Spain’s housing market enters a new expansionary phase

The Spanish housing market is in the midst of a boom, driven by lower interest rates, the improvement in purchasing power and population growth. Demand continues to grow sharply, with foreign buyers playing a notable role, while supply is also steadily gaining traction, although it still does not compensate for the housing deficit accumulated since 2021. House prices continue to accelerate, now exceeding the peak reached in 2007 in nominal terms, and signs of overvaluation are beginning to become apparent. However, the current context differs from the one prior to the bursting of the housing bubble: rather than an oversupply, there is a serious housing deficit, and that is what primarily explains the pressure on prices; moreover, households, the construction and developer sector, and the financial system are in a strong financial position. We expect prices and sales to remain dynamic in the coming quarters, underscoring the need to increase the supply of affordable housing.

Housing demand has undergone a rapid revival since mid-2024 and is at levels not seen since 2007

Thus, in the trailing 12 months to June 2025, there have been some 700,000 sales (according to data from the National Statistics Institute, or INE), 19.7% more than in the first half of the previous year, reaching levels not seen since 2007.1 However, while the volume of transactions is very high, the demographic pressure is now greater than it was then: there are 4.3 million more people and 3.2 million more households than in 2007. In the 12 months to June 2025, some 14.3 transactions per 1,000 inhabitants have been closed, well below the 17.3 reached in 2007. Also, most transactions correspond to existing homes, although the sale of new homes is gaining traction thanks to the gradual recovery of supply (22.2% in S1 2025 versus 21.0% in 2024). However, the current figures fall far short of 2007 levels, when 42.1% of sales involved new homes, reflecting the construction boom of that period, as we will analyse later.

In recent quarters, the revival of demand is widespread, occurring across the various types of buyers. Although the latest boom is primarily driven by purchases made by Spanish citizens, the role of foreign buyers is far from negligible: foreigners acquired around 50,000 homes in S1 2025, according to the Association of Property Registrars, which represents 14.1% of all sales (compared to a historical average of 10.5% in the period 2006-2024) and is 15% more than in the same period last year.2 In the article «How has the profile of non-resident foreigners who buy homes in Spain changed?» of this report, we delve into how foreign demand has influenced the behaviour of the housing market in this period.

- 1

According to MIVAU statistics (based on Notaries), the number of sales was 740,000 homes in the trailing 12 months to Q1 2025.

- 2

According to MIVAU transaction data (based on Notaries), sales to foreign buyers amounted to around 133,000 in the trailing 12 months to Q1 2025, accounting for 18% of the total.

Home sales in Spain

The supply of new housing has undergone a rapid revival in 2025, but is still far from compensating for the deficit accumulated since 2021

In the trailing 12 months to May, around 132,000 new homes were approved, representing a 13% increase year-on-year, on top of the 17% increase registered in 2024. Moreover, this trend is expected to continue to steady increase, taking into account the continuing strength of demand and the intention of the property developer sector to continue to grow the current housing stock. However, this increase in supply remains insufficient to absorb demand and close the accumulated deficit of more than 500,000 homes since 2021. In this same report we analyse in detail this accumulated deficit by region, in the article «The price of not building: how the housing deficit explains much of the price pressures».

The new housing supply is clearly inadequate in view of housing needs

The labour market continues to create employment in the sector and there has been a dramatic reduction in temporary employment in construction

The rest of the sector’s supply indicators offer a similar reading and show a gradual but modest improvement. On the one hand, the apparent consumption of cement is close to the levels seen in 2012 (around 15 million tons in the trailing 12 months to January) and is growing at a rate of 4% per year. On the other hand, the labour market is showing a steady increase in the number of registered workers in the construction sector (3.5% year-on-year in August), outpacing the average for the economy as a whole (2.3%) and reaching approximately 1.45 million workers in total.

