Uncertainty and US tourism

Tourism expenditure from the United States in Spain has shown a marked slowdown since late 2024. This deceleration partly reflects the normalization of tourism growth after the pandemic, as well as macroeconomic factors such as the appreciation of the euro against the dollar and deteriorating growth prospects for the US economy. However, since these factors operate with a time lag, it is likely that the current slowdown also stems from rising uncertainty surrounding US economic and trade policies impacting Americans' propensity to travel to Spain. Considering that in 2024, US tourists accounted for 4.6% of total arrivals and 7.1% of international tourist spending in Spain, this slowdown could potentially subtract up to 1 percentage point from growth of tourism GDP in 2025. Certain regions, particularly non-coastal urban areas, could experience greater impacts due to their higher dependency on American tourist expenditure. Thus far, the sharpest slowdown has been observed in rural areas, where the share of American tourists is comparatively smaller.

American tourism is showing signs of slowing down

Spain has experienced a boom in US tourism in the last five years. According to figures from the Spanish National Statistics Institute (INE), between 2019 and 2024, arrivals from the United States grew by 28.3%, more than double the 12.3% increase in total number of international arrivals. Consequently, the share of US visitors rose from 4.0 per cent to 4.6 per cent of total arrivals, while their contribution to tourist expenditure climbed from 6.3 per cent to 7.1 per cent. Significantly, spending by U.S. tourists accounted for 13.2 per cent of the total increase in international tourist expenditure over these five years, underlining the growing economic importance of US visitors to Spain’s tourism sector.

During the first months of 2024, US tourism showed remarkable dynamism, with increases in spending and arrivals above the average for non-US markets. However, since last autumn the indicators point to a clear slowdown, which is more intense than that observed in international tourism as a whole begs the question of to which extent US tourism could be a weakness for the Spanish tourism sector over the coming quarters, and of which destinations could be most threatened.

The growing role of US tourism makes it even more important to analyse the slowdown of this component of tourism demand, as well as the possible factors that explain it

US card spending at CaixaBank point-of-sale (POS) terminals grew roughly 17% year-on-year (y/y) from January to October 2024, then slowed abruptly, averaging −2.2% y/y between November 2024 and May 2025. By contrast, total foreign card spending decelerated more moderately— from 11.1% y/y in January-October 2024 to 8.5% y/y in November 2024-May 2025.11 Tourism-spending data from Spain’s National Statistics Institute (INE) corroborate this pattern: US tourist-expenditure growth fell from over 23% y/y in January-August 2024 to 5.6% y/y over September 2024-May 2025, whereas the slowdown in total international tourism spending was milder, easing from 17.8% y/y in January-August 2024 to 11.0% y/y in the eight months to April 2025.

Similarly, passenger arrivals from the US also slowed sharply from 17.5% year-on-year growth in the first 10 months of 2024 to a mere 2.3% between November 2024 and May 2025. In contrast, according to the INE, the slowdown in the number of US tourists who visited the country is less pronounced (from 14.6% to 6.8% in the same period), but again it was sharper than the slowdown in the number of international tourist arrivals as a whole (which went from 11.1% to 7.6% growth). Moreover, the loss of dynamism of US tourism in Spain is more pronounced than that experienced by US tourism as a whole, or in Europe, although it is of a similar magnitude to that recorded in Italy (see chart on next page). US arrivals to France, on the other hand, accelerated, which could be related to the holding of the Olympic Games last year.

- 11

Indicators for international tourism spending taken from the CaixaBank Research Real-time Economics portal, based on payments with foreign cards recorded on CaixaBank POS terminals, available at: https://realtimeeconomics.caixabankresearch.com/

The slowdown in US tourism could deduct around 1 pp from the growth of tourism GDP in 2025

These indicators reflect until recently that a key component of tourism demand – US tourism – which up until had contributed significantly to the sector’s growth, is showing clear signs of cooling. Given its magnitude and its important role within international tourism to Spain, we estimate that this slowdown could subtract up to 1 pp from the growth of tourism GDP. In a context in which we anticipate a slowdown in the growth of tourism GDP from 6.0% in 2024 to 2.7% in 2025 (–3.3 pps), the loss of dynamism of US tourism is emerging as a key factor to the sector's outlook.

