A positive momentum in the euro area business cycle

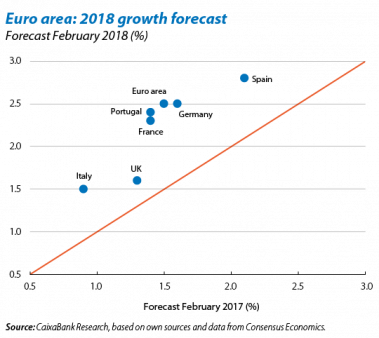

The euro area’s growth outlook is improving. After navigating through a complicated 2017, the euro area has made a good start to 2018. This can be seen both in GDP growth data for Q4 2017 and the first economic activity indicators for the year. It can also be observed in the 2018 growth forecasts made this February compared with the same predictions made February last year. Although some medium-term risk factors could mar the euro area’s good macroeconomic prospects, in the short term we believe there is enough slack to sustain a high GDP growth rate. This is due to several factors such as the drive provided by the global economy, accommodative monetary policy and a confident climate boosting job creation. As a result, CaixaBank Research has raised its euro area growth forecasts by 0.3 pp, both for 2018 and 2019, to 2.5% and 2.0%, respectively.

The political factor diminishes as a source of economic uncertainty. Although all eyes are now on Italy’s general election on 4 March, the polls continue to predict a fragmented parliament. This limits the new government’s ability to implement far-reaching reforms. However, it also contains the risks resulting from a potentially populist/Eurosceptic government. Importantly, several studies suggest Italy’s new electoral law (Rosatellum) might lead to a less fragmented parliament than indicated by the polls. Moreover, as pointed out by the same studies, this might benefit the centre-right parties the most, whose manifestos entail a limited risk regarding the construction of Europe in the short term. In Germany, the conservatives and social democrats (SPD) have reached a coalition agreement. This still has to be approved by the SPD members, on the same day as the Italian elections, 4 March. The agreement contains higher public spending on social policies, education and infrastructures, as well as more emphasis on European integration (by Germany making a larger net contribution to the budget and supporting the creation of a European Monetary Fund). Finally, negotiations are still underway between the UK and euro area to reach an agreement on the Brexit transition period. The biggest hurdle to achieving an agreement lies in the EU’s demand that, although the UK must leave all the EU’s legislative bodies during this period, it must still apply all European legislation approved in the meantime. Although there are risks, we expect an agreement to be reached by the end of March to be approved at the European Council meeting. This would allow both blocs to begin negotiations on future commercial relations.

Good momentum for the euro area at the end of the year. As we have already noted, GDP growth figures for Q4 2017 indicate a favourable growth dynamic whose inertia suggests it will continue into the first half of 2018. Germany and France posted particularly good growth figures, up by 2.9% and 2.4% year-on-year in Q4, the highest rates for the whole of 2017. This brought their overall growth for the year to 2.5% and 1.9%, respectively. Even Italy, which is still lagging behind the rest of the euro area, grew in Q4 by 1.6% year-on-year, bringing the annual figure to 1.5%, its highest since 2010. Outside the euro area, the eastern countries maintained the strength shown in previous quarters with year-on-year growth in Q4 of 4.8% by Hungary and 4.3% by Poland. Considering the high growth posted by the EU as a whole,

the poor performance by the UK was significant. Its economy grew by just 1.5% year-on-year in Q4, still affected by the uncertainty caused by the Brexit negotiations.

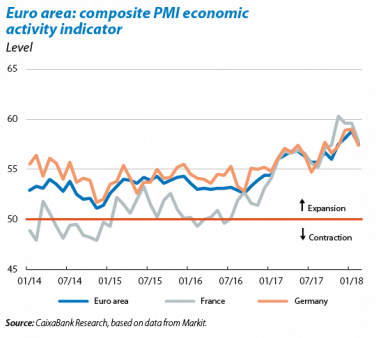

Economic activity indicators remain high. As we have already mentioned, this suggests that economic activity should continue strong at the beginning of the year. There was a sharp rise in the industrial production index, up by 5.2% year-on-year in December, resulting from strong growth in the production of capital goods and durables. The business sentiment index for the euro area as a whole posted 57.5 points in January 2018. Although this is a slight decrease compared with the previous month (58.8 points), it is still above the average for the second half of 2017 (56.6 points) and in a clearly expansionary zone (above 50 points).

Positive outlook for demand. Consumers continue to benefit from highly accommodative monetary policy and a labour market that is creating jobs, with the unemployment rate falling by 1.0 pp throughout 2017, down to 8.7% in December. Given this context, confidence is still high, boosting growth in consumption. One sign of this is the performance of the consumer confidence index in February which stood at 0.1 points, 2.5 points above the average for 2017. Retail sales also grew by 2.2% year-on-year in December, a similar rate to the 2017 average.

