The growth of services sustains the strength of the Spanish economy in 2025

The Spanish economy has shown a positive tone in the opening months of 2025, driven, above all, by the revival of domestic demand. Although growth is expected to be slightly more moderate than last year, the decline in inflation and interest rates will act as important support factors in an international context marked by uncertainty. The CaixaBank Research Sectoral Indicator reflects this buoyancy in the opening months of the year and shows an increase in the number of sectors in expansion, although the picture is somewhat mixed.

Excellent closure to 2024 and positive dynamics that extend into 2025

The Spanish economy once again surpassed expectations in 2024, registering a solid GDP growth of 3.2%, in contrast to the modest 0.9% advance observed in the euro area as a whole. This momentum continued at the beginning of 2025, with growth above potential: GDP increased by 0.6% quarter-on-quarter and 2.8% year-on-year in Q1, in line with the CaixaBank Research forecasts.

For 2025, we anticipate GDP growth of 2.4%, following a pattern similar to that observed at the end of 2024 and primarily sustained on strong domestic demand. This forecast is supported by three key assumptions: a moderation in inflation that would allow the ECB to continue to lower rates down to 1.75%, a contained oil price, and a lower contribution from the foreign sector due to weak growth in the euro area and a moderate impact of the trade tensions. In this regard, it is important to clarify that CaixaBank Research’s baseline forecast scenario contemplates that the tariff tensions will remain limited and that the uncertainty will gradually dissipate over the coming months. This would entail the trade tensions having only a limited and transitory impact on the Spanish economy, given its low exposure to the US in terms of trade and the fact that the main risks are derived from the knock-on effects of geopolitical uncertainty and lower global growth, as we analyse in the article of this same Sectoral Observatory «Tariff tensions and reconfiguration of trade flows: impact on Spain».

In this context, the CaixaBank Research Sectoral Indicator, which encompasses information from 17 variables for economic activity, the labour market and the external sector,1 shows that the Spanish economy continues to enjoy dynamic growth in 2025, similar to the the rate recorded in the closing months of last year. The indicator is giving a more positive signal than the national accounting figures, as can be seen in the chart below. In particular, the indicator suggests that the growth rate remains high in the second quarter, although it should be noted that the information for that quarter is still incomplete given that, as of the closing date of this report, only the data on the number of registered workers affiliated with Social Security for the month of April are available. Nevertheless, those data beat expectations and reflect the widespread good performance of the labour market across the different sectors of the economy.2

- 1This indicator is calculated monthly for 24 economic sectors, including the four major sectors: the primary sector (agriculture, forestry & fishing), manufacturing, construction and services, and it compiles data from January 2011. It should be recalled that the indicator does not incorporate the activity of the energy, financial, general government or health sectors.

- 2See Brief Note: «La creación de empleo gana tracción en abril | CaixaBank Research» (content available in Spanish).

The CaixaBank Research Sectoral Indicator shows that the Spanish economy continues to enjoy dynamic growth

Sectoral Traffic Light for the Spanish economy: the number of sectors in expansion is one the rise

The Sectoral Traffic Light for the Spanish economy, a graphical tool that classifies sectors into five categories according to the intensity of their rate of growth or contraction, shows that around 30% of the branches of activity are in a stable situation. This is a similar percentage to that recorded on average during the pre-pandemic period of 2017-2019, indicating a greater degree of consistency in the growth rates between sectors. Indeed, the Spanish economy is entering a more stable phase of the business cycle as the major shocks of recent years – such as the pandemic, the disruptions to supply chains, the energy crisis and the tightening of monetary policy – are left behind us.3

According to the Sectoral Traffic Light, in the opening months of 2025 around 50% of the branches of economic activity are in expansion – most notably the chemicals and pharmaceutical industries – compared to 30% in the second half of 2024 and 20% on average that year. Moreover, the number of sectors in difficulty has declined: just 24% showed weakness in the first few months of 2025, compared to 34% in 2024. Of particular note is the improvement in the two sectors that showed the worst performance in 2024, namely the mining and quarrying industry and the textile industry, and this has supported the improvement of the aggregate sectoral indicator.

- 3The measures of dispersion (standard deviation of the growth between sectors) remain at very contained levels in historical terms in the series available since 2011, although they have increased slightly in the opening months of 2025.

At what point in the cycle is each sector?