Factors contributing to the slowdown in US tourism

A change of the magnitude indicated by the data cannot be explained solely by the post-pandemic normalisation of the growth of international tourism. Some of this change could be justified by the macroeconomic factors that tend to determine US tourism growth, such as the increase in gross disposable income or the euro-dollar exchange rate. However, it is unlikely that they alone could be responsible for such a sharp slowdown, especially in such a short period of time, suggesting that the increase in uncertainty may have also contributed to this slowdown.

The real gross disposable income of US households rose 2.7% in 2024, after the 5.1% growth recorded in 2023, according to data from the US Bureau of Economic Analysis. Given that the growth of international tourist arrivals is closely related to the growth of gross disposable income,12 we would expect to see strong growth, although the slowdown in the growth of US gross disposable income between 2023 and 2024 is consistent with a normalisation of tourist arrivals. The worsening economic outlook following the start of the trade tensions (CaixaBank Research has revised its forecast for US GDP growth in 2025 downward, from 2.1% at the beginning of the year to 1.3% at present. The adjustment for 2026 is likewise notable, with the projection reduced from 1.9% to 1.3%)13 could be a source of weakness for US tourism demand.

Another macroeconomic factor that could be contributing to the slowdown of US tourism is the fall of the dollar against the euro. CaixaBank Research estimates that a 1% depreciation of the dollar against the euro reduces US tourist arrivals by 0.25% in the following quarter. The Bank of Spain finds similar results, estimating that the number of overnight stays in hotels by foreign travellers falls by as much as 0.4% when their currency depreciates by 1%, although this effect materialises five quarters later. The depreciation of the dollar since February could be weakening US tourism, but relatively modestly, and – according to both estimates by CaixaBank Research and the Bank of Spain – towards the summer and the second half of the year.

As the chart on the previous page shows, the change of trend in US tourism has coincided with a surge in economic uncertainty in the country. This is reflected by the Economic Policy Uncertainty Index, which measures uncertainty on the basis of news in the US press and which has soared to an all-time high since Donald Trump’s arrival in the White House and the beginning of the instability in global trade. Although international tourism is not directly affected by the tariffs, it is nevertheless a luxury good,14 which means it is an expense that can be easily cut when households are uncertain about the state of the economy.

- 12

See the article «What do the elasticities of international tourism demand tell us about the growth of the tourism sector in Spain?» in the Tourism Sector Report for S1 2025.

- 13

For more information on the new economic forecast scenario, see the June 2025 Monthly Report.

- 14

A luxury good is one with an elasticity to income greater than 1. Both the analysis by CaixaBank Research and the consensus in the academic literature find elasticities greater than 1 for international tourism. See «What do the elasticities of international tourism demand tell us about the growth of the tourism sector in Spain?» in the Tourism Sector Report for S1 2025.