The construction sector has experienced a drastic reduction in temporary employment in recent years, consolidating its position as one of the branches of the economy that has made the most progress in this field since the 2021 labour reform came into force. In 2022, temporary contracts (full and part-time) accounted for around 35% of the total. In 2025, this figure has fallen to just 4.8%, which represents a structural transformation of the hiring model in the sector. Full-time permanent contracts have gone from representing 63% to 85.6% of the total, reflecting a clear commitment to job stability. There is also a slight increase in permanent part-time contracts (from 5.1% to 6.0%), suggesting greater flexibility within this stability. Finally, there has been an increase in the use of discontinuous fixed contracts – a format that is well-suited to a sector in which downtime between projects is frequent. Its growth suggests that companies are reorganising their workforce in order to maintain the employment relationship without resorting to dismissal, but in any case, this only explains a small part of the reduction in temporary employment in the construction sector.

The sector's supply indicators show a gradual but modest improvement

The construction sector stands out as one of the branches of the economy that has reduced the temporary employment rate the most since 2022

House prices continue to accelerate hindering access to ownership

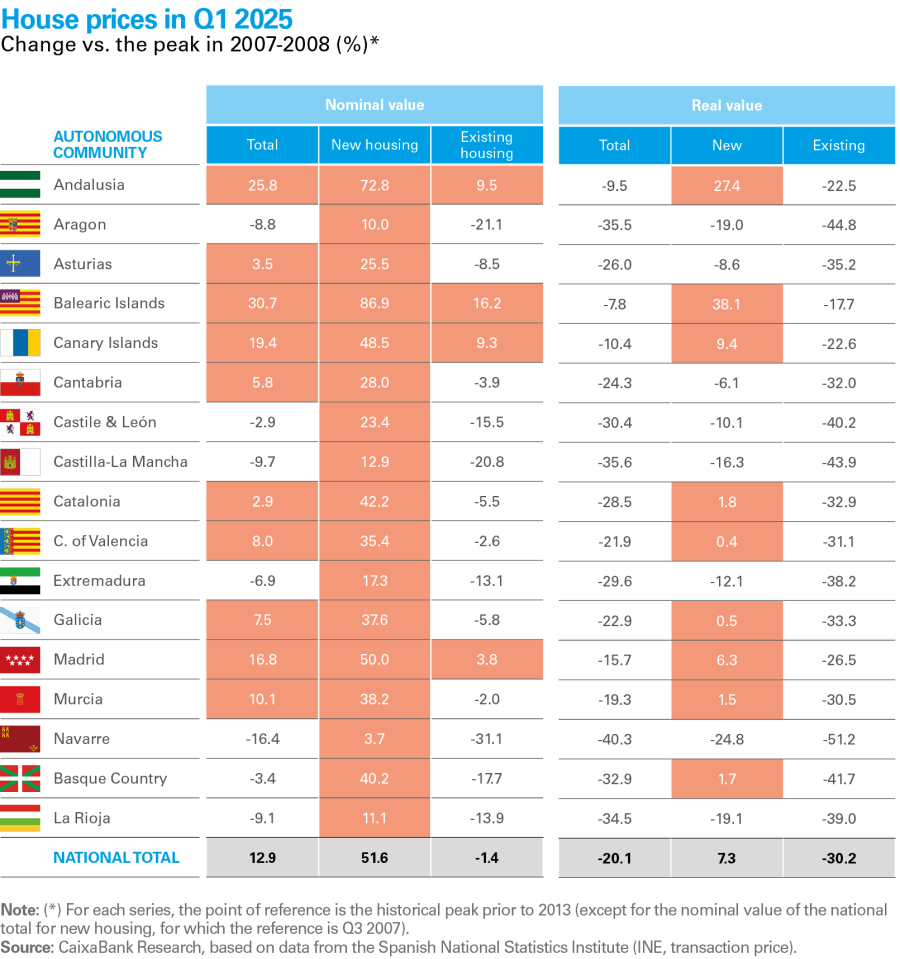

According to the main national price indicators, the growth of house prices continued to intensify in the opening months of 2025. According to the appraisal value index published by the Ministry of Housing and Urban Agenda (MIVAU), the increase was 9.0% year-on-year in Q1 2025, compared to 7.0% in Q4 2024. The price index published by the National Statistics Institute (INE), based on transaction prices, shows a sharper growth rate, at 12.2% year-on-year in Q1 2025 (11.3% in Q4 2024). With these increases, the price of housing now exceeds, in nominal terms, the peaks registered in 2007. Although there is no doubt that the growth of house prices in recent quarters has been significant, it should be recalled that this has occurred in an inflationary context and that, in real terms, prices have not yet reached the previous highs, except for in the case of new homes.

House prices set new highs in nominal terms and maintain a clear upward trend

By region, we see a mixed pattern. Firstly, the most economically dynamic autonomous communities, Madrid and Catalonia, have registered a sharp increase in prices due to the high demand for housing and the greater pressure on the available land. Secondly, Andalusia, the island regions, the Community of Valencia and Murcia stand out, being the most attractive regions for international tourists. In contrast, regions such as Aragon, Castilla-La Mancha, Castile and León and Extremadura, with lower pressure on housing, a more ageing population and less appeal for real estate investment, have recorded lower house price growth.3

- 3

