The Spanish economy concludes a strong first quarter

According to the first estimate for Q1 2023, GDP growth gathered pace compared to the previous quarter, with a quarterly increase of 0.5% versus 0.4% in Q4 2022 (after being revised 2 percentage points upwards). In year-on-year terms, growth rose to 3.8%, versus 2.9% in the previous quarter.

GDP growth accelerated to 0.5% quarter-on-quarter in Q1 2023

According to the first estimate for Q1 2023, GDP growth gathered pace compared to the previous quarter, with a quarterly increase of 0.5% versus 0.4% in Q4 2022 (after being revised 2 percentage points upwards). In year-on-year terms, growth rose to 3.8%, versus 2.9% in the previous quarter. In addition, the National Statistics Institute has revised the seasonal adjustment of the historical data, and this has changed the GDP growth profile throughout 2022. In particular, growth for Q1 2022 has been revised downwards by –0.4 pps to –0.4% quarter-on-quarter, while the estimate for Q2 2022 has been revised upwards by +0.3 pps to 2.5%, and those for Q3 and Q4 2022 have been revised up by +0.2 pps to 0.4% in both cases. With the publication of these revised figures, GDP for Q1 2023 is now just 0.2% below the level of Q4 2019, meaning that the pre-crisis level has been practically recovered. The drivers of growth in Q1 were investment, with a significant rebound in both equipment and construction, and the foreign sector with export growth well above that of imports. The negative note was the weakness of private consumption, with a quarter-on-quarter decline of 1.3%. The knock-on effect of the upward revision of growth in the latter part of 2022, together with the strong start to 2023, will cause us to revise upwards our growth forecast for 2023 as a whole.

Headline inflation rises due to energy base effects, but core inflation falls

According to the figure advanced by the National Statistics Institute, headline inflation rebounded in April to 4.1% (3.3% in March). Base effects continue to dominate the movements in the energy component. In April, the base effect was upward due to the fall in energy prices registered in April 2022 (as a result of the month-on-month decline in electricity prices following the sharp rally in March 2022 and the start of the 20-cent-per-litre fuel subsidy). Core inflation (excluding energy and unprocessed food) moderated significantly to 6.6% (7.5% in March), favoured by the base effect of processed food (a year ago they registered a monthly increase of 2.6%, the biggest month-on-month rise in the historical series) as well as due to the containment of prices in the rest of the components.