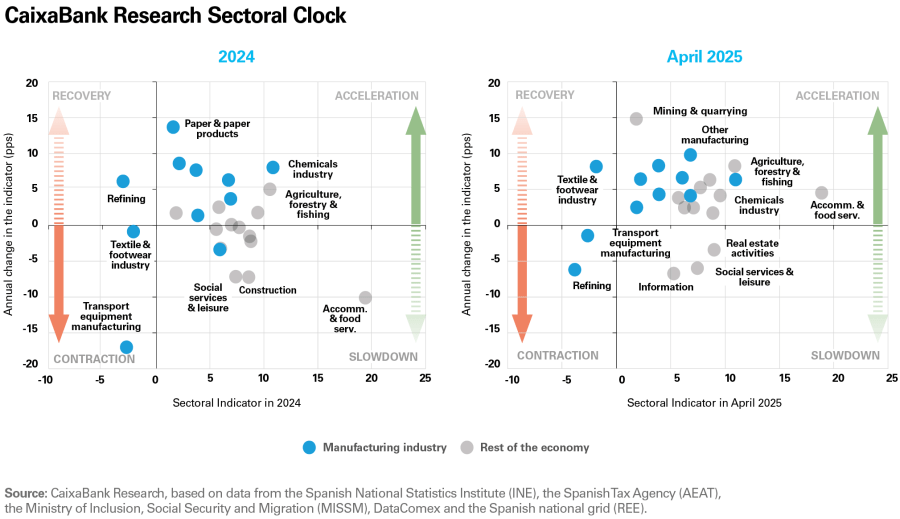

This improvement in the sectoral composition of the Spanish economy is also evident in the CaixaBank Research Sector Clock, a chart which compares the situation of each sector in 2024 with that of 2025 to date (with data up to April at the closing date of this report).4

Firstly, visually, we see how the number of sectors in the acceleration quadrant increases (going from 9 in 2024 as a whole to 16 in April 2025) and also how the number of sectors in the slowdown quadrant has reduced (from 8 sectors in 2024 to just 3 in April).

- 4The information available for the month of April is still very incomplete, as it only includes registered workers affiliated with Social Security.

Among the sectors that have improved the most, of particular note is the accommodation and food services industry, which in 2025 has resumed positive growth rates and continues to top the indicator’s ranking, following the slowdown recorded in 2024 due to a base effect after the exceptional rebound in 2023 linked to the post-pandemic recovery. In a similar situation we find retail trade, which also showed signs of cooling in 2024, but which has accelerated again in the first few months of 2025, thanks to the recovery of households’ purchasing capacity. Finally, the mining and quarrying industry, the wood and furniture industry, and other manufacturing (rubber manufacturing and machinery repair), all of which are energy-intensive, have jumped from contraction to acceleration at the beginning of this year, without passing through a recovery phase.

At the other end of the spectrum, that is, among the sectors that have deteriorated, two particularly significant cases are worth highlighting. Firstly, the refining sector has moved from the recovery quadrant to the contraction quadrant, registering a decrease in refining margins that is affecting the sector’s lower production (which was down 5% year-on-year in Q1 2025). Secondly, the automotive sector remains in the contraction quadrant and continues to experience significant weakness: industrial production fell by 14% in Q1, exports have been registering negative year-on-year rates since the end of 2024 and some 8,000 jobs have been destroyed in the 12 months to April.

