Neither geopolitical risks nor trade threats hinder the advance of risk assets

Contained impact from the spike in geopolitical risk

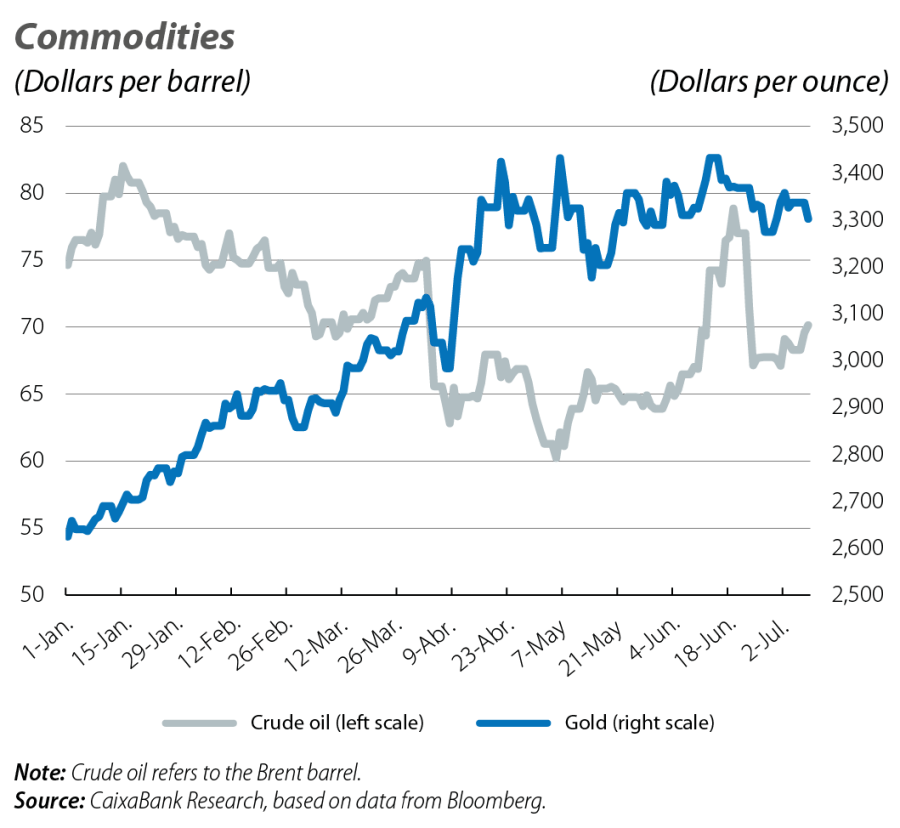

The escalation of tensions in the Middle East, with the attacks between Israel, the US and Iran, was short and intense, but contained. So was the response of financial markets. The price of Brent crude oil surged by 20% in just one week, from 66 to 79 dollars, before falling 15% in just five days after a truce was announced. Since then, the price of Brent has stabilised at levels around 67-68 dollars per barrel, as fundamentals have redirected the price dynamics in a context of oversupply, in which OPEC+ will reverse the 2.2-million-barrel cut implemented in 2023. Production will increase by 548,000 barrels per day in August, accelerating the pace with respect to the consecutive increases of 411,000 barrels per day in May, June and July. Other financial assets responded more timidly. On the day of the US bombings, the S&P 500 fell just 1.5%, the dollar appreciated 0.3% and gold, a traditional safe-haven asset, rose 3% only to quickly return to its previous levels. Following this short episode, markets resumed the trends observed in the previous month: more stable sovereign yields in the euro area, without any surprises from the ECB; rates in the US moving to the tune of monetary policy expectations, without any significant impact from the fiscal risks arising from the new budget act (the OBBBA) or the threats of tariffs. The stock markets, meanwhile, continued to advance despite trade tensions, which could reflect investors’ optimism that the White House will eventually reach agreements with its trading partners, or simply disbelief that Trump will reimpose the reciprocal tariffs.

