Spain and its new energy advantage

Between 2018 and 2024, the Spanish economy experienced a substantial improvement in its relative electricity and gas prices, going from paying more than the European average to benefiting from lower rates. This decline is a result of the significant growth of solar photovoltaic and onshore wind power, the two forms of electricity generation with the lowest cost. Lower electricity prices compared to European competitors have facilitated the manufacturing sector’s good performance in recent years. This advantage in the generation of sustainable and low-cost electricity gives Spain’s industry a competitive edge over its competitors.

Historically, Spanish manufactures have faced the challenge of having higher energy input prices than their European competitors. According to data from Eurostat, in the entire period for which data are available up until 2018, the industrial price of electricity in Spain was above the euro area average (see the chart on the next page). This has contributed to the fact that, also according to Eurostat data, the gross value added (GVA) of Spanish manufactures grew at a lower rate than that of the euro area as a whole between 1997 and 2018. In this period, the compound annual growth rate (CAGR) of Spain’s manufacturers stood at 0.6%, while in the euro area it was 1.6%. In the same period, both France (1.3%) and Germany (2.0%) experienced growth rates of their manufacturing GVA more than double that of Spain. This growth differential contributed to the fact that, according to Eurostat data, Spanish manufactures’ share of GDP contracted between 1997 and 2018 faster in Spain (–5.9 pps) than in Germany (–0.0 pps), France (–4.6 pps) or Italy (–3.7 pps).

This adverse circumstance for Spain’s industry has been reversed in recent years. Between 2018 and 2024, relative energy prices for industrial use shifted substantially in Spain’s favour compared to the rest of Europe. Whereas in 2018 Spain’s industry was paying 31.5% more for its electricity than European industry, in 2024 it paid 20.9% less. Spain’s industry has also experienced a favourable relative price change in the case of gas, which between 2018 and 2024 went from being 5.8% more expensive than in the rest of Europe to being 15.6% cheaper. In this same period, the annualised growth of Spanish manufacturers has been above that of the euro area (+1.7% vs. 0.6%).

This positive shock in the terms of trade is a response to two key factors. On the one hand, Spain was less exposed to Russian gas and, therefore, has suffered less disruption as a result of Russia’s invasion of Ukraine. According to Bundesnetzagentur, Germany’s energy regulator, the country imported 52% of its natural gas in 2021 through pipelines connecting it to Russia. In contrast, the poor energy connections between the Iberian Peninsula and the rest of the European continent – a historical disadvantage for Spain – meant that the effects of the closure of the Russian gas pipelines were minor for Spain.

On the other hand, Spain has a competitive advantage over Europe for the two types of electricity generation with the lowest cost: solar photovoltaic and onshore wind. According to data from the US Energy Information Administration,13 these two generation sources produce the least expensive electricity. While electricity generation through coal combustion or combined cycle costs 89.33 dollars/MWh and 42.27 dollars/MWh respectively, onshore wind and solar photovoltaic costs 31.07 dollars/MWh and 23.33 dollars/MWh. A German study (by Fraunhofer-ISE)14 corroborates these results for Europe, finding a similar order in the cost of electricity generation from each source.

According to data from Spain’s national grid (Red Eléctrica), between 2018 and 2024, low-cost renewable electricity generation increased from 22.8% to 40.2% of total electricity production in Spain. This increase is mainly due to the increase in solar photovoltaic production, which went from 3% to 17% of total production in the same period. This increase in low-cost renewable electricity generation has a significant impact on electricity prices. In a recent study,15 the Bank of Spain estimated that wholesale electricity prices are 40% lower today than they would have been if wind and solar energy production had remained at 2019 levels.

- 13«Estimated levelized cost of electricity (LCOE) U.S. Energy Information Administration», Annual Energy Outlook, 2023.

- 14Christopher Kost. «Study: Levelized Cost of Electricity – Renewable Energy Technologies». Fraunhofer ISE.

- 15J. Quintana «The impact of renewable energies on wholesale electricity prices». Bank of Spain, Economic Bulletin 2024/3.