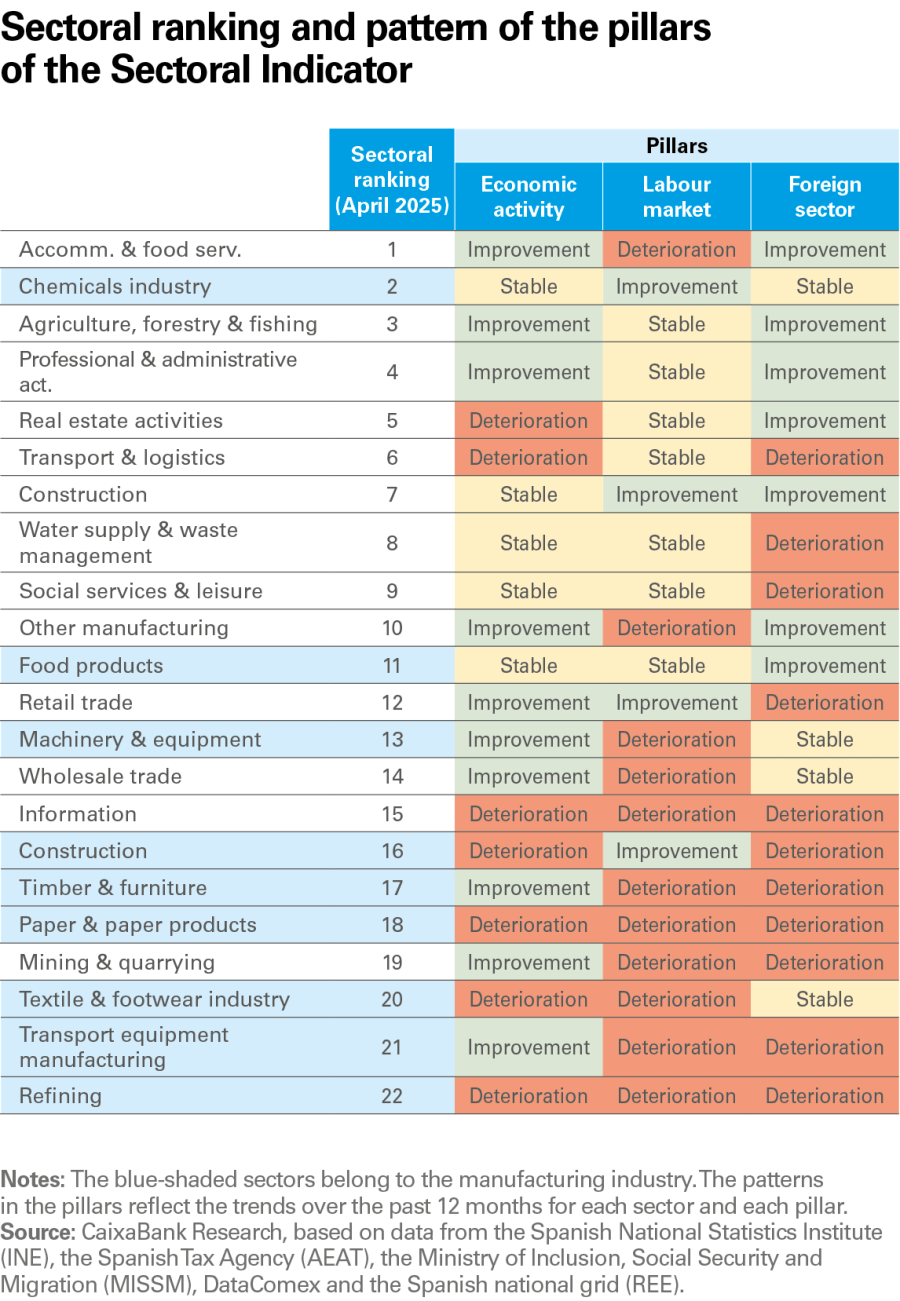

What characterises the sectors that are leading and trailing in our sector ranking?

In order to identify patterns in the current behaviour of the various economic sectors, we have analysed the ranking according to the Sectoral Indicator and identified the characteristics that are shared by the sectors at the top and the distinctive features of those at the bottom. This analysis is based on the contribution of the three pillars that make up the Sectoral Indicator: economic activity, the labour market and the external sector.5

- 5The 17 variables that make up the indicator are grouped into three pillars (economic activity, labour market and external sector), allowing us to analyse the contribution of each of these spheres to the performance of each economic sector. For further details on which indicators make up each pillar, see the Methodology note: CaixaBank Research Sectoral Indicator.

In general, it should be noted that the sectors that top the ranking are characterised by an improvement in the indicators within the economic activity pillar:

- The accommodation and food services industry has improved thanks to the positive contribution of all of the indicator’s pillars, with the economic activity indicators standing out, having made their greatest contribution since 2022.

- The chemicals and pharmaceutical industries have registered gradual and widespread improvements in all pillars. In this case, the labour market has been the main driver of this sector’s recent buoyancy.

- The agriculture, forestry & fishing sectors, previously affected by the increase in energy prices and the drought, has experienced a revival in 2024 and 2025, as reflected in the activity and foreign sector indicators, while the improvement in the labour market is more modest.

The economic activity indicators have reached their greatest contribution since 2022

Contribution of the pillars to the Sectoral Indicator in the sectors that lead the ranking

(pps)

In contrast, among the sectors found at the bottom of the ranking there is no clear pattern, as their deterioration has been driven by different factors in each case:

- Refining occupies the last position, affected by a reduction in refining margins as well as other more structural factors linked to the energy transition. Despite this adverse context, the tone in the sector's labour market remains upbeat, in line with the trend observed in recent years.

- The transport equipment manufacturing sector shows a slight deterioration, caused by the weakness of the labour market (significant job destruction) and the deterioration of the foreign environment (exports have registered negative year-on-year rates since the end of 2024).

- The textile industry, affected by relocation and the boom in online consumption, has entered a recovery phase thanks to the activity and foreign sector pillars, although it continues to face difficulties in the labour sphere.

Contribution of the pillars to the Sectoral Indicator in the sectors at the bottom of the ranking

(pps)

Finally, it is worth mentioning that the manufacturing branches of the economy are located in the mid-lower part of the ranking, largely due to the weakness of the foreign sector. This pillar will most likely continue to exert downward pressure over the coming quarters due to the trade tensions. However, the competitive advantage enjoyed by the Spanish economy in terms of energy costs should support the performance of the country’s manufacturing sector in the medium and long term. These two aspects – trade tensions and energy costs – are analysed in further detail in the articles «Tariff tensions and reconfiguration of trade flows: impact on Spain» and «Spain and its new energy advantage» in this same report.