Financial upheaval in the emerging economies: a prelude to something else?

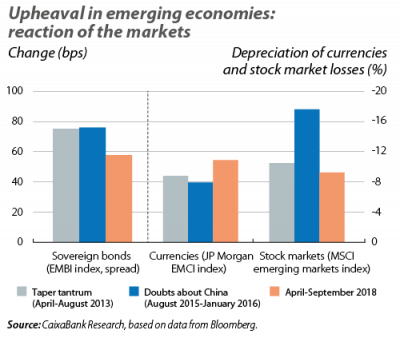

2018 is not proving to be a good year for financial assets of the emerging economies. Following a 2017 in which they offered high returns, 2018 has seen a return of volatility. This has been brought about by stock market losses, higher risk premiums and currency depreciations in not insignificant quantities: so far this year, the MSCI stock market index for the emerging economies as a whole has amassed losses of around 10%, the emerging markets bond index (EMBI) is showing an upturn in credit spreads of more than 50 bps, and the emerging currency indices reflect a depreciation of slightly more than 10% (much higher in the currencies of countries such as Turkey and Argentina, with depreciations of 37% and 55%, respectively).

This instability has not been the result of chance. In the last decade, the growth of the emerging economies has been favoured both by accommodative global monetary conditions (with which they obtained cheap and abundant financing from abroad) and by the expansion of international trade, supported by China’s growing central role. But the tables have turned and the markets are beginning to operate in an environment of tightening financial conditions (with US interest rate rises and a stronger dollar) and greater trade tensions and uncertainty (both political and over the slowdown in China’s economy). These drivers, coupled with the high idiosyncratic vulnerabilities of some countries like Turkey and Argentina, have triggered attitudes of greater risk aversion towards the emerging economies. Will this be a prelude to something else?

Characteristics of the recent upheaval

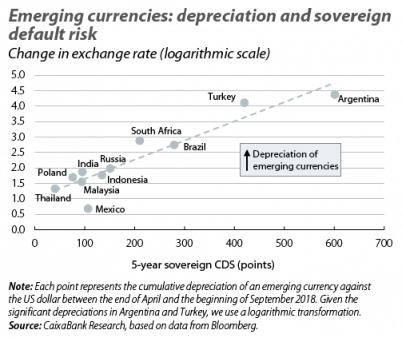

The poor performance of emerging financial assets became particularly stark starting in April 2018, when the impact of political uncertainty, trade tensions (especially between the US and China) and the tightening of US monetary policy began to be felt in investor sentiment towards the emerging economies. Since then, although most of the emerging countries have been affected by the instability, there has been a certain degree of discrimination between economies with more and less solid macroeconomic fundamentals. In fact, as can be seen in the second chart, there is a strong parallel between the depreciation of the exchange rate that each country has suffered and the perception of the risk of default on their sovereign debt.

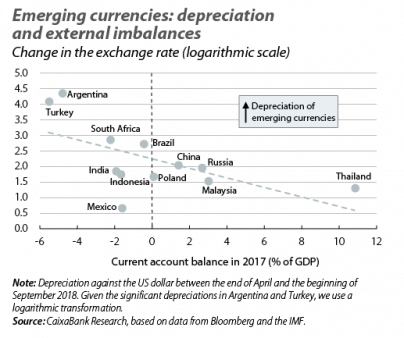

Thus, the currencies that have suffered the most have been those of economies with significant external vulnerabilities (greater external financing needs, few international foreign exchange reserves and/or large numbers of foreign investors participating in the local bond market), as illustrated in the third chart. Meanwhile, stock prices in the Asian economies, which are deeply involved in international trade and especially in trade with China, have been particularly affected. Lastly, and in the same vein, throughout this period there has been

a slowdown in portfolio capital inflows and there have even been investment fund withdrawals, which have particularly affected Asian economies such as Indonesia and Malaysia.1

Overall, the scale of the turmoil has been similar to that of other past episodes, such as the so-called taper tantrum of 2013 or China’s stock market corrections in 2015 (see the first chart). However, up to now there has been one key difference: investors are showing a greater degree of discrimination and are raising doubts about certain emerging economies (those known to be fragile), while showing less concern about many others.

