The National Statistics Institute improves the growth profile of the last few quarters

Specifically, it has revised GDP growth for the first half of 2022 upwards and, instead, has slightly revised down the estimated growth for Q3 last year. Thus, according to the new estimate, GDP in Q1 grew by 0.1% quarter-on-quarter (previously –0.2%) and in Q2 it grew by 2.0% (previously 1.5%). GDP growth in Q3 2022 remained virtually unchanged, going from 0.2% to 0.1% quarter-on-quarter. Following these changes, we will soon revise our GDP growth forecast for 2022 as a whole. Currently, it stands at 4.5%, and will probably end up above 5%.

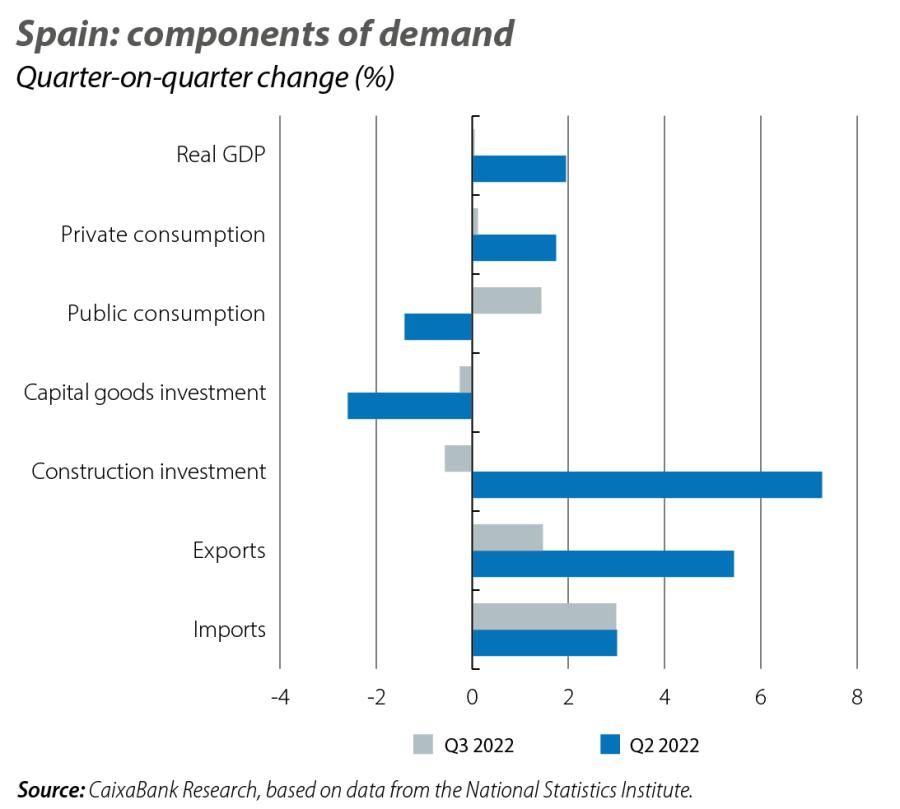

Reduced strength of domestic demand in Q3

The slight downward revision of GDP in Q3 is primarily due to the reduced strength of private consumption, which has gone from growing by 1.1% quarter-on-quarter to 0.1% in the new estimate. This lower growth in Q3 has been offset by upward revisions in the previous two quarters, so consumption remains 5.4% below the pre-pandemic level (Q4 2019),

the same gap as was initially estimated. Investment growth, meanwhile, has also been revised downwards by 0.7 pps to –0.1% quarter-on-quarter, while public consumption has been revised upwards by 0.8 pps to 1.4% quarter-on-quarter. The upward revision of public consumption has been unable to offset the lower growth of the other components, so domestic demand has gone from contributing 1.0 pp to quarter-on-quarter GDP growth to contributing 0.5 pps. Foreign demand, on the other hand, had a less negative quarter-on-quarter contribution than initially estimated, at –0.4 pps versus the previous –0.8 pps.

The available indicators suggest a less pronounced weakening than expected in Q4

The indicators for the final quarter of last year offer mixed signals. On the one hand, there is an apparent weakness in the industrial sector, which has been the one most affected by the supply shocks. Specifically, the PMI for the manufacturing sector stood at 45.6 points on average in the quarter, the lowest level since Q2 2020, in addition to an average decline in industrial production in October-November of 1% compared to the previous quarter. On the other hand, the services PMI improved over the course of the quarter and ended up in expansionary territory (51.6 points in December). Also, foreign tourism continues to show significant buoyancy. In November, the number of international tourists grew by 29.2% year-on-year, while their expenditure grew by 43.2%, placing it 6.4% above the level recorded in the same month of 2019. The retail trade index, meanwhile, registered strong growth in November, at 3.8% month-on-month (–0.6% year-on-year). This pushes the average for October-November 2.7% above the average for Q3, hinting at consumption growth in Q4.