The ECB cuts rates and reaches «the end of a monetary policy cycle»

As anticipated, in June the ECB cut rates by 25 bps (placing the depo rate at 2.00%). Lagarde described the current situation as nearing «the end of a monetary policy cycle», with inflation now normalised following the disruptions triggered by COVID-19 and the war in Ukraine. Looking ahead to the new phase of the cycle, a range of scenarios are opening up in an environment which the ECB described as being marked by «exceptional» uncertainty, which is why the central bank reiterated its data-dependent approach for its forthcoming meetings. However, Lagarde said that the current tone of monetary policy is well positioned to respond to uncertainty, thus indicating little willingness to lower rates again in July. Financial markets expect rates to remain unchanged at the next meeting and one further 25-bp cut towards the end of the year.

The Fed on pause and with division of opinions

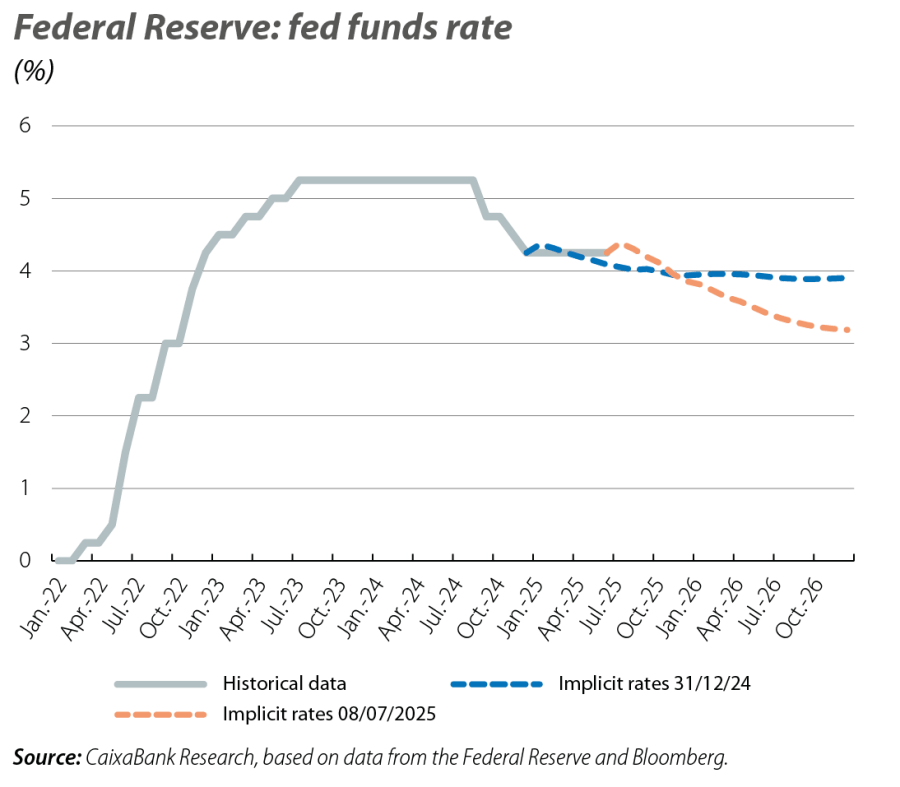

There were no surprises from the Federal Reserve either, which kept the fed funds rate in the 4.25%-4.50% range, extending the pause it began this year for the fourth time in a row. It once again justified the decision by arguing it needs more clarity on the impact of tariffs on prices and economic activity before making any further moves, and believes the economy’s strength allows it to take another pause. In its macroeconomic forecast update, the Fed maintained its qualitative assessment of an outlook with higher inflation and lower growth, although it did intensify the magnitude of the impact due to higher tariffs than originally estimated. More relevant were the interest rate projections in the dot plot. The chart showed two well-defined and similar-sized blocs within the FOMC: on the one hand, a more cautious group that anticipates only a single rate cut this year, or even none at all; on the other, a more dovish wing that continues to project at least two cuts. This dispersion of expectations highlighted the growing uncertainty surrounding the trajectory of monetary policy and reinforces the data-dependent strategy. Financial markets expect the Fed to resume its monetary easing after the summer, with two 25-bp cuts this year.

