Portugal: the automotive industry leads exports of goods

The importance of automotive exports1

In recent years, the automotive cluster in Portugal has acquired greater economic weight in terms of GDP. Today, the automotive sector is responsible for nearly 8.5% of the production of Portugal’s industry and 2.1% of the production of the Portuguese economy as a whole. It also accounts for 0.7% of total employment and 4.8% of occupation in the manufacturing industry.2 In addition, according to the Automotive Association of Portugal (ACAP, in Portuguese), in 2017, 176,000 cars were manufactured (a 22.7% increase), of which AutoEuropa (of the Volkswagen Group) was responsible for more than 60%.3 Finally, the sector is highly orientated towards exports. This is shown by the fact that, according to the ACAP, in 2017 nearly 96% of car production was exported, a figure that rose to 99% in the light vehicle category.

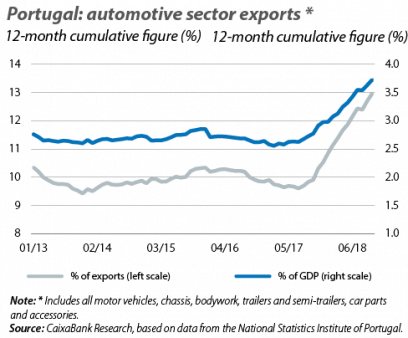

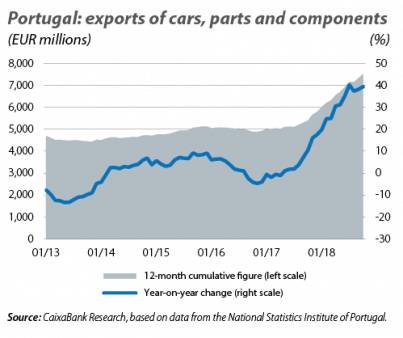

With these figures, it is no wonder that the automotive sector will play a key role in the performance of Portugal’s goods exports. As shown in the first chart, in the latter part of 2018, exports of the automotive industry reached 13.0% of the total exports of goods (the highest figure since the end of 2004) and 3.7% of GDP (an all-time high). In addition, as can be seen in the second chart, in October 2018 the sector’s exports registered a growth of 39.4% year-on-year (reaching 7.5 billion euros for the 12-month cumulative total). Therefore, if we combine these figures with the fact that goods exports of the economy as a whole grew by 6.5%, we see that the automotive sector accounted for over 70% of the growth in total exports last October.

How does this picture of the Portuguese automotive industry compare with other economies? If we look at countries of a similar size in terms of GDP, in economies such as the Czech Republic or Hungary the automotive sector accounts for a greater proportion of the total. Specifically, according to data for 2017, the sector’s exports represent around 21% and 18% of total exports, respectively. In contrast, in countries with more developed economies but a population size similar to that of Portugal, such as Belgium and Austria, the automotive industry represents a similar fraction of the economy to that of Portugal. Indeed, in 2017 the sector’s exports accounted for around 11% of total exports in Belgium, while in Austria the figure stood at 9%.

By sub-sector, the automotive industry is divided into three large groups: motor vehicles for all purposes, including tractors; parts and accessories; and chassis, bodywork, trailers and semi-trailers. The figures up to October 2018 (12-month cumulative figures) show that the first sub-sector represents 59% of exports; the second, nearly 40%; and the third, a little over 1%. A year ago, the two main sub-sectors were at par, with values close to 49%, but in 2018 there has been a significant recovery in the sale of motor vehicles, as a result of higher production levels.

By region, the Lisbon metropolitan area leads the automotive sector’s exports with a 42% share, as it includes the district of Setúbal, where AutoEuropa (of the Volkswagen Group) is located. It is followed by the Northern region, which represents 36% of the sector’s exports and includes a large number of companies that specialise in automotive parts and accessories. In third position is the Central region, which accounts for another large part of exports amounting to 19%, through the companies PSA Peugeot Citroen de Mangualde and Renault de Cacia.

Lastly, despite the buoyancy of exports in the automotive sector as a whole, in net terms the sector’s trade balance remains negative. However, this situation has improved considerably in the last year: in October 2018, the balance of the automotive sector stood at –1.3 billion euros, compared to –2.7 billion euros in October 2017. In addition, the various sub-sectors are in different situations: much of the deficit comes from the motor vehicles sub-sector, since the domestic demand for cars is almost exclusively met with high foreign imports (as we have seen, practically all of the domestic production is exported). In contrast, the parts and accessories sub-sector has generated a surplus since the end of 2015. This is because, in recent years, it has expanded at a greater rate than the supply for internal customers (specifically, to vehicle assembly and export companies, a function with which the sub-sector was initially developed), and it has expanded into exporting to supply factories abroad.

Future outlook

A car is a durable consumer good and, as such, purchasing one requires a high initial outlay from households: this is why the automotive industry is traditionally highly sensitive to changes in the business cycle. In the case of Portugal, given that the sector is highly orientated towards exports, the industry must cope with an international environment that is at the mercy of possible spikes in geopolitical tensions and the tightening of financial conditions. In this regard, it should also be noted that Portugal’s automotive exports are currently concentrated in a relatively small number of countries. Specifically, based on data for October 2018, Spain leads the purchases of Portuguese automotive products, with 22.1%, followed by Germany and France with 18.5% and 18.4%, respectively, and the United Kingdom with 8.8%. In other words, these four countries together accounted for 67.8% of the total exports of the Portugal’s automotive industry.

Finally, the sector also faces major challenges in the medium and long term, such as the new demands relating to emissions and the consequent introduction of alternatives to engines that run on fossil fuels, which could lead to a realignment of the sector. Faced with these and other challenges, the automotive industry has made significant investments through programmes to increase competitiveness in sectors with a medium-high technological intensity. According to the Ministry of Economy, since the implementation of these operational programmes,4 total investment in the sector has reached 211 million euros, of which 80.5% corresponds to the vehicle components industry. Furthermore, there are investments in R&D, mostly financed by the equity capital of the companies in the sector.5

In short, the automotive industry has increased its productive capacity through innovation and technology, as well as with improvements in the skills of the companies’ workforce, competitiveness and internationalisation – all this in order to develop this sector, which is regarded as strategic for the Portuguese economy.

1. The figures discussed encompass all motor vehicles and tractors, chassis and bodywork, automotive parts and accessories, as well as trailers and semi-trailers included in the combined nomenclature NC8.

2. See the Office for Strategy and Studies of the Ministry of Economy of Portugal (2018), « A indústria automóvel na economia portuguesa », Temas Económicos, n° 61, November.

3. Most vehicles produced in Portugal are light vehicles, mainly cars (72% of total production).

4. Between 2014 and August 2018.

5. See footnote 2.