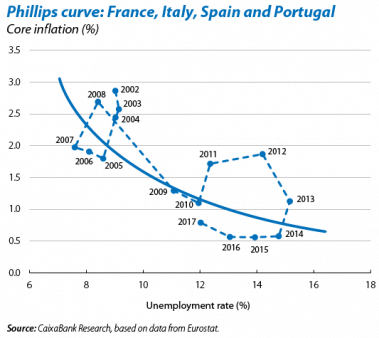

Inflation remains contained. In February, euro area inflation fell by 0.1 pp compared with the previous year, down to 1.2%. Mostly, this is due to the decrease in the component of unprocessed food. Core inflation posted the same figure as in January, namely 1.2%. Although these price growth rates are moderate considering the recovery in economic activity, there is still significant slack in the labour market which limits upward pressure on wages and therefore on prices. Discounting the case of Germany, whose labour market has gone through structural changes resulting in a dramatic fall in the unemployment rate, the combined Phillips curve for France, Italy, Spain and Portugal shows that, in 2017, the curve was at a similar level to 2010 and there is still plenty of margin before inflationary pressures kick in. CaixaBank Research therefore predicts the labour market will start to enter a more mature phase of the business cycle towards the end of 2018 and, from then on, inflation will recover, gradually reaching 1.8% in 2019.

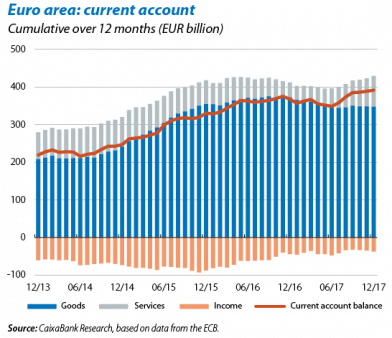

More balanced growth. The euro area has managed to increase its GDP growth rate while maintaining a current account surplus. In 2017, the euro area had a surplus of 3.5% of GDP, 0.1 pp higher than in 2016, thanks to a larger surplus in the services and income accounts which more than offset the deterioration in the balance of goods. Given the strong growth in private consumption, this figure confirms the competitiveness gains achieved by the euro area over the past few years.

PORTUGAL

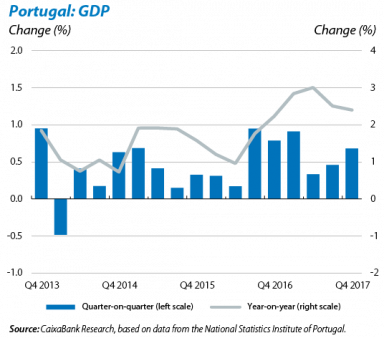

The data at the end of the year augur well for 2018. The Portuguese economy continued to enjoy solid GDP growth in Q4 2017 with year-on- year growth of 2.4%. This brings the total figure for 2017 to 2.7%, its highest growth rate since 2000. Over the coming years, CaixaBank Research predicts 2.4% growth in 2018 and 2.3% in 2019, forecasts that have been raised by 0.1 pp in both cases. These forecasts are partly supported by external factors such as a stronger global economic outlook and in the euro area in particular. Domestic support factors include dynamic exports resulting, to some extent, from Volkswagen’s new car production plant and the good performance by the tourism industry. This is accompanied by a very confident climate that is benefitting from a fast job creation rate and will continue to boost growth in private consumption. We predict the country’s healthy position in the business cycle, and the recent fall in its risk premium (down by 20 bp in January to around 130 bp, where it has remained in February) will give the government leeway to increase public spending without harming the fiscal deficit targets. We also expect this higher growth to be achieved while maintaining a current account surplus.

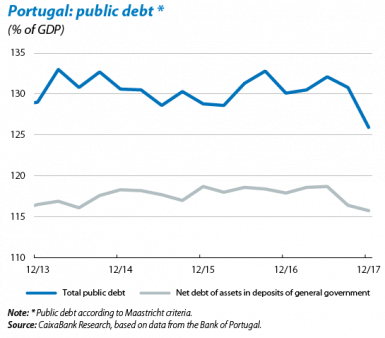

Public debt continues to fall. After fluctuating for several years around 130% of GDP, in December 2017 Portugal’s public debt fell by 4.2 pp compared with the same month the previous year, down to 125.9% of GDP. The factors supporting this reduction has been greater fiscal effort, faster growth and, as already mentioned, a fall in the country’s risk premium. Over the next few quarters, we expect Portugal’s debt to continue decreasing thanks to faster growth in GDP, reaching around 123.2% of GDP by the end of 2018, 1 pp below the target set by the European Commission (124.2%).

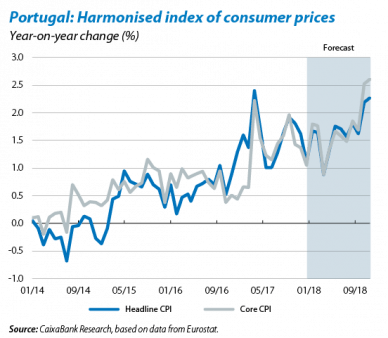

Inflation remains surprisingly low. In January, inflation fell more than expected, down to 1.1%, due to an aggressive sales campaign and the impact of an appreciating euro on the energy component in the basket of goods. We have therefore lowered our inflation forecast for 2018 slightly, to 1.5%. However, the high rate of growth in employment (3.7% year-on-year change in December) is reducing the slack in the labour market. We therefore expect wages to start recovering gradually and, ultimately, this should help inflation to recover in the second half of 2018 and throughout 2019.