The Spanish economy remains resilient in a challenging environment

The available information suggests that Spain’s economic activity has continued to grow at a steady pace during Q1, despite an adverse economic context and inflation hovering at around 3%.

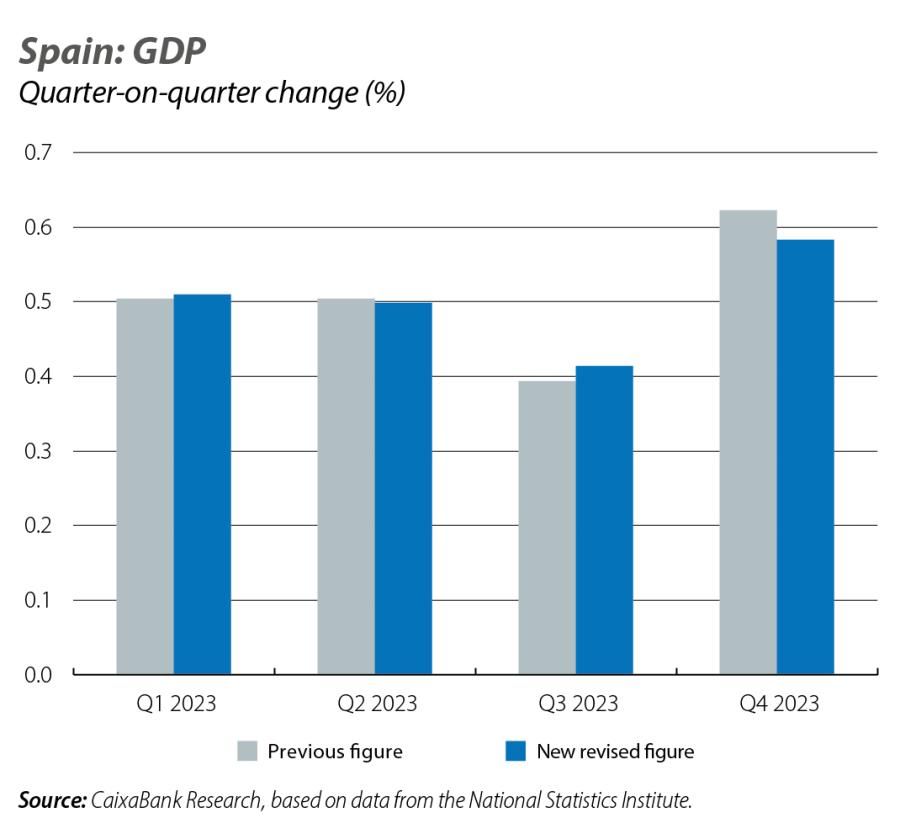

The available information suggests that, despite an adverse economic context marked by the impact of last year’s interest rate hikes and inflation hovering at around 3%, economic activity has continued to grow at a steady pace during Q1. The new estimate for GDP growth in Q4 2023 published by Spain’s National Statistics Institute as part of its usual schedule of revisions has also not changed the reading of the recent past. GDP growth in the last quarter of 2023 remained unchanged from that offered by the flash estimate, while in the breakdown by component there was a slight downward revision of the growth of private and public consumption, offset by a slight upward revision of investment.

