The markets anticipate further interest rate hikes

The strength of the economic data stirs the debate over whether there will be a hard or a soft landing

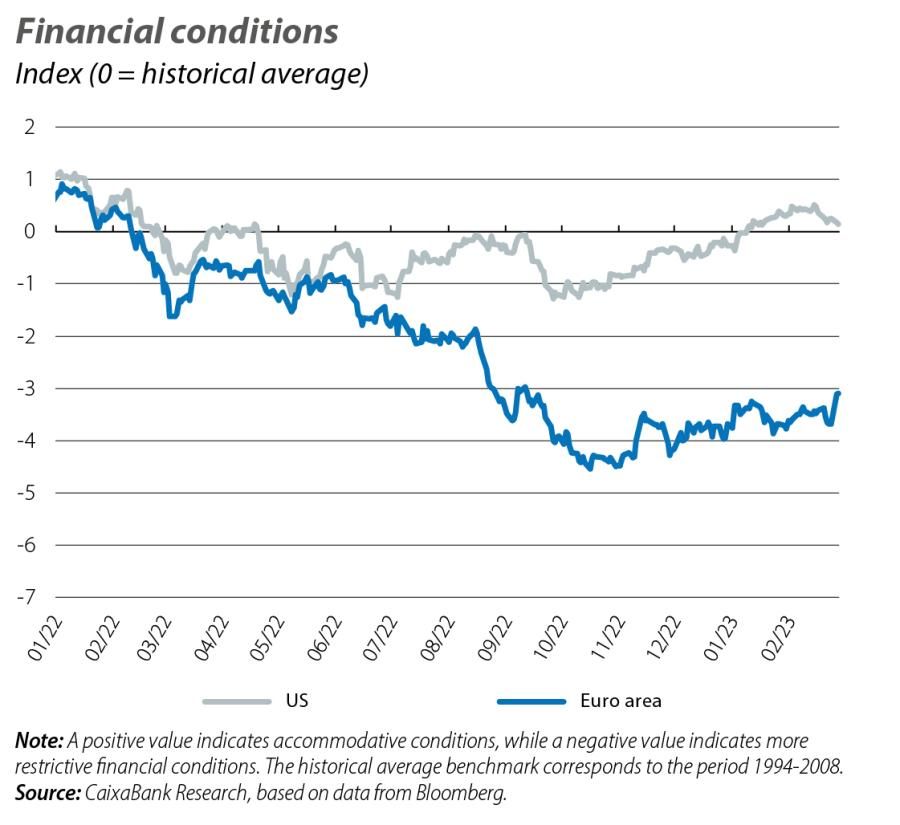

After a buoyant and upbeat January, the financial markets resumed the tone of volatility and reduced risk appetite throughout February, in a context in which positive surprises in the economic data failed to translate into good news for risky assets. Investors thus interpreted the strength in the macro indicators as fuel for inflation, which in turn would justify a more restrictive monetary policy on the part of the central banks. Thus, the debate on whether the global economy is facing a hard or a soft landing was overshadowed by the possibility of no landing at all, that is, a situation in which, despite the headwinds, global economic activity and inflation show resistance to moderating. In the financial markets, this change in tone resulted in a notable revision in investors’ expectations regarding the future path of official interest rates, which led to further tightening of financial conditions around the world and truncated the gains that had been registered in fixed-income assets, equities and emerging currencies.

Higher rates and for longer

The publication in February of better-than-expected economic activity and employment data, both in the euro area and especially in the US, highlighted the blocs’ economic resilience at the beginning of the year despite the tightening of financial conditions. However, the optimism, which had brushed aside the threats of economic recession, soon faded as it became apparent that this buoyancy was accompanied by the persistence of inflationary tensions. This situation triggered a restrictive bias in the discourse of the members of the Fed and the ECB. The shift was particularly pronounced in the case of the US monetary authority, going from Jerome Powell’s comment on the beginning of the disinflation process at the start of February, to ending the month with most members indicating the need to raise reference rates more quickly and for longer in order to curb the price rally. Meanwhile, the ECB expressed its intention to raise interest rates by another 50 bps in March (to 3.00%), as it anticipated at its last meeting, and left the door open for further increases in the coming months. Investors, meanwhile, quickly revised upwards their expectations regarding the short- and medium-term monetary scenario, having previously anticipated the end of the cycle of interest rate hikes sometime around the summer. Thus, the money markets reflected expectations that Fed rates would peak at 5.50% before the summer and that ECB rates would do so in the autumn at around 4.00%, pushing back the prospect of any downward adjustments well into 2024 in both cases.

Sovereign debt yields spike

Within this new episode of volatility, the shift in the markets towards a scenario in which interest rates are expected to remain at restrictive levels for longer was reflected in the rise in interest rates throughout the sovereign yield curves on both sides of the Atlantic. In the US, the 2-year rate reached 4.8%, its highest level in 15 years, while the yield on 10-year treasuries ended up at the 4% mark. The euro area saw a similar movement in its yield curves, with the yield on the 10-year bund reaching 2.65%, its highest level since 2011. In both cases, the movements in the short section of the curve were more pronounced than in the long section. Despite the rise in yields, risk premiums in the peripheral countries remained favourable, with the Spanish spread remaining below 100 bps. On the other hand, the dollar capitalised on the upward shift in the US yield curve, as well as the increase in volatility in the money markets, appreciating against other major currencies. In particular, against the euro it appreciated around 3% in the month, although this trend could be reversed over the coming quarters (see the Focus «On the round trip movement of the (king) dollar» in this same report).

The price of energy products drops

The price of Brent oil closed February slightly down (–0.7% monthly), making it the fourth consecutive month of declines. Its price was affected by the increase in inventories in the US and by fears that the tightening of US monetary policy could cool global demand. However, the incipient improvement in the economic activity data in China and the scant prospect of an increase in supply from OPEC offset the downward pressures on oil. Similarly, the price of European natural gas (the Dutch TTF benchmark) fell by 19% in February, accumulating an 86% decline since the peaks of last August (although it is still 250% above its pre-crisis average). The price was below €50/MWh thanks to the high level of gas reserves in the EU, the surge in imports of liquefied natural gas and the mild weather.

The shift in interest rate expectations reins in the stock market rally

The prospect of a scenario with higher interest rates for longer put a damper on investor sentiment regarding the state of the business cycle. This was particularly noticeable in the performance of the US stock indices, which ended the month down by more than 2%. The European indices performed somewhat better (Eurostoxx 50 +2%), especially the IBEX 35 which registered the highest gains (+4%), favoured by the composition of the indices and specifically the greater presence of sectors with a defensive bias compared to in the US. In emerging markets, on the other hand, price movements were dominated by profit-taking, with setbacks approaching 20% in year-on-year terms in view of the continued restrictive financial environment worldwide.