House prices and sales have surged since mid-2024, especially in the most expensive areas, widening the territorial gap and shifting demand to more affordable areas, such as peripheral municipalities and regions in the north-west of the country. For a more detailed analysis of where the demand for housing is growing the most in Spain, see the article «The real estate boom spreads across Spain», published in the Real Estate SR S1/2025.

Price pressures are even more evident in the rental market, where the lack of supply is pressing. In this regard, CaixaBank’s average rental price indicator, which is based on rent payments made by direct debit, rose 5.5% in the first half of 2025 and has accumulated a 30% increase since 2019. The increase is even more pronounced if we take into account the indicators available from the main real estate portals, according to which the highest increases in recent years have been recorded (14.1% year-on-year in July according to Fotocasa and 10.9% year-on-year in July according to Idealista).

Some indicators are beginning to detect signs of overvaluation

After several quarters of sharp price increases, some indicators are beginning to reflect signs of possible overvaluation in Spain’s property market. In its latest Financial Stability Report, the Bank of Spain estimated that the price of housing was between 1.1% and 8.5% above its long-term equilibrium level at the end of 2024 (versus a range of 0.8% to 4.8% six months earlier).4 In parallel, the European Central Bank also estimates an overvaluation of Spain’s residential market of around 10% at the end of 2024. In both cases, for now, these levels are still contained, but the trend is clearly upwards (see chart).5 These indicators, although based on aggregate data and subject to a high degree of uncertainty, serve as an indication for monitoring the possible deviation of house prices relative to values that could be considered equilibrium.

If we apply the methodology developed by the Bank of Spain6 in our estimates of the affordability ratio at the autonomous community level, which we publish quarterly on the CaixaBank Research Real-Time Economics portal,7 we find that most regions show signs of overvaluation, with the Balearic Islands and Madrid topping the list. In both cases, these estimates suggest that house prices have been gradually decoupling from the trend in household incomes, leading to increasing tension in the affordability ratios.

This rally in the market could fuel fears of a sharp correction in house prices like the one suffered between 2008 and 2013. In this regard, it is important to note that, for the moment, the current environment presents important differences compared to the previous cycle, as summarised in the following infographic on the housing market.

- 4

Financial Stability Report, Spring 2025, Chapter 4.1.

- 5

Average estimate of the four valuation methods used by the ECB.

- 6

The gap is calculated as the difference between the ratio of house prices to household disposable income and its long-term trend, obtained using a single-tail Hodrick-Prescott filter with a smoothed parameter equal to 400,000.

