The Spanish economy remains buoyant, but the outlook for 2023 darkens

Downward revision of the growth outlook for 2023

The Spanish economy remains buoyant despite the difficult context, spurred on by household consumption and tourism, which is translating into a strong labour market. Nonetheless, the inflation shock is becoming more intense and persistent, both because of the higher energy and commodity prices and due to the indirect effects on the rest of the basket of goods. This persistence of high inflation is driving central banks to tighten financial conditions by more than we expected. In this context, which is also still marked by many sources of uncertainty in the geopolitical sphere, the medium-term outlook has become gloomier. Thus, we have revised our GDP growth forecast for 2023 downwards, and our inflation forecast for both 2022 and 2023 upwards. As for GDP, the two underlying factors – more persistent inflation and the tightening of financial conditions – have led to a 1.4-pp downward revision of growth for 2023, bringing the figure to 2.4%. As such, we now expect GDP to recover to pre-pandemic levels in the second half of 2023.

Upward revision of inflation

For 2022, we expect higher price increases in food, industrial goods, and services, driven by the indirect effects of energy inflation, the surge in tourism demand and a more persistent impact of the bottlenecks. Thus, we anticipate inflation of 8.0% for the year as a whole (+1.2 pps compared to the previous scenario). This forecast has been produced incorporating June’s inflation flash indicator, of 10.2%, which is much higher than our previous forecasts had anticipated as a result of the surge in food and fuel prices. Looking ahead to 2023, the revision is substantial and we expect average inflation in the year of 2.6% (previously 1.1%) due to more persistent inflationary dynamics in food and core components (services and industrial goods).

The economy maintains a good tone thanks to tourism and the resilience of the labour market, but the PMIs point to a slowdown in industry and services

The end of the restrictions is enabling a rapid rebound in the tourism sector. In particular, international tourism expenditure in May stood at 8 billion euros, just 1.4% below the figure for May 2019. This marks an improvement over the April figure (–2.2%) when the Easter season was already very positive. This figure points to a booming tourist season this summer, given that 2019 was an exceptionally good year for the sector. With regards to the labour market, the figures for June were once again very encouraging: Social Security affiliation grew by 76,948 workers in seasonally adjusted terms (33,336 in May). For Q2 as a whole, the quarter-on-quarter growth in the number of non-seasonally adjusted registered workers not on furlough was 1%. Our card-spending indicator also suggests there is a recovery in consumption, following the 2.0% quarter-on-quarter decline in Q1. The discordant tone came from the PMIs for June. The services PMI fell 2.5 points, to 54.0 points. The manufacturing sector, meanwhile, was once again affected by rising input prices and the bottlenecks in global supply chains, and the manufacturing PMI fell to 52.6 points, down 1.2 points compared to May. While this figure is above the growth threshold (50 points), it denotes a moderation in the pace of expansion in the sector due to a slowdown in production growth and a decline in new orders.

Real estate market: high price growth in 2022, but with a cooling in sight

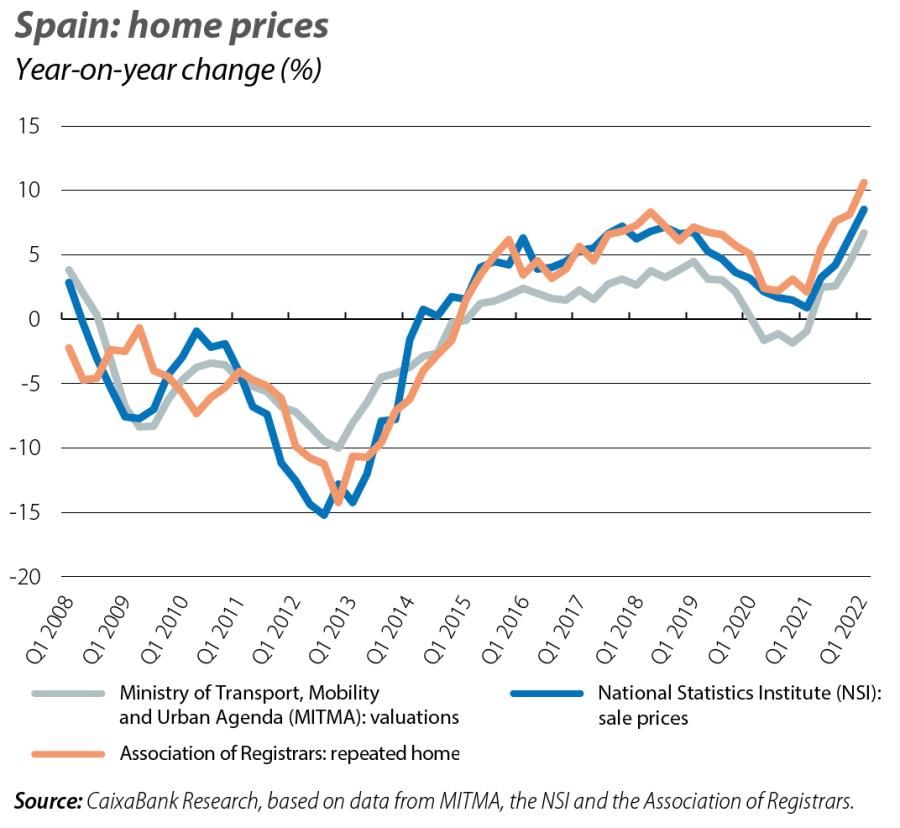

The strong demand combined with the increase in the cost of materials and the shortage of supply has led to a significant rise in home prices in Q1 (8.5% year- on-year according to the National Statistics Institute and 6.7% according to the Ministry of Transport, Mobility and Urban Agenda (MITMA)). These higher-than-expected results lead us to increase our growth forecast for home prices based on valuations to 6.0% in 2022 (previously 3.5%). However, over the coming quarters some of the factors that have stimulated demand will lose momentum (slower growth in real household disposable income and rising interest rates), so we expect to see a moderation in both demand and prices. Thus, for 2023 we have revised down our growth forecast from 3.2% year-on-year to 2.2%.

The government announces a new Action Plan which will have an impact on the deficit

The government has announced a new plan aimed at mitigating the impact of high inflation on households. This plan has been allocated a budget of 9.1 billion euros and combines the extension through to December of the measures implemented in April which were due to expire in June – mainly a 20-cent-per-litre fuel rebate for all users (with a fiscal cost of 4 billion) and cuts in electricity taxes (resulting in a 3.6-billion reduction in revenues) – and a set of new measures aimed at the most vulnerable households (a 200-euro cheque for those with low incomes, discounts on public transport from September and a temporary 15% increase in non-contributory pensions). The impact of these measures on the deficit will be 0.5% of GDP. However, the dramatic pull of tax revenues (year-on-year growth between January and May of 16.2%, in like-for-like terms) and the resilience of the labour market act as a counterbalance, such that we maintain our forecast for the budget deficit at 5.5% for 2022.