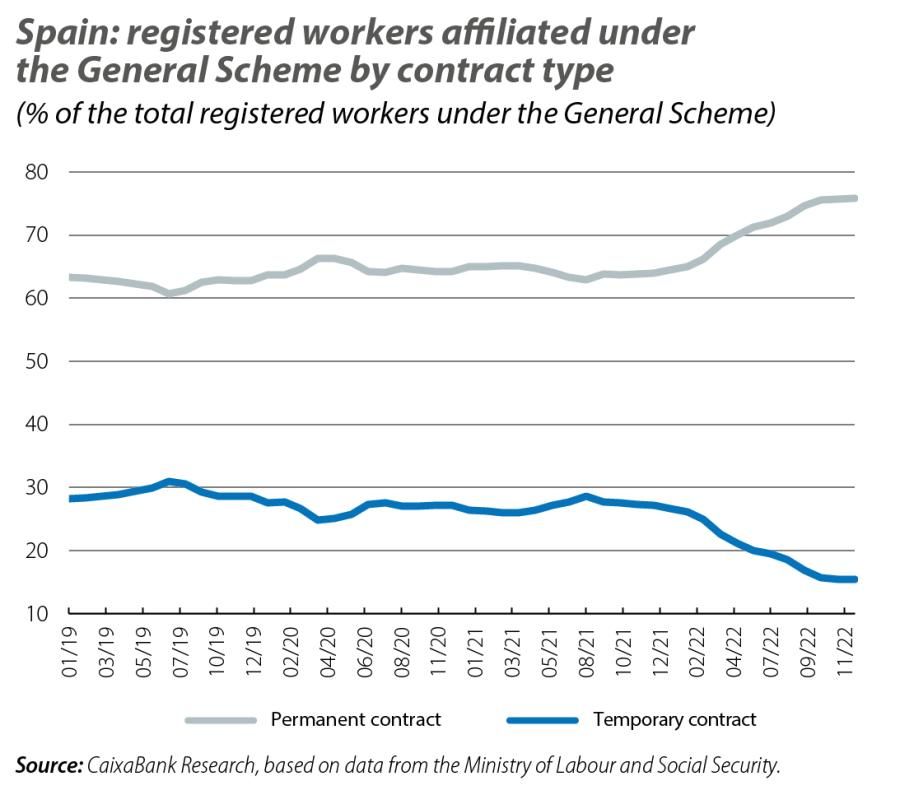

Job creation weakened in December, but the results for Q4 and for the year as a whole are positive

Social Security affiliation increased in December by 12,640 people, below the average for the month of December in the period 2014-2019 (64,300). In addition, in seasonally adjusted terms this measure registered the first decline since April 2021 (–8,347 registered workers). In any case, for Q4 2022 as a whole, the seasonally adjusted number of registered workers not on furlough grew by 0.6% quarter-on-quarter, barely 1 percentage point less than in the previous quarter, thanks to the strong job growth registered in November. At the 2022 year end, the number of registered workers stood at 20,296,271, meaning that 471,360 jobs were created in the year.

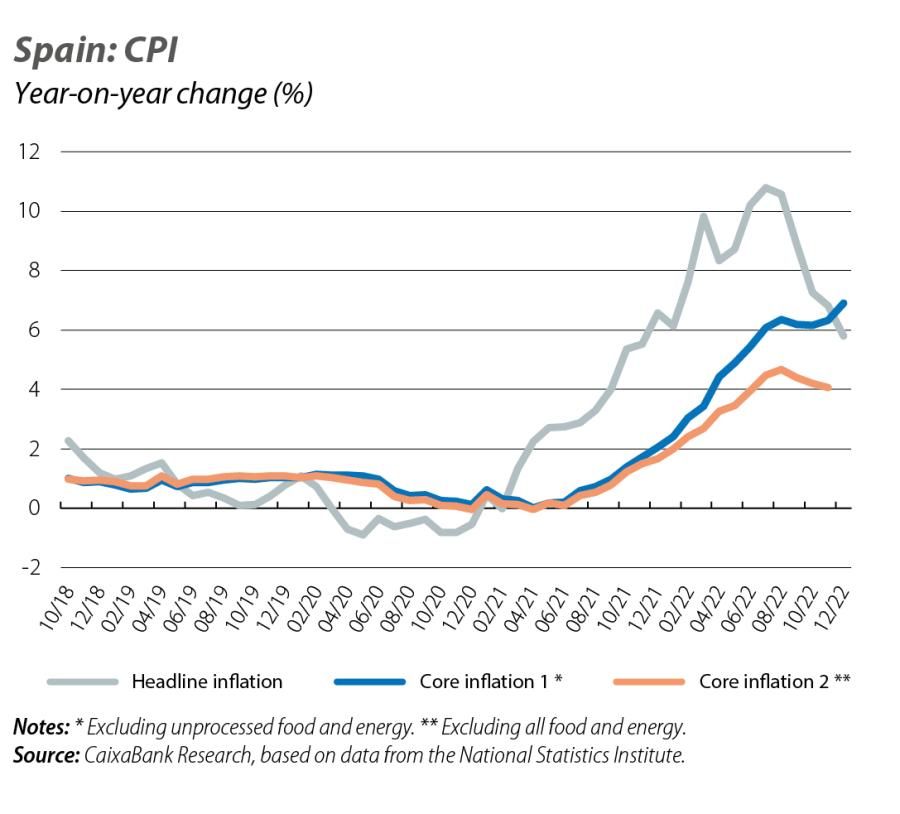

The headline inflation rate continues to moderate thanks to the cooling of energy prices