How is the macroeconomic health of the emerging economies?

As we have seen, this discrimination appears to act on external imbalances in the emerging economies. But the tightening of global financial conditions, trade tensions and the economic slowdown in China mean that investors may begin to question the very sources of growth in the emerging markets in the last decade.

In other exercises,2 we have already identified the emerging economies that are most vulnerable to changes in global investor sentiment based on their macroeconomic imbalances (Argentina, Turkey and South Africa), as well as a secondary group (Brazil, Colombia, Hungary, Indonesia, Malaysia and Poland) where the focal points of risk are less widespread and are concentrated in the accumulation of debt (mainly corporate debt, but also public debt, as in the case of Brazil). It is the first group that has been punished the most by the current episode of financial stress, while some countries in the second have been affected more sporadically and to a lesser extent.

The cases of Turkey (discussed in the Focus «Turkish financial crisis: in stoppage time» in this Monthly Report) and Argentina can be explained by the bad combination of a delicate external position, the presence of internal imbalances (such as high inflation) and economic policy mistakes. However, in other cases the reasons for the weak financial asset valuations are less easy to pin down, as is the case for Russia, India and Brazil, which are particularly relevant because of their greater systemic role. Therefore, we must look beyond the conventional concept of imbalances, which may be too generic.

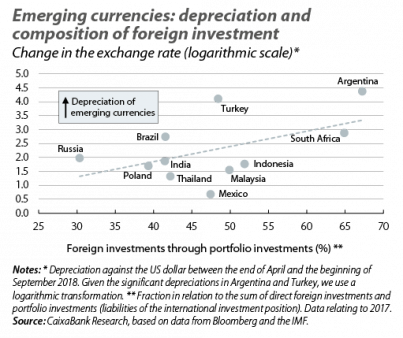

On the one hand, with regards to external financing needs, not only is their scale important but so is their composition. In particular, as various authors3 have pointed out, portfolio debt and the loans and deposits of foreign banks are especially sensitive to global volatility spikes. In fact, the analysis of the current episode appears to confirm that the currencies of those countries with a higher proportion of foreign investment conveyed through portfolio flows (and a lower proportion of foreign direct investment) are enduring greater downward pressures (see the fourth chart). This helps to explain, at least partially, why economies like India are under scrutiny, despite having a current account deficit that does not appear to be excessive.

On the other hand, external vulnerabilities do not deplete existing risks. Even though the direct link that is becoming apparent is broadly between exchange rate crises and doubts arising over external financing, in a situation with global debt at an all-time high, we must also pay attention to the total level of indebtedness. If we take a step back, we see that most of the above discussion stems from an increase in the cost of external financing due to the combined impact of an appreciation of the dollar and higher interest rates in the US. But the impact of less accommodative financial conditions in advanced economies also translates to the emerging countries’ local currency interest rates: in a way, it generates an externality. In fact, various analyses confirm that these externalities vary considerably from country to country. However, they tend to agree that, based on historical data, they are more pronounced in some of the emerging markets that have been affected by the current episode of financial stress, such as Brazil, Mexico, Indonesia, Hungary, South Africa and Turkey.

In short, the current episode appears to validate three basic premises. Firstly, the situation among the emerging economies is clearly varied and the exchange rate crisis is primarily affecting to the so-called «fragile» countries. As a logical counterpart of the first premise, a second one is that many other emerging economies have reasonably satisfactory fundamentals. Finally, the third premise is that investors are pointing out a wide variety of vulnerabilities, and this can provide a clue as to what to expect in the future (watch out for debt!). In particular, this raises the question as to whether or not the current trend of moderate contagion is likely to persist in the near future.