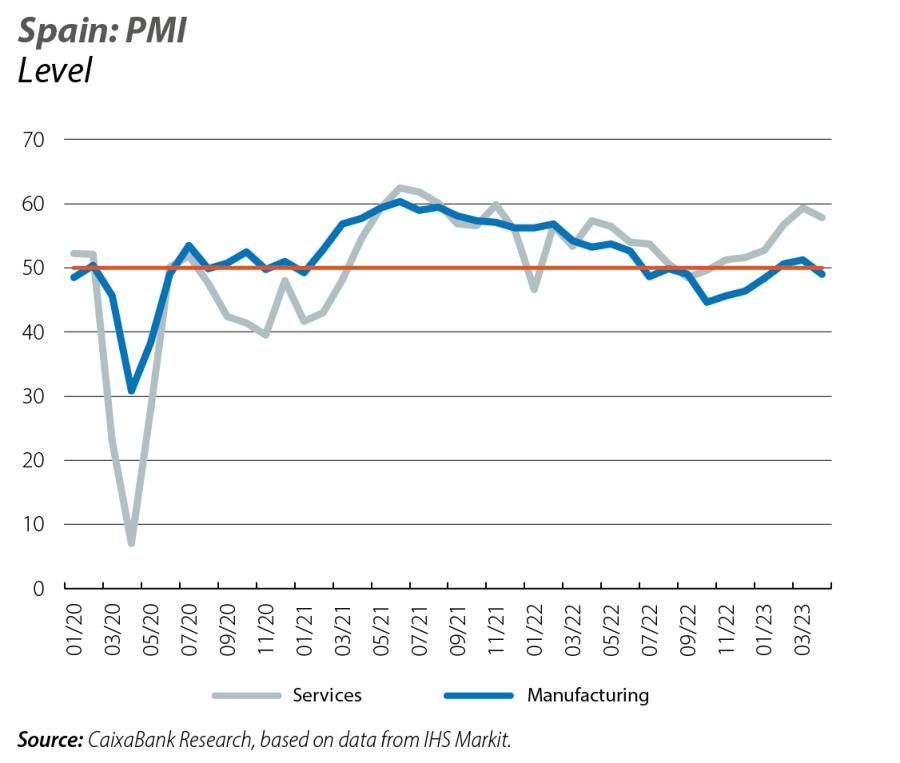

Mixed signals in the economic sentiment indicators at the beginning of Q2

The PMI for the services sector receded, but remained comfortably within expansionary territory (>50 points) at 57.9 points in April (59.4 in March), the second highest level since November 2021. However, the industrial sector has fallen back into contractionary territory after two months at expansionary levels; specifically, the manufacturing PMI fell by 2.3 points in April to 49 points. This was attributable to a fall in new orders and a slowdown in production growth, although manufacturing firms continued to grow their workforce.

The labour market exhibits a very positive tone

The Q1 2023 LFS results and the April data for registered workers confirm the buoyancy of the labour market. The employed population according to the LFS grew at a quarterly, seasonally corrected rate of 1.16%, well above the 0.16% of Q4 2022. On the other hand, the number of unemployed rose by 103,800, above the average increase for Q1 in the period 2014-2019 (+15,000). That said, this increase was affected by the significant growth of the labour force (+92,000 vs. –93,000 on average in Q1 between 2014 and 2019). Thus, the unemployment rate increased to 13.3% from the 12.9% of Q4 2022, although this figure is 3 percentage points lower than that of a year ago. Social security affiliation, meanwhile, picked up in April, driven by services activity over the Easter period. Specifically, the number of registered workers grew by 238,436 people, compared to the April average of 174,000 people between 2014 and 2019. The total number of registered workers thus rises to 20,614,989, marking a new all-time high and 595,908 people more than a year ago. In addition, registered unemployment fell by 73,890 people in April and stood below 2.8 million (the lowest figure since 2008).

The improvement in the trade balance provides a boost to the current account

In the first two months of the year, the current account balance posted a surplus of 5,600 million euros, compared to a deficit of 3,900 million registered in the same period in 2022, thanks to the sharp reduction in the trade deficit and the buoyancy of tourism. The lower trade deficit is the result of an improvement in both the energy and the non-energy balance. In particular, the energy deficit fell in February to 3,045 million euros, from 3,626 million in February 2022, against a backdrop of falling import prices (–7.6% year-on-year). The balance of non-energy goods, meanwhile, showed a surplus of 580 million euros. This marks the biggest surplus in a month of February since 2014 and contrasts with the 626-million-euro deficit of February last year. This has been possible as nominal growth in exports (+10.1% year-on-year) has far exceeded that of imports (+5.6%). In any case, the strong growth of exports was largely driven by the increase in the price of goods, which were up 14.1% year-on-year.

The tourism sector continues to perform well

The tourism sector continues to perform well with a cumulative surplus in the balance of tourism services in the first two months of the year of 6,300 million euros, compared to 4,200 million in January-February 2022. The tourism sector maintained its buoyancy in March, albeit with a slight slowdown compared to February. In particular, the third month of the year saw the arrival of some 5.6 million foreign tourists, who spent 6,657 million euros. These figures are 6.9% below the level of the same month in 2019 in the case of arrivals (–1.4% in February) and 10.3% higher in the case of expenditure (14.3% in February). This reduced buoyancy in March was due to the decline in tourists from Germany and France. Nevertheless, tourist arrivals from other key source markets remained positive; especially in the case of Britons, narrowing their gap versus 2019 levels, and that of US tourists, with 6.8% more arrivals than in March 2019 (–0.8% in February).