Monetary and fiscal policy expectations guide sovereign rates

With no surprises from the ECB and no change in the underlying trends of the euro area economy, the region’s sovereign rates remained relatively stable during the first half of the month. With the announcement of Germany’s new draft budget, which entails an increase in public spending, sovereign rates rose across the board, ending June up to 10 bps above the previous month’s level. In the US, in contrast, sovereign rates saw back-and-forth movements, initially falling throughout the yield curve prompted by expectations of a more dovish Fed (which could cut rates up to three times this year) in view of the apparent limited impact, for now, that the tariffs are having on the inflation data. However, strong June employment data reversed this trend and reinforced expectations that the Fed will keep rates on hold until after the summer, triggering a rebound in Treasury yields from the beginning of July up until the close of this publication.

Geopolitical tensions were not enough to boost the dollar

Despite escalating geopolitical tensions and trade uncertainty, the US currency weakened against its main peers by almost 3% in June, reaching its lowest levels since 2021. The truce between the countries involved in the Middle East conflict, which increased the appetite for risk assets, as well as the swings in US sovereign rates, caused the currency to lose value. Additionally, concerns over fiscal deterioration in the US continued to weigh down on the currency. The dollar’s depreciation has been especially intense against the euro, which is now trading at around 1.18 per dollar (almost 15% higher than at the start of the year).

Stock markets: optimistic, sceptical or both?

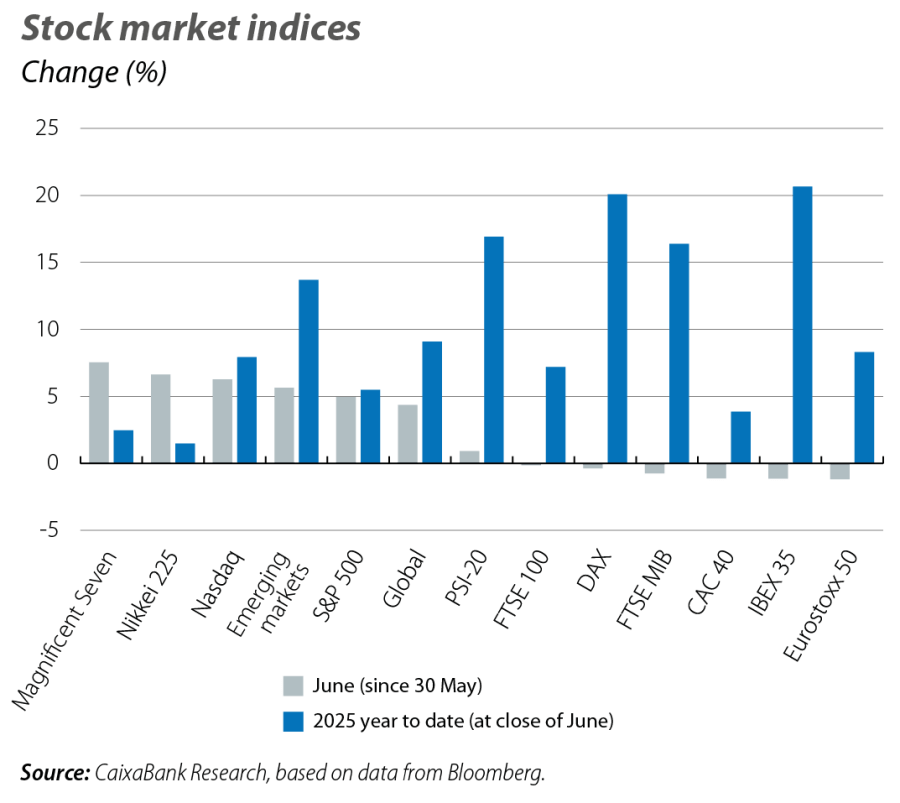

In a context of high geopolitical uncertainty, and with the expiry date of the pause on the reciprocal tariffs drawing near, global stock markets had a positive month (the MSCI All Country World Index climbed +4.3% in June). US indices led the gains, driven by tech stocks, and the S&P 500 hit a new all-time high. Thus, this was a month in which the stock markets were less reactive to Trump’s threats, in what some analysts have labelled the TACO trade (Trump Always Chickens Out), reflecting expectations among investors that the president will eventually delay or fail to follow through on his threats. Thus, stock markets closed the first half of the year recovering from the turbulence in April and distilling optimism that trade deals will eventually be reached and that the global economy will avoid a disorderly tariff war.