Moderate contagion... but with risks

The conclusion that many emerging economies are built on reasonably solid economic fundamentals could offer a good explanation for why the contagion so far has been limited. Nevertheless, there are elements that suggest caution.

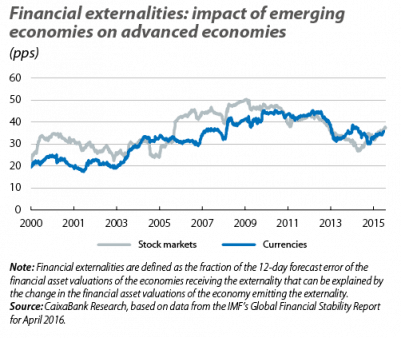

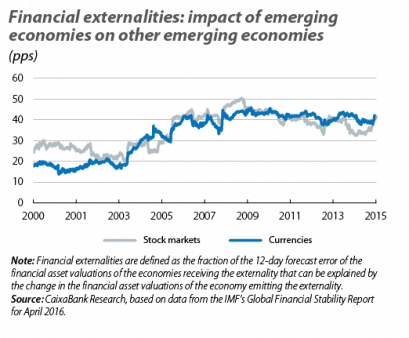

Firstly, various authors have warned of an increase in the influence that asset valuations in emerging economies have on the rest of the international financial markets, due to their greater integration into global trade and the international capital markets.4 As an example, this trend, which is clearly reflected in the fifth and sixth charts, led to the fluctuations in certain emerging market financial assets in 2016 explaining around 30% of the variability of the returns in the stock markets and currencies of the advanced economies, and 40% for those of other emerging markets. Secondly, and related to the previous point, it has been documented that there is a greater likelihood of contagion when sectors with a high dependency on external financing and companies with less liquidity and higher leverage play an important role.

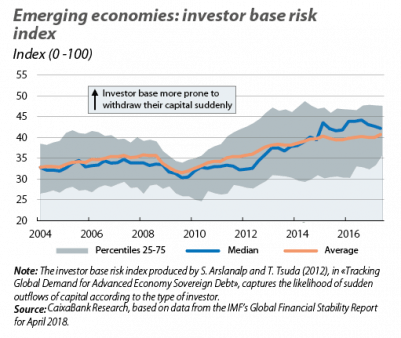

Thirdly, the strong growth of global intermediaries to channel capital flows means that the financial structure has become more prone to contagion: by operating in different jurisdictions, adjustments in an economy’s portfolio mean that these intermediaries are likely to trigger adjustments in the portfolios they hold in other economies. Finally, and in the same vein, in recent decades, passively managed investment funds (including exchange-traded funds, or ETFs) have grown significantly, achieving a prominent market share as conduits for investments in emerging economy assets.5 According to various authors,6 this increasing importance of passive investment instruments as vehicles for channelling capital inflows into emerging economies has consequences for their ability to withstand upheaval and for the level of contagion they can generate. In particular, empirical analysis indicates that passive investment funds are relatively more likely to adjust their portfolios in response to global developments than in reaction to local factors specific to the countries in which they have invested assets. Thus, the emergence of passive investment funds would contribute to reducing the containment role that more solid macroeconomic fundamentals can play in the event of financial turbulences in emerging markets (at least in the short term). Similarly, indices like the one presented in the seventh chart show that the emerging economies have received increased levels of investment from investors with a greater propensity to withdraw their capital at short notice.

What does the future hold?

Very fragile economies, such as Argentina and Turkey, must undertake an agenda of economic adjustments to correct their large macroeconomic imbalances, while in the other cases we generally find differing combinations of macroeconomic fundamentals and some idiosyncratic weaknesses.7 However, in a less favourable international context, emerging market financial assets are likely to continue to suffer moderately over the coming months, which will have a small but significant effect on these countries’ growth rates.

