Volatility and the financial markets diverge in summer

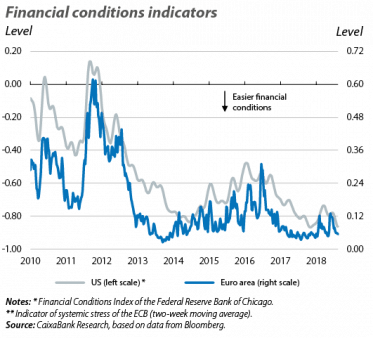

The summer has also left behind the environment of very low volatility. The financial markets are leaving behind the period of very low volatility of recent years, with erratic stock market prices, higher risk premiums and interest rates, and weakness in the international currencies against the US dollar (particularly among the emerging economies). This change of panorama was also palpable during July and August. After a start to the summer marked by the stock markets alternating between indecision and gains, in August the financial markets were stressed by doubts surrounding the strength of growth in China, the succession of trade threats with the US and a spike in financial turmoil in Turkey (which had a severe impact in Turkey itself and also spread, to some extent, to the rest of the markets). These factors, framed within the context of a global tightening of monetary policy and greater risk aversion (fed by the geopolitical tensions), affected the emerging economies in particular. The emerging stock markets and currencies suffered major losses during the course of August and, once again, there were net outflows of capital according to the most recent (albeit still preliminary) data. The advanced economies, meanwhile, suffered the turmoil unevenly. In Europe, it was added to a spike in uncertainty surrounding Italy and its fiscal policy, and both the major stock markets and interest rates and risk premiums suffered instability. In the US, in contrast, the stock markets continued to break records and reached new all-time highs, although some indicators still shed concerns regarding the sustainability of these high valuations, especially in an environment of higher interest rates.

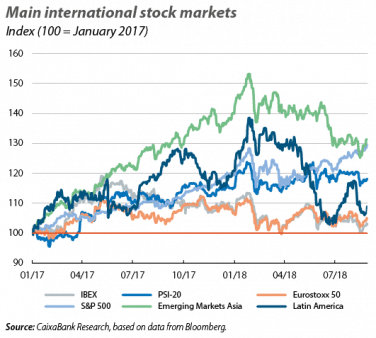

The emerging stock markets suffer, the European markets hesitate and the American markets break records. The main international stock markets exhibited differing behaviour over the course of the summer, which was marked by the turmoil suffered in August. In particular, the doubts surrounding the strength of the growth of the Chinese economy and the fears of a rise in protectionism at the global level had a widespread negative impact on the emerging economies’ stock markets. In addition to these two factors, Turkey suffered a spike in financial volatility (caused by its high and growing macroeconomic imbalances). While the contagion was only moderate, on the Istanbul stock market this episode led to a correction of –10% (which was mitigated by the end of August). Thus, in July and August together, the MSCI index for the emerging markets as a whole closed down (–1.3%), driven by both the Asian indices (where the Shanghai stock market particularly suffered, with a decline of 4.3%) and those of Latin America. Among the advanced economies, the stock markets of the euro area showed a mixed performance, with slight gains in the core economies (the German DAX +0.5% and the French CAC +1.6%) and somewhat more marked losses in the periphery (Ibex 35 –2.3%, PSI 20 –1.9% and the Italian MIB –6.3%). In contrast, the US stock market enjoyed strong gains (S&P 500 Index +6.7%), surpassing the levels registered prior to the corrections at the end of January and reaching new all-time highs.

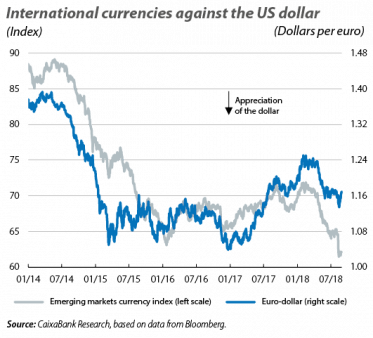

Widespread depreciation of the emerging currencies. Throughout the summer, the foreign exchange market served as a thermometer for the financial turmoil suffered by the emerging economies. The currencies that suffered the most over the summer were those that were already being watched by international investors (such as the Argentinian peso and the Turkish lira, which have depreciated by more than 100% and 70% since the start of the year and suffered depreciations over the summer of around 30% and 40%, respectively). That said, practically all the emerging currencies suffered against the US dollar (the JP Morgan Emerging currencies index lost around 5%). The Mexican peso was the notable exception, appreciating by 4% thanks to the progress made in the trade negotiations with the US, which culminated at the end of August with a preliminary bilateral agreement to replace NAFTA.

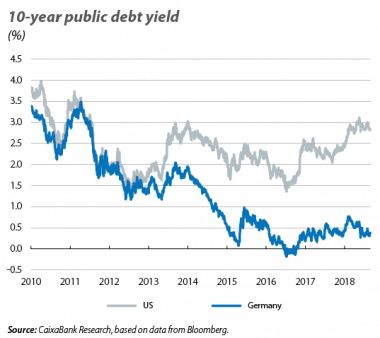

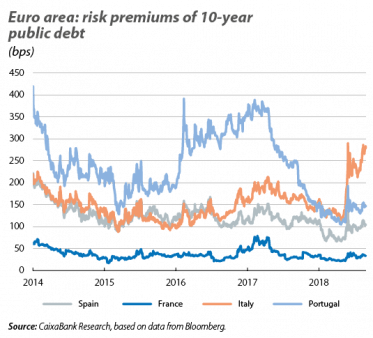

The advanced economies’ central banks reiterate a positive view of the scenario. This summer, the Fed and the ECB offered no surprises and sent messages of continuity for their macroeconomic scenarios. In the US, the Fed kept its reference rates within the 1.75%-2.00% range at its meeting in late July, but reiterated that the strength of economic activity and the firmer inflationary dynamics support an approach of gradually increasing rates over the coming quarters. The ECB, meanwhile, offered no significant updates at its meeting in July, which focused on reinforcing the decisions taken at the June meeting (ending the net purchases of assets next December and the intention not to modify interest rates before September 2019). In this context, US sovereign interest rates fluctuated without following any clear trend, while in the euro area, the upturn in the Italian risk premium (reaching around 280 bps, close to the year’s high point) due to the uncertainty surrounding its fiscal policy caused a slight rise in the premiums of the rest of the peripheral countries. On the whole, and despite the turmoil experienced over the summer, the macroeconomic scenario of the US and the euro area remains positive. Therefore, at their September meetings, the Fed and the ECB can be expected to continue with their strategies. Both investors and most analysts, including CaixaBank Research, expect the Fed to increase interest rates again and the ECB to reinforce its commitment to the announcements made in June.

Oil prices remained relatively stable. Despite the volatility suffered by the financial markets of the emerging economies over the summer, the price of crude oil was relatively stable and fluctuated between 70 and 75 dollars per barrel of Brent. Although the OPEC agreement to cut production (and the recent easing of quotas announced in June) supported this price stability in the case of oil, other commodities (such as copper, which experienced a fall of nearly 10% in its price between July and August) were significantly affected by the financial turmoil and the succession of trade threats exchanged by the US and China.