Where is the activity of the Spanish agrifood sector concentrated?

Agrifood activity in Spain plays an important role that goes beyond its share of the economy. Its strategic role in international competitiveness, territorial cohesion and productive autonomy makes it a key sector. This article analyses its capacity to shape the country, taking a closer look at its importance at the regional and provincial level, as well as at the evolution of its relative weight in the national economy in recent decades. Andalusia, Castilla-La Mancha, Castile and León and Catalonia are the autonomous communities that contribute the most to Spain’s agrifood sector, among which Andalusia stands out both for its volume of activity and for its recent dynamism. At the provincial level, Almeria, Seville and Barcelona are the country’s top agrifood hubs.

Contribution of the agrifood sector to the economy

The agrifood sector is of vital importance for the Spanish economy. In 2022, it contributed 4.9% of the economy’s gross value added (GVA), compared to 5.2% in the 2010s and 5.5% in the 2000s, reflecting its gradually diminishing role in an increasingly tertiary economy. The sector consists of some 915,000 farms,20 which generate 2.5% of the total GVA, and more than 29,400 food processing companies,21 providing another 2.3%.

In order to obtain our own estimate of the GVA of the agrifood sector in Spain, we measured, on the one hand, the primary sector and, on the other, the agrifood industry. For the primary sector we used the nominal GVA of the agriculture, livestock, fisheries, mining and forestry sectors;22 while for the agrifood industry, we estimated the GVA of the food industry (category 10 of the National Classification of Economic Activities, or CNAE), of beverage manufacturing (CNAE category 11) and of the tobacco industry (CNAE 12).23,24

It is followed by Castile and León, Catalonia, Castilla-La Mancha and Galicia, completing the top 5, due to the importance of the primary sector in all of them except for Catalonia, which makes a significant contribution to the food industry.25 At the opposite end of the ranking we find Cantabria, the Balearic Islands, Asturias, La Rioja and Navarre, which make a smaller contribution to the sector.

- 20

Farm Structure Survey by the Spanish National Statistics Institute (INE, 2020).

- 21

Companies in the agrifood industry with CNAE (National Classification of Economic Activities) codes 10, 11 and 12, according to the structural business survey for the industrial sector by the Spanish National Statistics Institute (INE, 2023).

- 22

The data corresponding to the GVA of the agriculture, forestry and fishing sector come from the statistics published by the Spanish National Statistics Institute (INE), from the Spanish Regional Accounts, and the latest available data correspond to 2022. This corresponds to section A of the CNAE (National Classification of Economic Activities) codes.

- 23

To calculate this estimate, we begin with the GVA of the food, beverage and tobacco industry that appears in the national accounts by branch of economic activity in the statistics of the Spanish National Statistics Institute (INE, latest available data for 2022). To disaggregate the estimate by autonomous community, we use their weight relative to the total of all companies in the sector, taken from the Central Business Register survey, also part of the National Statistics Institute’s statistics.

- 24

This estimate of the GVA of the agrifood sector does not include the transportation and storage phases (logistics channel), wholesale and retail distribution (commercial channel), or the consumption of imported inputs, services and products. The Ministry of Agriculture, Fisheries and Food (MAPA) regularly estimates the contribution of the agrifood system, albeit with some delay due to limitations in the availability of data. In its latest estimate, corresponding to 2022, it is estimated that it contributed 9.7% of total GVA.

- 25

Catalonia stands out for its food and beverage industry, the second largest contributor to the national sector (behind only Andalusia), largely thanks to its meat industry, especially that of pork meat (it exports 50% of the national total).

In the chart on the right, the analysis focuses on the importance of the agrifood sector within each regional economy, identifying what share of the region’s GVA it represents in order to understand the region’s degree of specialisation or dependency on the sector. Extremadura, La Rioja, Castilla-La Mancha, Castile and León and Andalusia are the regions where the agrifood sector is most important. The case of La Rioja is particularly striking: although its contribution to Spain’s agrifood sector is low, the sector – and especially the agrifood industry – has an extraordinarily high relevance within its own economy, reflecting a high degree of productive specialisation.

In contrast, Madrid, the Balearic Islands, the Basque Country, Catalonia and the Community of Valencia are where the sector plays a smaller role. In this case, Catalonia and the Community of Valencia stand out, as they make a significant contribution to the Spanish agrifood sector as a whole, but do so more modestly within their respective economies, given their high diversification across other sectors.

Extremadura, La Rioja, Castilla-La Mancha, Castile and León and Andalusia are the regions where the sector has the greatest relative weight in their respective regional economies

How has the relative weight of the agrifood sector changed over time by autonomous community?

In order to ascertain how the importance of the agrifood sector has varied over time between the various autonomous communities, we compared our estimate of the agrifood GVA in the current decade so far (2022 being the latest available data) with the same estimate for the 2000s (see the charts above).

At the aggregate level, it is apparent that the sector's relative weight in the various regional economies is moderating, due to the pervasive process of economic tertiarisation. It is also observed that, within the agrifood sector, the role of industry is gradually growing in relative terms. In figures, the sector has gone from contributing 5.5% to Spain’s total GVA in the 2000s to contributing 5.2% in the current decade, while within the sector, its industry has gone from contributing 43% to the sector’s GVA in the 2000s to 45% today.