Good figures from the economic activity indicators

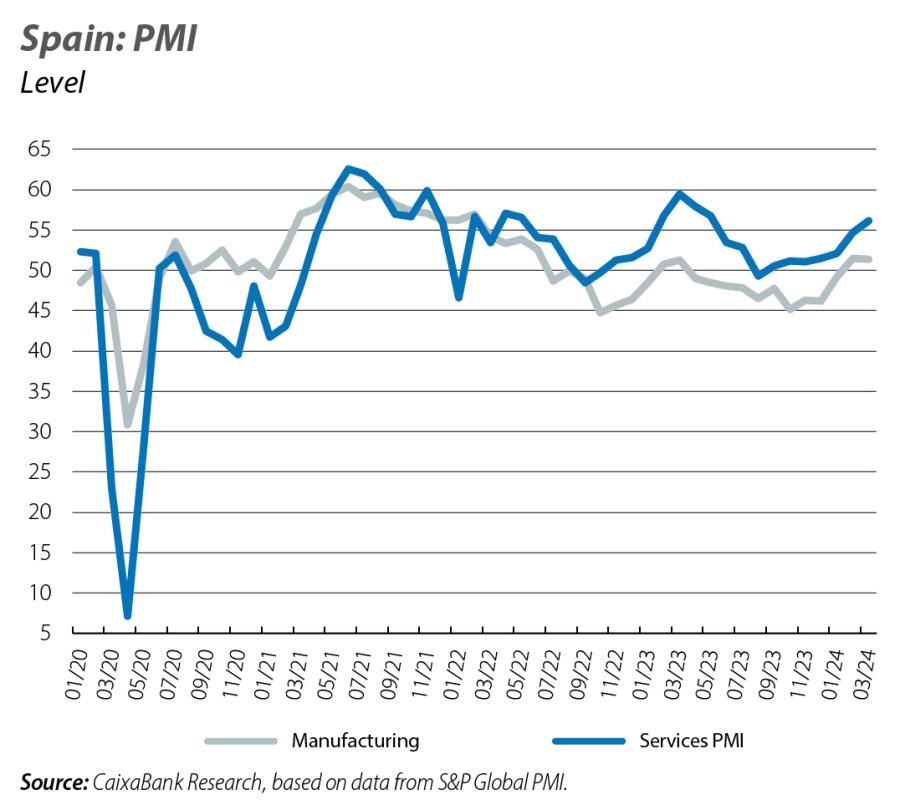

The economic activity indicators available for Q1 2024 show a better than expected performance, especially among those for sentiment, employment and tourism. In March, the services PMI maintained its upward path and reached 56.1 points, a level that suggests a considerable pace of expansion in the sector. The industrial sector, meanwhile, is leaving behind its weakness and the manufacturing sector PMI, at 51.4 points, has consolidated its position within the territory that marks growth, after lying below this threshold in the previous 10 months. Moreover, industrial production grew by an average rate of 0.8% to February compared to Q4 2023, slightly faster than in the previous quarter (+0.6% quarter-on-quarter). On the consumption side, retail sales in February rebounded 0.5% month-on-month, following declines in December and January. However, despite the rebound, the January-February average continues to show a slight decrease of 0.3% compared to the average for Q4 2023. Tourism has also kicked off the year with excellent figures; in February, arrivals of foreign tourists increased by 15.9% year-on-year and spending, by 25.8%. Thus, both tourist arrivals and their spending stand well above the pre-pandemic levels of February 2019, specifically 14.4% and 44.8% above, respectively.