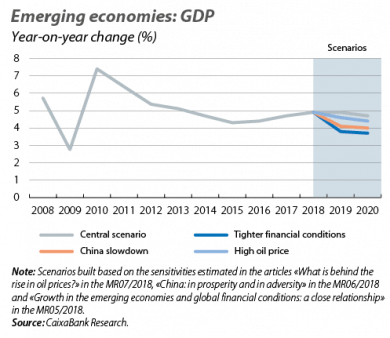

Among the factors that will determine the scale of this burden, we highlight the following ones: the tightening of global financial conditions, the scope of the slowdown in China and the evolution of oil prices. The latter factor is particularly difficult to predict, but there is some consensus among analysts that the tightening of financial conditions and the slowdown in China will both be gradual processes. As such, the growth slowdown in emerging countries is likely to be limited. Nevertheless, it is necessary to analyse what could happen if the dynamics of these three factors end up being different to those considered in this central scenario.

Firstly, a surge in inflation in the US and/or clear indications of overheating could cause a higher-than-expected tightening of monetary policy by the Fed and, consequently, of global financial conditions. In this scenario, economies with high levels of debt denominated in foreign currency, such as Malaysia, as well as those with significant external financing needs, such as Indonesia, India and South Africa, could be particularly affected. Secondly, with regards to China, a very gradual slowdown is expected due to the authorities’ extensive margin for manoeuvre (such as the large buffer of reserves and the possibility to implement more expansive monetary and fiscal policies). Nevertheless, estimates suggest that an accentuation of trade tensions with the US could detract 1 pp from Chinese growth. In this scenario, the impact on the emerging bloc would be varied, but it would have a clear and adverse effect on producers of industrial metals (such as Brazil, Chile and South Africa) and on the East Asian countries most closely connected to the global supply chains that are centred around China (such as Malaysia, Taiwan and South Korea). Finally, if the price of oil continues to steadily increase, we would find ourselves in a scenario with winners (net exporters that are now included on the list of fragile economies, such as Brazil and Colombia) and losers (importers of crude oil, such as India, which would see an increase in their current account deficits).8

According to the estimates presented in the analyses we have published previously,9 these scenarios could subtract between 0.3 and 1 pps from the growth of the emerging bloc over the next two years (see the last chart). These figures are significant enough to give us reason to remain alert, although they are apparently not sufficient to put the expansion of the global economy at risk. This reflects the view that, as a whole, the emerging countries are in a better position now than they were 10 years ago, and particularly than they were in the fateful 1990s. There are some pathological exceptions, made worse by bad economic policy decisions (Turkey and Argentina) and, in a more complex global context, it is likely that the financial assets of emerging economies will continue to be adversely affected. Nevertheless, their foundations and the discrimination shown by investors so far should prevent a situation of severe and widespread turmoil.

1. For more details, see IMF (2018), «External sector report».

2. See the Focus «Fragile emerging countries: Argentina and Turkey, neither exceptional cases, nor the first of many others» in the MR06/2018.

3. See, for example, G. Hoggarth et al. (2017), «Assessing the riskiness of capital inflows based on lender and currency», VoxEU.org.

4. See G. Gelos and J. Surti (2016), «The growing importance of financial spillovers from emerging market economies», VoxEU.org.

5. Some estimates put their market share at 20%. See N. Converse et al. (2018), «How exchange-traded funds amplify the global financial cycle in emerging markets».

6. See the reference in the previous note.

7. For instance, the majority of them have adequate reserves, whereas there is greater diversity in terms of fiscal policy margin (ranging from

a relatively delicate situation in Brazil to more comfortable positions in emerging Asian economies).

8. In this scenario, the situation in India deserves a separate mention. Its current account is very sensitive to fluctuations in oil prices and, in addition, the rise in the cost of imports could lead to social unrest in 2019, a year in which President Modi will be seeking re-election.

9. See the Focus «Growth in the emerging economies and global financial conditions: a close relationship» in the MR05/2018, «China:

in prosperity and in adversity» in the MR06/2018 and «What is behind the rise in oil prices?» in the MR07/2018.