According to the flash indicator for December, there was a notable moderation in headline inflation, falling from 6.8% in November to 5.8%. This moderation in the headline rate was mainly driven by the energy component. However, the core rate (excluding energy and unprocessed food prices) prolonged its rally and reached 6.9% (6.3% in November), driven above all by higher processed food prices.

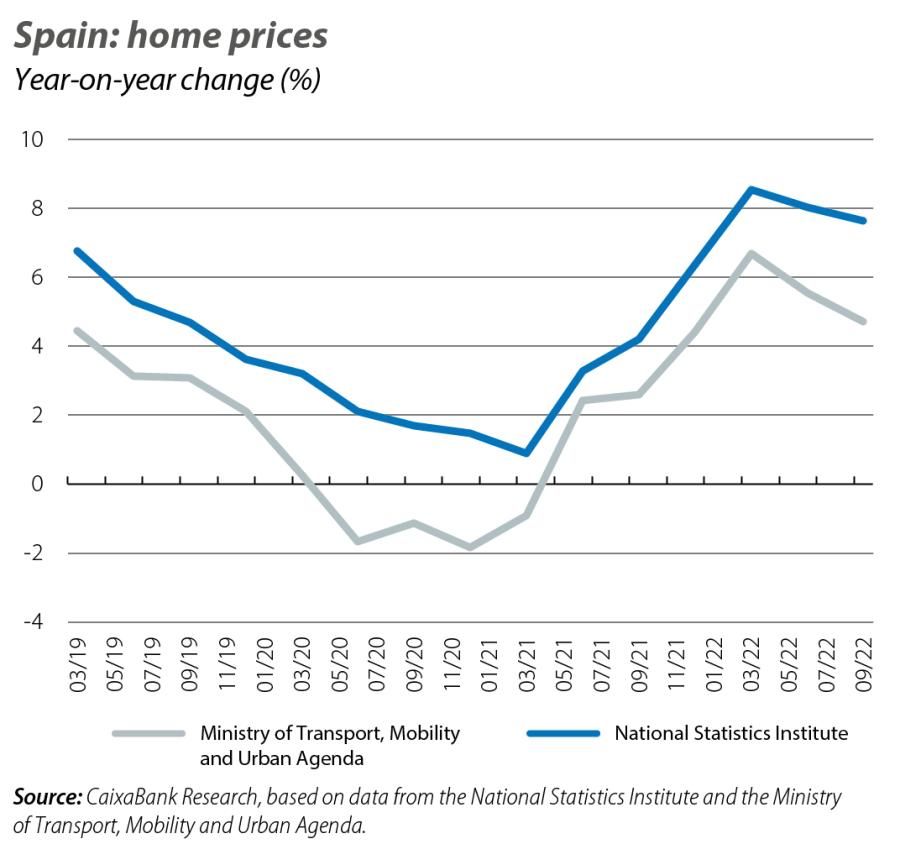

Real estate activity holds up well, but the growth of home prices slows

In October, 51,625 home sales took place, 11.4% more than in the same month of the previous year. Although the growth of sales transactions has moderated significantly compared to the year-on-year rates in excess of 20% recorded at the beginning of the year, growth remains resilient considering the context of tightening monetary policy and erosion of household purchasing power due to the high inflation. Looking ahead to the next few months, we expect sales to slow as the increase in rates filters through to lower demand. Home prices according to the National Statistics Institute, meanwhile, increased by 7.6% year-on-year in Q3. Although a significant rate of growth, this is still below that recorded in Q1 and Q2 2022, when it stood at 8.5% and 8.0%, respectively.

A new action plan is approved to combat the inflationary pressures as the budget execution to October indicates a deficit in 2022 below 5.0%

The consolidated general government deficit, excluding local corporations, for the cumulative period from January to October stood at 1.2% of GDP. This figure is lower than the 4.4% of October 2021 and even the 1.5% of October 2019 (the deficit in that year ended up being 3.1% of GDP). The improvement is due to the buoyancy of tax revenues (+16.3% year-on-year on a cumulative basis up to October, which represents 34.5 billion more than in 2021), favoured by the effect of the increase in prices on taxable bases and the resilience of the labour market. Public spending increased by much less, at 2.4% year-on-year to October. On the other hand, the government approved a new action plan to mitigate the impact of inflation in 2023, with a budget of 10 billion euros (see the Focus: «A new action plan to mitigate inflation: the key points» in this same Monthly Report).