- 7

https://realtimeeconomics.caixabankresearch.com/#/monitor

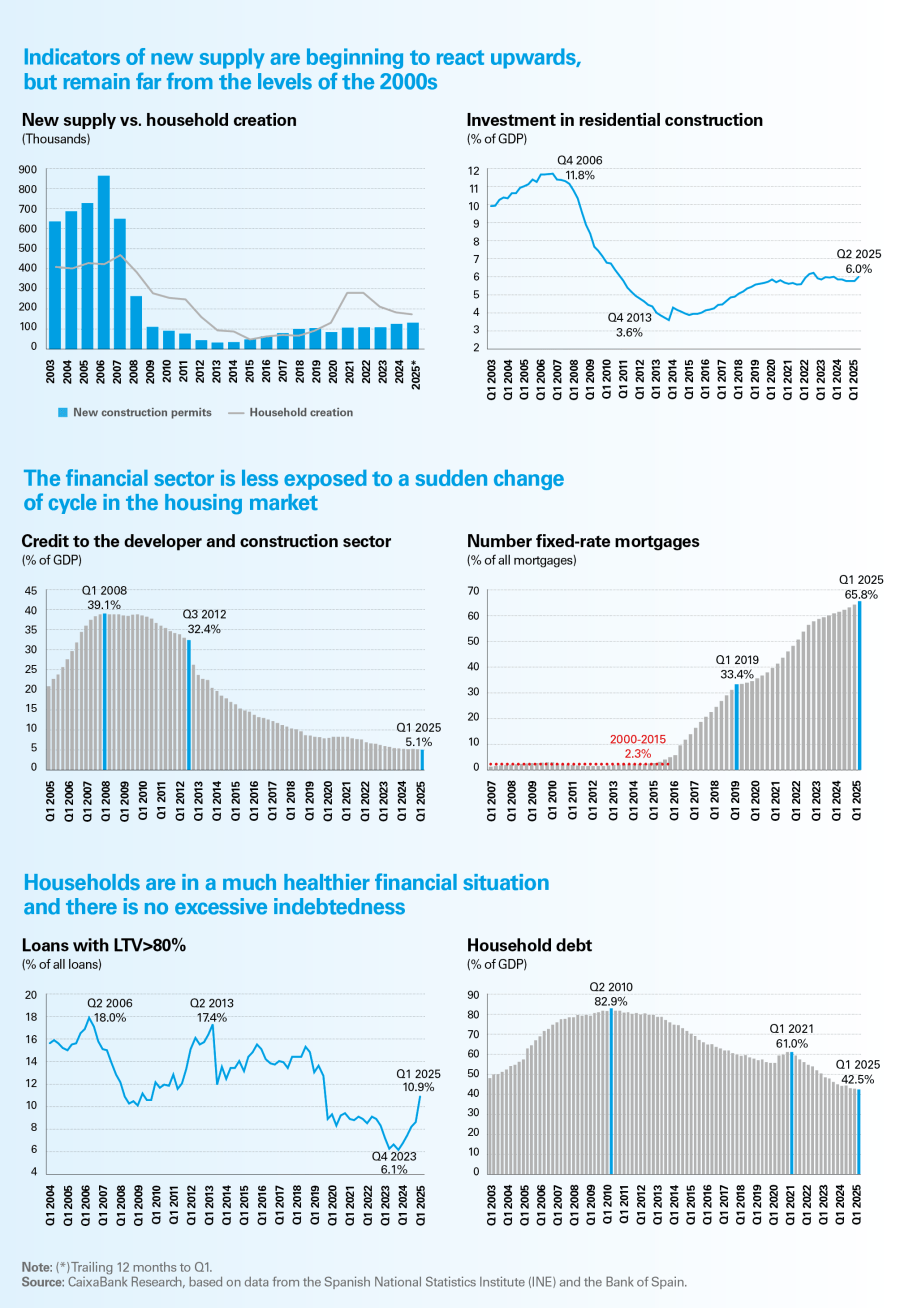

Firstly, there is no perceived oversupply of housing as was the case in the 2000s; indeed, quite the opposite. In the 2000s, around 550,000 new homes were approved per year, compared to the creation of 400,000 households. Since 2021, around 118,000 new homes have been approved annually, with a creation of 226,000 households, resulting in an accumulated housing deficit of more than 500,000 units since then. In addition, investment in residential construction remains broadly stable in recent quarters and stands at around 6% of GDP, whereas in the 2000s, in the midst of the housing bubble, it was practically double that level.