The labour market remains remarkably dynamic

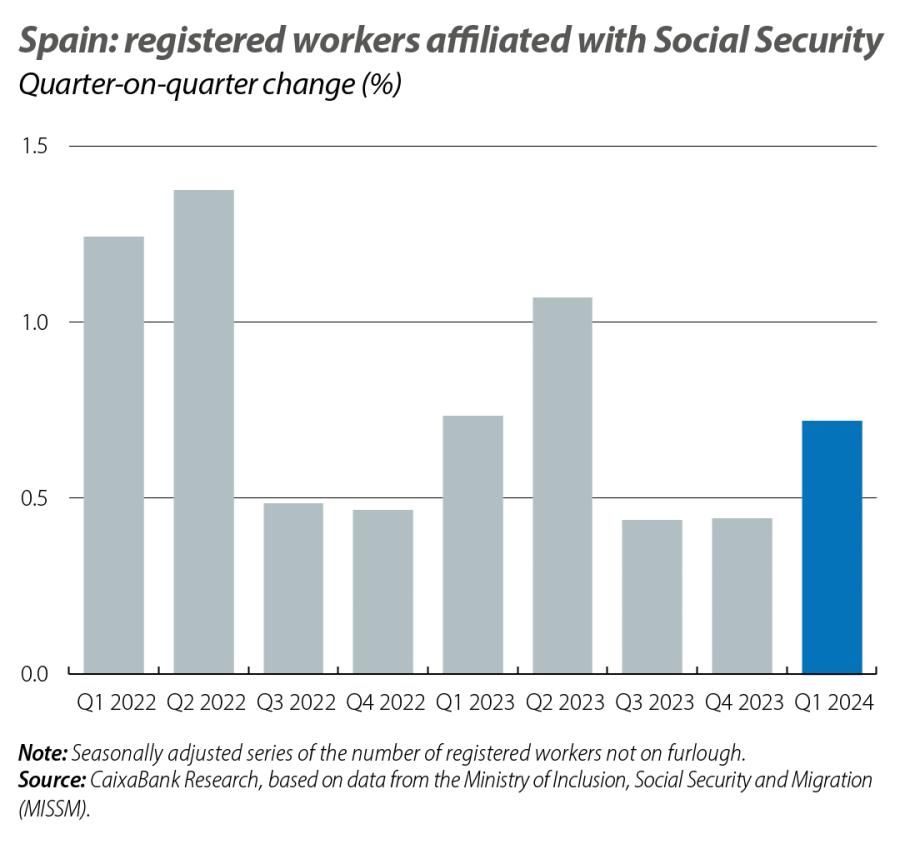

The number of registered workers affiliated with Social Security grew in March by 193,585 people compared to the previous month, which is more than usual for the month of March (140,000 on average in the months of March during the period 2014-2019). Correcting for seasonality, employment posted an increase of 77,876 registered workers, such that the average monthly increase in Q1 rose to 63,242 workers, higher than the average for Q4 2023 (31,248). In Q1 2024, the quarter-on-quarter growth rate in the number of registered workers intensified to 0.7% (0.4% in the previous two quarters).

Energy prices and the withdrawal of the fiscal measures dominate the inflation dynamics

