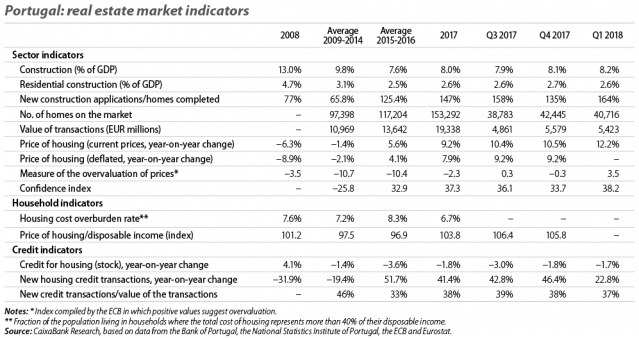

The real estate market is going through a period of great buoyancy, which is reflected in the growth of prices and the number of transactions, as well as in a wide range of other indicators (see table below). What factors are stimulating supply and demand? What trend will they follow? We analyse this below.

Unlike previous business cycles, domestic credit does not currently appear to be the main driver of this buoyancy. In particular, the latest data (relating to Q1 2018) show that new mortgage credit represents a relatively small fraction of the total value of transactions carried out in the market (specifically, 37%, a far cry from the nearly 65% recorded prior to 2010). Meanwhile, despite the marked increase in new mortgage credit transactions, the stock of credit for housing is going down, since the repayment of mortgages still exceeds new transactions.1

In the current cycle, on the other hand, the entry of foreign investors has played a key role in revitalising the Portuguese real estate market. Two factors stand out in particular: the strength of tourism, which has contributed to the increase in real estate refurbishments, and the adoption of measures to attract foreign investment, by offering very attractive tax benefits and granting residence permits. For example, since the Golden Visa2 programme came into force in October 2012, the purchase of homes by non-residents has risen to 3.5 billion euros, approximately 5% of the total transactions carried out to date in the sector.3

After five years with positive growth rates, the price indicators also reflect a sector which is clearly on the rise. In this case, the difficult task of evaluating the sustainability of the price increases is hampered by the important role played by foreign investment. Nevertheless, some indicators have recently stood at levels suggesting that prices could be overvalued. For example, the ratio between house prices and household disposable income, as well as the real estate market overvaluation index drawn up by the European Central Bank,4 have increased steadily. However, other indicators paint a less negative picture: for example, the percentage of households for which the total cost of housing represents more than 40% of their disposable income is less than 10% (and lower than the average for the euro area).

Finally, it is important to remember that, throughout the last decade, a reduction in the number of new houses built has created a gap between supply and demand, which also pushes up the prices of the sector. Between 2009 and 2014, the number of homes completed barely exceeded an average of 24,000 per year, compared to the 60,000 that were completed in 2008. A slight recovery began in 2015, but in the last 12 months, based on the data available up to March 2018, the figure for completed homes remains below 10,000. The increase in new construction applications (which exceed 15,000) points towards a further increase to come over the next few years. Thus, this trend will gradually reduce the imbalance that exists between supply and demand, which should favour a moderate slowdown in the growth of prices in the medium term. In fact, this is the prevailing view in the sector: a recent survey shows that real estate professionals expect prices will continue to rise over the next 12 months at a robust pace, but the rate of growth will gradually stabilise at around 5% over the next five years.5

1. The volume of repayments increased substantially in 2017 and, according to data from the Bank of Portugal, 50% of them corresponded to early repayments which, for the most part, were not associated with the purchase of a new home.

2. Residence permits granted to non-residents who invest in the country. In the case of real estate investment, the minimum investment is 500,000 euros.

3. The Bank of Portugal has pointed out the importance of the entry of non-residents into the real estate market, particularly in relation to the increase in the sale of properties belonging to the banking sector and the reduction of unproductive credit. See the Bank of Portugal’s Financial Stability Report for June 2018.

4. This index, calculated based on the ratio between house prices and gross disposable income per capita, indicates that there has been a slight overvaluation since late 2017.

5. See the «Portuguese Housing Market Survey», Confidencial Imobiliário.