Spain has competitive advantages when it comes to renewable energy generation, as it receives a high level of solar radiation and has significant wind potential thanks to a combination of natural, geographical, political and economic factors. In particular, it has favourable climatic and geographical conditions, such as large areas of land with low population density which facilitate the installation of wind turbines. Moreover, in the late 1990s, policies were introduced to support this industry, and this led to the development of Spain’s world-leading wind industry. While the competitive advantage associated with gas prices is expected to be temporary, that associated with electricity prices is more sustainable in the long term. Lower gas prices in Spain are based on geopolitical circumstances which could change in the long term, for instance, if the conflict in Ukraine were to end or other European countries were to boost their capacity to absorb liquefied natural gas. On the other hand, the competitive advantage in electricity prices is more sustainable in the long term, as the factors behind it are physical ones that are not expected to change in the short or medium term.

Energy costs are key to manufacturing output

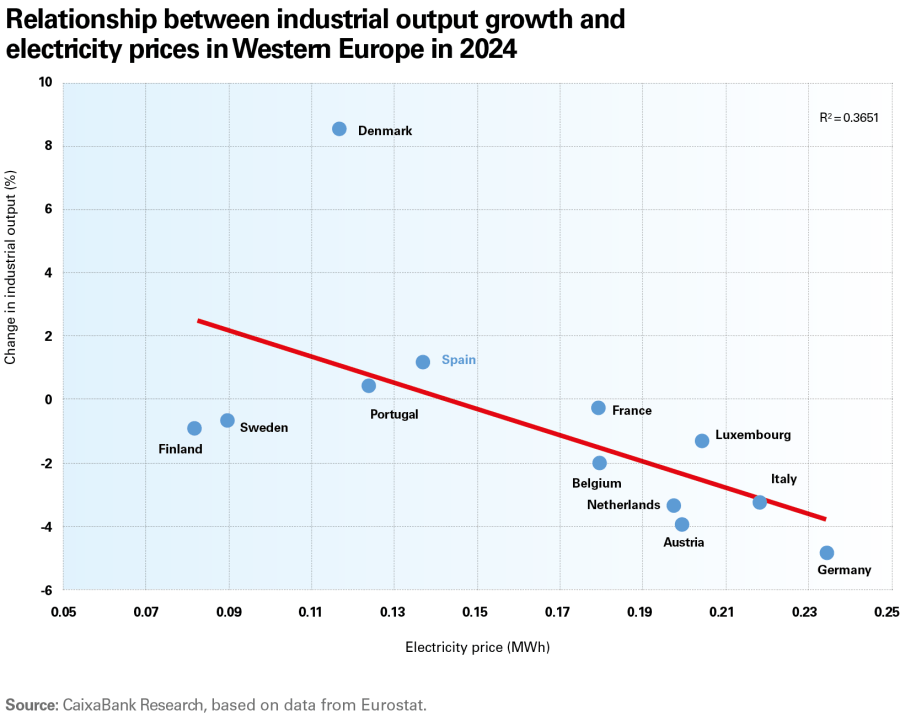

Energy input prices are closely associated with manufacturing performance. Electricity prices in 2024 show a strong negative correlation with the growth of manufacturing output. The Nordic countries and Spain, with their more competitive electricity rates, have performed better, while industrial output in Italy, Austria and Germany is suffering the effects of high electricity costs.

Renewable energy is boosting the competitiveness of Spain’s manufacturing industry

With a longer time horizon, we use panel data from European economies between 2007 and 2024 to analyse the relationship between the growth of manufacturing GVA and electricity prices for industrial producers.16 Our estimate suggests that a 10-cent increase in the price per kWh is associated with a reduction in the growth of manufacturing GVA of between 2.0 and 2.7 pps, depending on the statistical specification and the sample used.17 According to this estimate, electricity prices in 2018 exerted a negative pressure on Spain’s manufacturing sector of approximately 0.6 pps relative to the growth of the euro area as a whole. On this basis, the lower relative electricity prices in Spain in 2024 explain the fact that Spain’s industrial output grew by around 0.8 pps above that of the euro area as a whole. Given that Spain’s industrial GVA grew 1 pp less than that of the euro area in the period 1995-2018, and that it grew 1.1 pp higher in the period 2018-2024, the electricity price differential appears to explain both the majority of the poorer past performance and the current improvement.

- 16The econometric specification includes fixed country and year effects that allow us to control for factors that are constant across every country or year. It should be recalled that these estimates should be interpreted as correlations, since other factors not included in the analysis could affect this relationship.

- 17In particular, we exclude small countries and those where the manufacturing sector is insignificant.