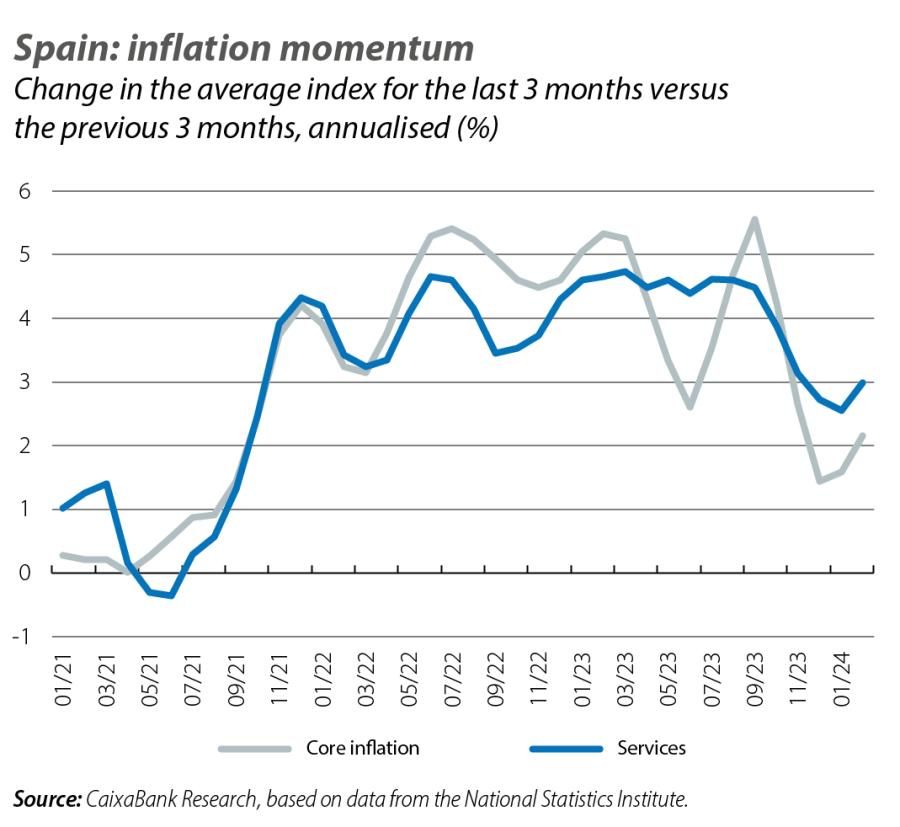

According to the CPI flash estimate, headline inflation rose by 40 pps in March, to 3.2%. This rebound is mainly due to the increase in electricity and fuel prices. On the electricity side, the fall of 13.1% month-on-month in the PVPC tariff (the voluntary price for small consumers) was more than offset by the increase in VAT from 10% to 21% in March – an increase triggered by the wholesale market price in February falling below the 45-euros/MWh threshold established in the law that was passed last December. Current forecasts in the futures market suggest that wholesale market prices will not climb back above 45 euros/MWh until the summer. If these forecasts are met, then VAT on electricity would return to its reduced rate of 10% in July. On the fuel side, the price of Brent has been on the rise for three months now and in March stood at an average of 78 euros per barrel, which led to a 1.9% month-on-month increase in petrol prices. Despite these fluctuations, the underlying trends indicate that the disinflationary process is continuing. In March, underlying inflation – excluding energy and unprocessed food – fell 0.2 pps to 3.3%, while the momentum of core inflation – excluding energy and all food – suggests that it should continue to moderate.