Although the changes of trend are not significant at the aggregate level, there are major differences between regions. Andalusia, for example, has increased its share of the national total, primarily driven by the growth of its primary sector. On the other hand, regions such as Madrid, Valencia and Catalonia show greater industrialisation, with a growing role of the agrifood industry and a reduction in that of the primary sector.

As for the sector’s relative weight within the regional economies, it is steadily decreasing, particularly in La Rioja, Extremadura and Cantabria, where its role has shrunk the most. In contrast, and counter to the national trend, the sector has gained relative weight in Aragon (where the livestock sector stands out, particularly pig stocks), Andalusia and the Canary Islands.

How has the importance of the sector changed in recent decades? Period 2020-2022 vs. period 2000-2009

Provincial analysis: Almeria, Seville and Barcelona top the ranking

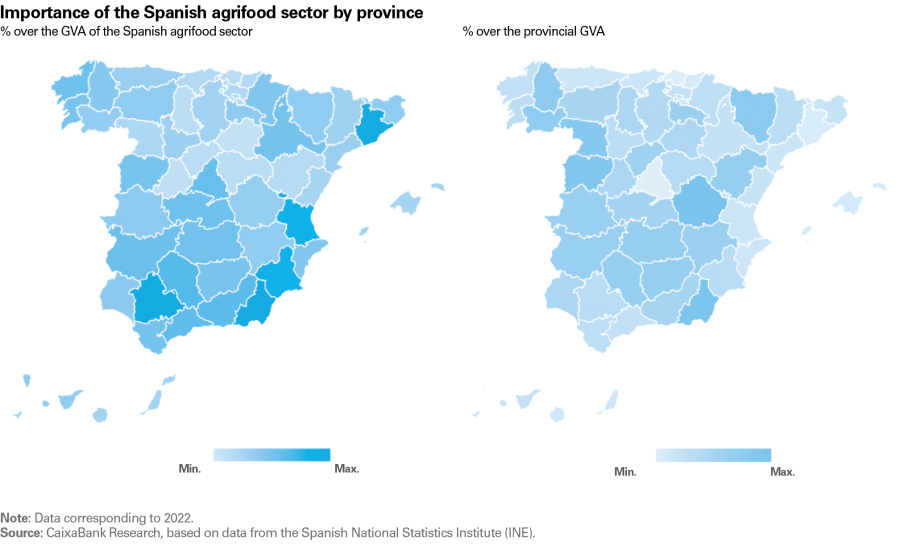

The analysis at the provincial level allows us to take a closer look at differences within each autonomous community. We conducted the same exercise as above: observing the difference between the contribution to the national sector and the relative weight within the respective provincial economies, which is represented in the maps on the following page.26

- 26

In order to estimate the provincial breakdown of agrifood GVA, active local units of the food industry (taken from the National Statistics Institute’s Central Business Register survey) are used as a proxy for the relative importance of the agrifood sector by province. Active local units are productive units located in a particular place from where a company carries out one or more economic activities.

The map on the left shows the contribution of each province to the national agrifood sector as a whole. At first glance, the map reveals the immense diversification of the sector across Spain and the cohesive role it plays throughout the territory. Broadly speaking, the provinces of Andalusia and some in Eastern Spain are those which contribute the most to the national sector. Specifically, Almeria, Seville, Barcelona, Murcia and Valencia together contribute more than 20% of the sector’s total national GVA. With the exception of Barcelona (where the agrifood industry plays a pivotal role, alone contributing 3.7% of the sector’s total), these are provinces characterised by a powerful primary sector (with the biggest contribution to the sector’s total GVA). At the opposite end of the spectrum, Soria, Avila, Palencia, Segovia and Biscay are the provinces that contribute the least to the national agrifood sector. The case of Castile and León is particularly interesting: while at the regional level it contributes more than 10% of the sector’s GVA, at the provincial level only León and, especially, Salamanca exceed the national average.27

- 27

The 50th percentile of the distribution of provincial contributions to the GVA of the agrifood sector at the national level is 1.8%.

Cuenca, Almeria and Salamanca are the economies most dependent on the agrifood sector

Finally, the right-hand map analyses the relative weight of the agrifood sector within the economy of each province, that is, what proportion it represents of each province’s total GVA. Cuenca, Almeria, Salamanca, Zamora and Huesca are the five provinces that are most dependent on the sector, as it contributes around 18% of their provincial GVA on average. At the other extreme we find Madrid, Biscay, Barcelona, the Balearic Islands and Guipuzkoa, economies with a high sectoral diversification and a highly-developed services sector, reducing the relative weight of agrifood.

In conclusion, even if it has seen its share of the total economy decline, Spain’s agrifood sector remains a strategic pillar due to its capacity to unify the country and generate value across multiple regions. The evolution at the regional level reveals an increasing industrial specialisation in some autonomous communities and a greater level of dependency in others, reflecting the country’s productive diversity and providing a better understanding of the challenges and opportunities of the sector at the territorial level.