Upturn in risks in an environment of healthy growth

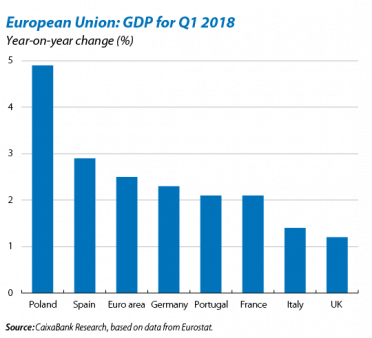

Growth in the euro area has tempered in Q1. After ending the year on a very good footing, the GDP data published this month show that the growth of the euro area has slowed in Q1 2018, just as the economic activity indicators had already indicated. Specifically, the area grew by 0.4% quarter-on-quarter (2.5% year-on-year), 3 decimal points below the figure for the previous quarter. By country, the slowdown in Germany and France was particularly noteworthy, with quarter-on-quarter growth rates between 3 and 4 decimal points below those of Q4 2017. These low figures can be attributed, at least in part, to a series of temporary factors that have weighted on economic activity, such as the unusually bad weather conditions in northern Europe and the strikes in Germany. In Germany, it is also highly likely that the political impasse which gripped the country during Q1 also restricted growth. The breakdown by component of GDP growth for Q1 in Germany shows that, while private consumption and investment continued to perform well, which reaffirms the climate of confidence, there was a sudden drop in public consumption which partly caused the decline in growth. We expect public consumption to rebound over the next few quarters, now that the country has a new government. Therefore, as these temporary factors gradually dissipate, here at CaixaBank Research, we expect the growth rate to pick up again in the coming quarters. This is because the economy continues to benefit from the support offered by a very accommodative monetary policy, a fiscal policy which is neutral or could even become expansionary in some cases, and a favourable context of global growth.

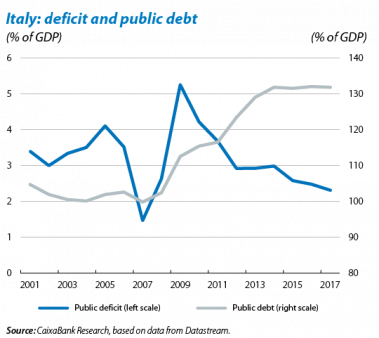

Italy and the price of oil, the two main sources of risk. Although the outlook for the euro area remains positive, there are certain risk factors that have come to the fore during the last month which could hinder the economy’s growth. In Italy, the decision of the President of the Republic to block the formation of the government generated a surge in uncertainty in the markets, due to fears that any repeat elections would focus on Italy’s relationship with the EU. However, the latest news suggests that M5S and LN could finally form a government. The government agreement between the two parties includes, among other measures, a strong fiscal stimulus and the intention to confront Brussels regarding the fiscal rules and Italy’s contribution to the European budget. All this has called into question the sustainability of Italy’s public debt, which has seen a spike in its risk premium, reaching above 270 bps and affecting the risk premiums of other surrounding countries (for example, Portugal’s risk premium has reached over 170 bps). Meanwhile, the US withdrawal from the Iran nuclear deal has led to a notable rise in the price of oil. Although we expect this spike to be temporary (Saudi Arabia and Russia can compensate for a possible production cut by Iran), if it were to persist, it could slightly erode growth in the coming quarters.

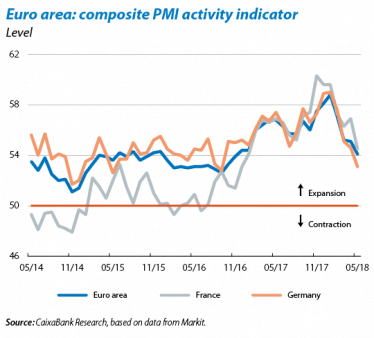

The economic activity indicators remain at moderate levels. The various indicators suggest that growth will pick up again in the coming quarters, although it will remain at more moderate levels than those observed in late 2017. Specifically, the business sentiment index for the euro area as a whole fell in May to 54.1 points, 1 point below the previous month. Despite falling below the levels recorded at the end of 2017, the indicator remains well within expansive territory (above 50 points). The industrial production index, meanwhile, rebounded in March after having fallen in the previous three months. It registered a year-on-year growth rate of 3.0%, very similar to the average for 2017 (2.9%).

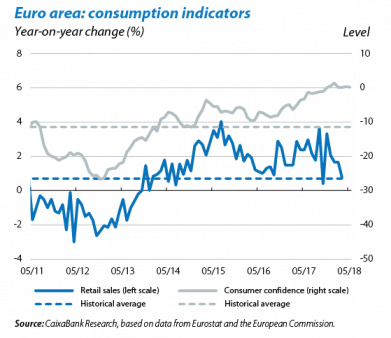

Close attention should be paid to the indicators on the demand side. More specifically, the latest figures show a slight disconnect between the sentiment indicators and those of retail sales. While the consumer confidence index in May remained very high (at 0.2 points, compared to an average of –2.5 points in 2017), in March retail sales growth fell to 0.8% year-on-year, well below the average for 2017 (2.2%). The gap between the two indicators is consistent with the fact that temporary factors, such as bad weather, may have played a role in household consumption decisions during Q1 of this year. All in all, as suggested by the confidence indicators and given the positive developments in the euro area labour market and the favourable conditions for access to credit, here at CaixaBank Research, we expect that private consumption will rebound in the coming months and will continue to be the main driver of growth.