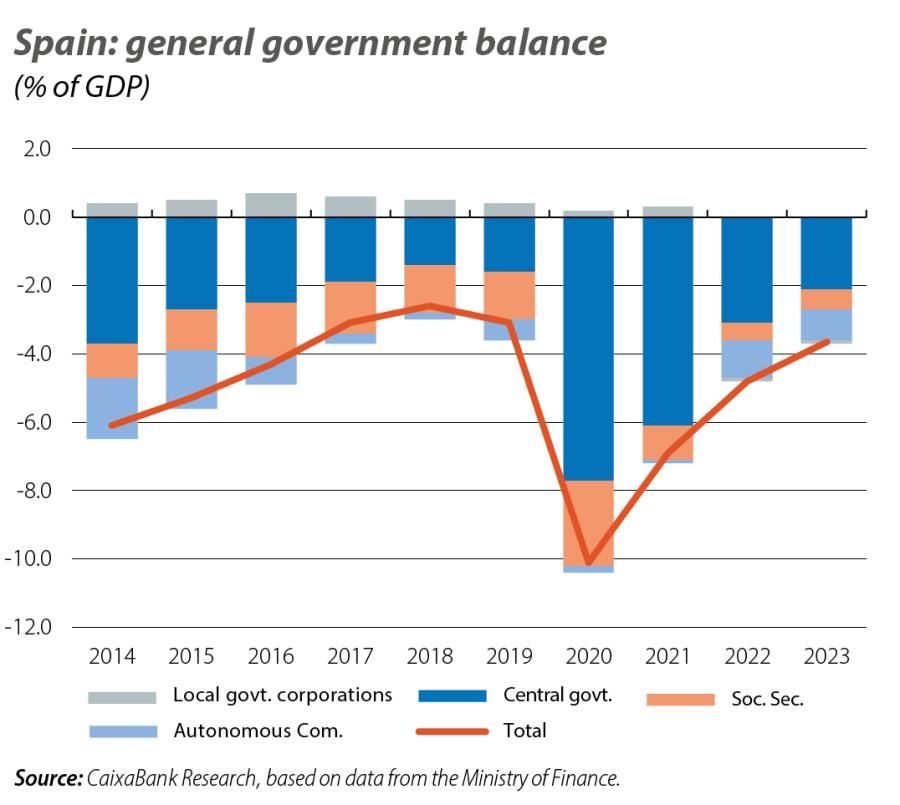

The budget deficit fell in 2023 to 3.6% of GDP

This represents a significant improvement over the 2022 deficit (4.7% of GDP), although it is still above the pre-pandemic level (3.1% of GDP in 2019). By government administration, the deficit of the central government was 2.1% of GDP; that of the autonomous communities was 0.9%; that of the social security system was 0.6%; and that of local government corporations was 0.1%. The reduction in the deficit in 2023 was due to the buoyancy of public revenues, which increased by 9.0% compared to 2022, mainly due to the strength of the collection of direct taxes and social security contributions, while total expenditure increased by 6.5%, driven by the pension increase and the maintenance of a large part of the measures introduced to tackle the energy shock.

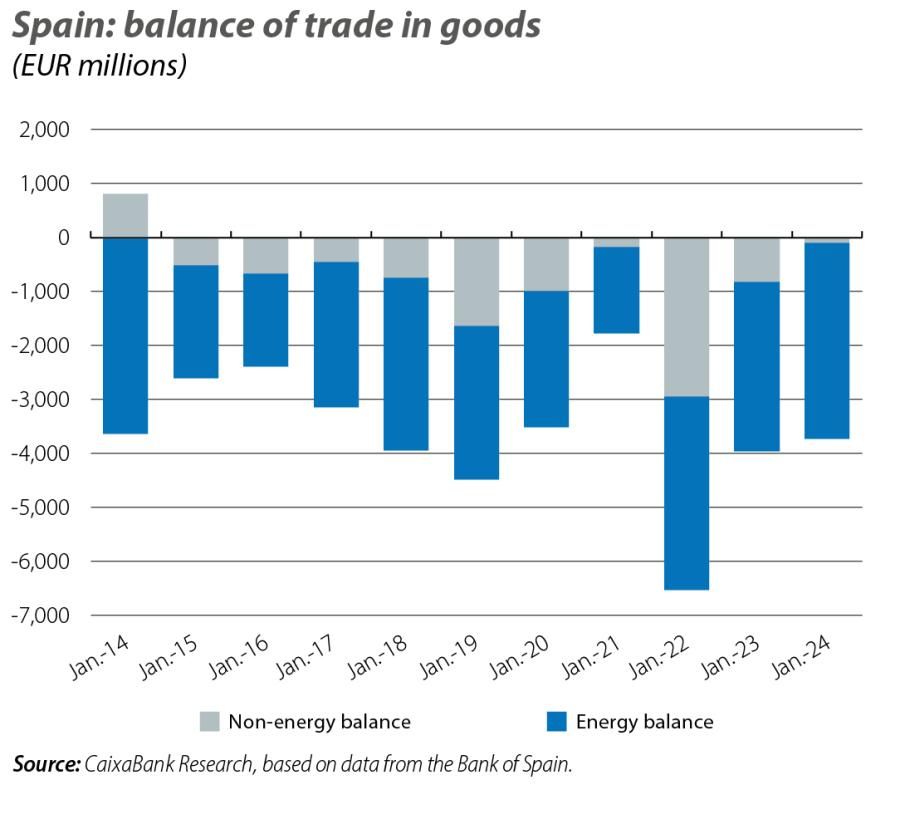

The foreign sector starts the year on a good footing

The trade deficit stood at 3.729 billion euros in January, lower than the deficit of 3.956 billion registered in January 2023 (–5.7% year-on-year) thanks to the improvement of the non-energy component. In particular, the non-energy deficit fell from 816 million euros in January 2023 to 90 million in January this year, in an environment marked by growing exports, which were up 1.7% year-on-year, and falling imports, which were down 0.9% year-on-year due to the fall in prices (of –3.9% year-on-year). In contrast, the energy deficit increased to 3.639 billion euros, from 3.140 million a year earlier, due to a sharper reduction in exports than imports (–41.2% and –12.3% year-on-year, respectively).