Secondly, the financial sector is much less exposed to a hypothetical sudden change in the housing market cycle. Credit to the developer and construction sector has remained at around 5% of GDP in recent quarters, a far cry from the ratios above 40% of GDP registered in the late 2000s. As for mortgage credit to households for the purchase of homes, at 30.6% of GDP it is well below the levels of the previous boom (63.6% of GDP in 2006). Moreover, since the pandemic fixed-rate mortgages have become widespread in the Spanish market, accounting for over 50% of all those granted since 2022 (in the 2000s they represented just 2% of the total). Also, the ratio of the number of mortgages to the number of sales remains relatively stable (68.0% in S1 2025 compared to 66.3% in 2024). That is, approximately two in every three transactions currently involve the buyer taking out a mortgage. In addition, there does not appear to be any significant increase in purchases for investment purposes. For instance, the percentage of sales in which the buyer is a legal entity was 11.5% in

S1 2025, which represents a slight increase compared to the 10.8% recorded in 2024, but is still below the average for the period 2014-2019 (12.8%).

Por último, la situación financiera de las familias está mucho más saneada que en los años 2000. A pesar del repunte de la concesión de hipotecas, la deuda de los hogares apenas supone el 42,5% del PIB, cuando en 2010 suponía algo más del 80%. Por otra parte, y de forma muy relevante para evitar la repetición de errores del pasado, no se observa una relajación de los estándares de concesión de crédito. Si bien es cierto que se observa un cierto repunte en la concesión de hipotecas por un importe superior al 80% del valor de tasación (10,9% en el 1T 2025), ello se debe en gran parte a los programas de ayuda al acceso a la primera vivienda para determinados colectivos (jóvenes, familias monoparentales, etc.), que son los que tienen mayores dificultades para acumular el ahorro necesario para acceder a una vivienda en propiedad.

Finally, households are in a much healthier financial position than they were in the 2000s. Despite the rebound in mortgage lending, household debt stands at only 42.5% of GDP, compared to just over 80% in 2010. What is more, there are no signs of a relaxation of lending standards – a key point if we are to avoid repeating the mistakes of the past. While it is true that there is a slight upturn in the granting of mortgages for an amount exceeding 80% of the appraisal value (10.9% in Q1 2025), this is largely due to the programmes in place to help certain groups to buy their first home (young people, single-parent families, etc.), as they are the ones who have the most difficulties in accumulating the savings required to become homeowners.

Outlook for Spain’s real estate sector in 2025-2026

The persistent imbalance between supply and demand in the housing market has been a determining factor in the rise in house prices in recent years. Although supply is expected to gain some dynamism in the coming quarters (we anticipate some 140,000 new construction permits for 2025 as a whole, and 150,000 for 2026), it will not be sufficient to meet demand in a context in which the creation of new households could remain close to current levels, at around 180,000 per year (in addition to around 50,000 net purchases by non-residents). In addition, the limited availability of housing in the rental market will continue to shift demand to the sales market. Our forecasts estimate that housing demand will remain at historically high levels in both 2025 and 2026 (around 720,000 sales per year).

Consequently, far from being corrected, the housing deficit will continue to widen, albeit at a more moderate rate than in previous years. This is the main reason why we have revised upwards our house price forecasts for 2025-2026. Specifically, here at CaixaBank Research we anticipate growth of around 10% this year and 6.3% next year. This growth, which is higher than that expected for disposable income per household, will further stress the affordability indicators, especially in the areas of greatest demand. All this reinforces the need to accelerate the construction of affordable housing, as we have noted in previous reports.8

- 8

See «The challenge of increasing the supply of affordable housing in Spain», published in the Real Estate SR S2/2024.