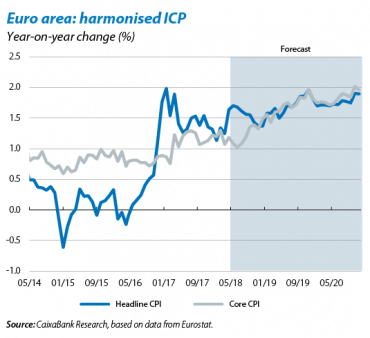

Inflation temporarily drops back down in April and stands at 1.2% year-on-year, 1 decimal point below the previous month. Core inflation, meanwhile, fell 2 decimal points to 1.1%. This slowdown can be attributed to calendar effects, since this year Easter fell in March instead of in April, hence we expect prices to rebound in the coming months. In fact, we have revised our inflation forecast for this year up by 1 decimal point to 1.5%, given the rise in the price of oil. As the euro area enters into a more mature phase of the cycle and the labour market continues to absorb the current degree of slack, we expect wages to pick up gradually and inflation to approach the ECB’s target at the end of 2019 of close to, but below, 2%.

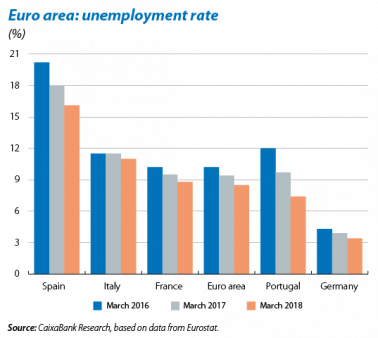

The labour market remains a key element of growth. The strong climate of confidence which has fuelled the economic recovery of the euro area is due, in no small measure, to the healthy recovery of the labour market. The progress shown in the latest data is an encouraging sign, with unemployment in the euro area standing at 8.5% in March, 0.9 pps below the figure for the same month last year. By country, there were significant improvements in Portugal, where the unemployment rate fell in the same period by 2.3 pps to 7.4%; Spain, where the rate fell by 1.9 pps to 16.1%; and France, with a drop of 0.7 pps to 8.8%. Nevertheless, there is still a wide gap in the unemployment rates between euro area member countries. On the one hand are countries such as Spain, with an unemployment rate of 16.1%, and on the other, those like Germany, with a rate of 3.4%.

PORTUGAL

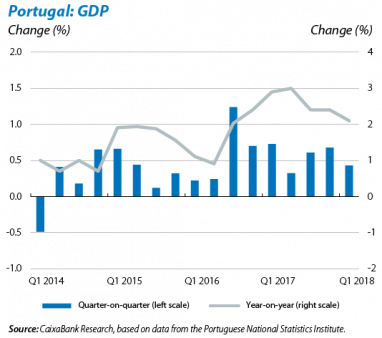

Slight temporary slowdown in economic activity in Q1 2018. The Portuguese economy’s growth slowed in Q1 2018 after growing by 0.4% quarter-on-quarter (2.1% year-on-year), 3 decimal points lower than the previous quarter. In the absence of the breakdown by component, the Portuguese National Statistics Institute suggests that domestic demand remained high and, therefore, that net external demand was the cause of the slowdown in economic activity. Here at CaixaBank Research, we believe this slowdown to be a temporary bump which reflects the inherent volatility over time. We also expect growth to increase over the coming quarters, albeit below the levels reached in late 2017. This scenario is supported by an international context which we expect will remain favourable and will support the growth of exports. At the domestic level, we expect that the growth of private consumption will continue to benefit from the high rate of job creation (year-on-year growth of 3.2% in Q1). This is demonstrated in the indicator for retail sales, which registered year-on-year growth of 7.6% in March, well above the average for 2017 (4.1%). In addition, the economy will continue to benefit from accommodative monetary conditions. All in all, as a result of the growth figure for Q1, we have revised our growth forecasts for 2018 slightly down by 1 decimal point to 2.3%.

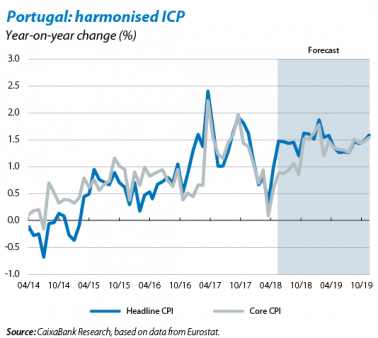

Inflation falls in April. The headline inflation rate stood at 0.3% in April, 5 decimal points below the figure for the previous month. Core inflation also fell by 8 decimal points, reaching 0.1%. This slowdown in the growth of prices is largely due to the calendar effects associated with the fact that this year, Easter fell in March instead of in April. Once this effect has dissipated, we expect inflation will rebound and will continue to grow gradually due to growth in economic activity. In addition, due to the rise in the price of oil, we have revised our headline inflation forecasts for 2018 up by 2 decimal points to 1.2%.

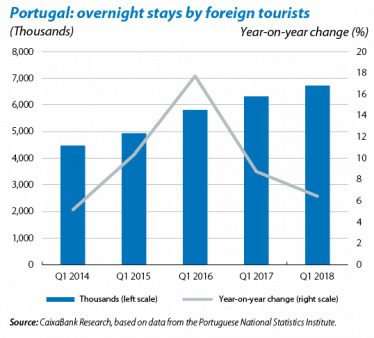

The tourism sector continues to support the Portuguese foreign sector. The latest data confirm the country’s popularity as a tourist destination. In the cumulative 12-months to March 2018, foreign tourists racked up more than 42 million overnight stays in hotels, an 8.3% increase compared to the same figure for the previous year. By country of origin, most visitors came from Spain (15.5%), the United Kingdom (12.5%), Germany (10.8%), France (9.6%) and Brazil (9.1%). These figures suggest the tourism sector has consolidated its position as one of the cornerstones of Portugal’s economic recovery.