and demand were here to stay, in 1986 it gave up this task and caused the price to plummet (returning to its pre-1973 level in real terms).

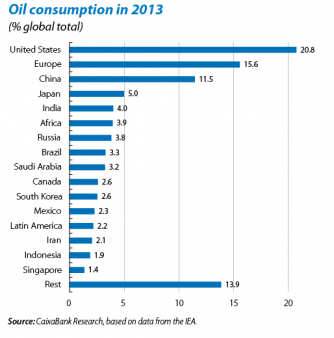

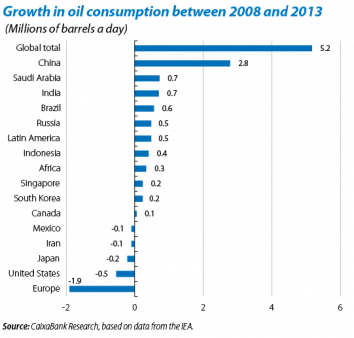

This gave way to a period full of short-term fluctuations but without any great medium-term variations until 2001, the date when we can see the start of the second super-cycle. Here there are notable parallels with the first super-cycle: most of the extra, unexpected demand for transport fuel was attributable to China (see the second and third graph), OPEC regained some discipline and low short-term elasticities played their part (with an added boost from the speculative financialisation of commodities as part of the financial bubble of 2007). But after a period of time (and the shock of the Great Recession), incentives reappeared for an increase in supply in the medium term, especially in the exploration and start-up of new sites thanks to the revolution in fracking and shale oil. This phenomenon was already quite evident towards 2011-2012 and the real price started to fall slightly. In 2014 the prospect of China's economic transformation and slowdown increased downward pressure and, from then on, the pattern from the early 1980s was repeated: OPEC once again lost cohesion and, to date, has not made any serious attempt to moderate supply. In fact a fierce rivalry can be seen between its members in order to defend their own market share (particularly now that Iran is extracting oil again). One important element has been Saudi Arabia's strategy as, to the surprise of many, it decided in 2014-2015 to increase its production, possibly given the perception that shale oil and stranded oil are not temporary phenomena but structural changes in the oil market.

Short-term fluctuations have shown a variety of profiles in terms of their intensity, duration and frequency but, in general, they have resulted from one of two types of cause. Firstly, geopolitical conflicts such as the Iran-Iraq War (1980-1988) mentioned earlier, the Kuwait invasion in 1991 and the Second Gulf War in 2003. This kind of event has caused sudden but relatively brief rises as no prolonged cuts have resulted in the chains of extraction and transport. In fact, the main way they have affected the oil price is by increasing demand for precautionary reasons. Secondly, unexpected variations in fuel consumption related to the macroeconomic cycle, such as the recession in western countries in 1991-1992, the Asian crisis in 1997, the Great Recession in 2009, and the crisis of the emerging countries in 2014-2015. This kind of fluctuation tends to be longer than the geopolitical type and follows a common pattern: the initial fall in the price discourages investment in exploration for new wells and after a few months the effective production capacity decreases due to the decline so that, once fuel demand recovers, there is a scarcity which leads to sharp increases in the price of crude oil.

In summary, over the last few years both short-term, medium-term and even long-term factors, on both the supply and on the demand side, have come together to create a perfect storm for the price of crude oil. After its rapid slump it is now at a level, in real terms, similar to the period of 1986-2001 and only a little above the price prevailing during its «golden age». This episode has undoubtedly been one of the most remarkable within an already highly agitated life. The next article in this Dossier presents some key aspects concerning what we might expect in the future.

Macroeconomics Unit,

Strategic Planning and Research Department, CaixaBank