The impact of the slowdown in US tourism is uneven

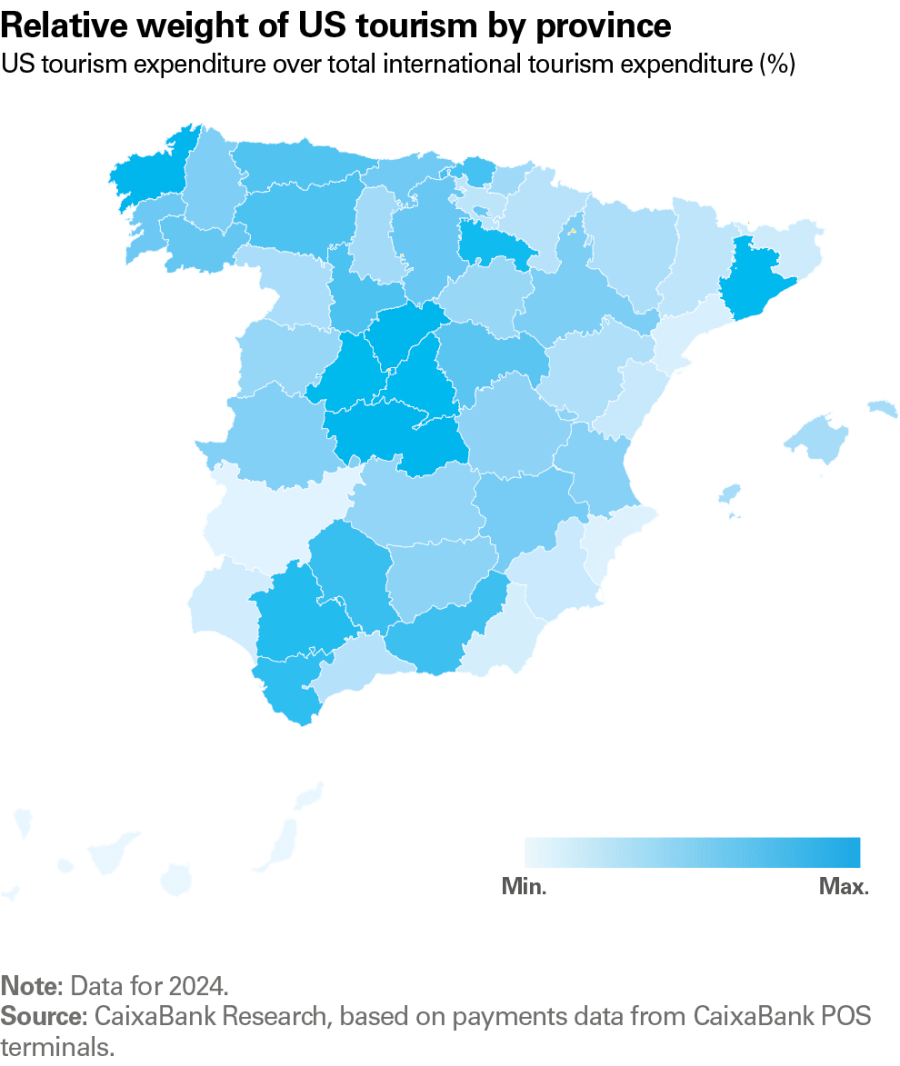

While the fall in US tourism in Spain is not incompatible with continued growth of the sector, its uneven distribution across the country means that some areas are more exposed to the slowdown than others. American tourists accounted for 9.9% of all the international tourist expenditure recorded on CaixaBank POS terminals in 2024 in the whole of Spain, but in provinces such as Barcelona, Madrid, Toledo and Segovia, they exceeded 17% of the total international expenditure. La Rioja and parts of Andalusia are also highly exposed to US tourism. In contrast, certain provinces of the Mediterranean coast such as Alicante, Castellón, Almería, Tarragona and Girona have a much lower proportion of US tourism, representing less than 4% of the expenditure recorded on CaixaBank POS terminals. The Canary Islands, and to a lesser extent the Balearic Islands, are also more insulated from American tourism.

In terms of destination type, if we segment Spanish municipalities between urban (with more than 30,000 inhabitants) and rural, and between coastal and non-coastal, we observe that US tourism plays a particularly important role in non-coastal urban municipalities (14.7%). In rural municipalities – both coastal and non-coastal – US tourism accounts for just over 4% of total expenditure. The evolution of US tourism spending also varies, with the destinations where this nationality plays a greater role showing a somewhat better performance. Thus, among rural destinations, where US tourism represents a smaller proportion of the total, the year-on-year declines in US tourism spending between November 2024 and April 2025 are around 10%. In urban coastal destinations, however, the decline is more modest (–5.4%), and in non-coastal urban destinations, where US tourism plays a bigger role, the spending has registered a very slight increase (+0.1%).

Although the slowdown is slightly less pronounced in destinations where US tourism plays a more prominent role, it is important that they develop a strategy to offset this slowdown, for instance by promoting high-value-added tourism, including from other long-haul source markets. In recent years, some long-haul source markets have shown very solid performance, including the Middle East, Latin America and Australia. In contrast, Asian long-haul tourism has recovered more modestly. In fact, spending by tourists from China and Japan recorded on CaixaBank POS terminals has not yet recovered to 2019 levels, even in nominal terms. Promoting the recovery of markets that are lagging behind, as well as continuing to focus on long-haul source markets that are showing strength, could prove key to mitigating the impact of the slowdown in US tourism on the sector.