Slowdown in the growth of euro area economic activity

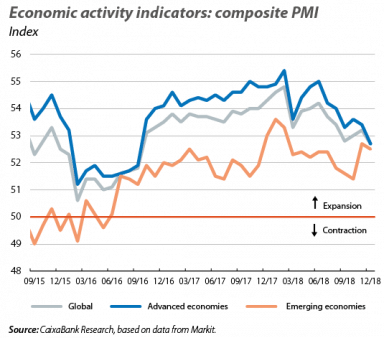

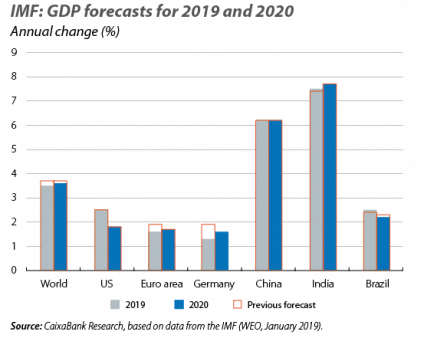

The global expansion continues at a more moderate pace. This is what the latest global economic activity indicators suggest, such as the global composite Purchasing Managers’ Index (PMI), which remains in expansionary territory (above 50 points) but fell to 52.7 points in December, the lowest level since September 2016. Likewise, the IIF Growth Tracker index, which seeks to estimate emerging markets growth, fell for the fifth consecutive month in December, although it still points to solid growth rates. This moderation in the pace of global economic activity seen in recent months is the result of a combination of factors. Specifically, idiosyncratic factors in advanced economies (particularly in Europe) have added to the tightening of global financial conditions, the deterioration in confidence due to trade tensions and uncertainty over the true extent of the slowdown of the Chinese economy. Given that these factors are expected to persist over the coming quarters, this supports a more moderate growth scenario for 2019 (3.4%, according to CaixaBank Research). Similarly, the IMF shares a similar view. In its economic forecast update in January, it revised its global economic growth forecasts for 2019 slightly downwards, to 3.5% (–0.2 pps), and to 3.6% for 2020 (–0.1 pp). The IMF also pointed out that the escalating trade tensions continue to be a source of risk, although the 90-day truce in the introduction of new tariffs between the US and China and the reasonably positive tone in the subsequent negotiations have allayed concerns about a trade war.

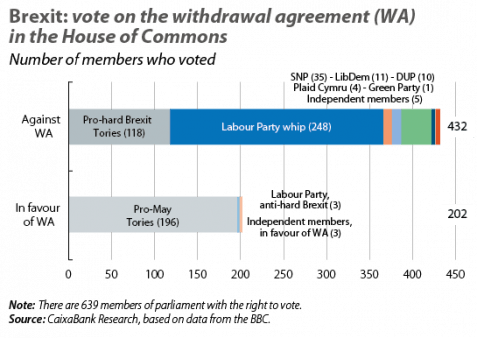

Uncertainty around Brexit persists. In the UK, the House of Commons overwhelmingly rejected the Withdrawal Agreement drawn up between the Government and the EU by a (see the third chart). Following the vote, Prime Minister Theresa May, of the Conservative Party, has to devise an alternative plan that can gather sufficient parliamentary support. In order to win the support of the Eurosceptic wing of her party and of the Irish DUP, the Prime Minister has opted to try to negotiate new concessions with Brussels on the backstop clause on Ireland. In this context, the existing difficulties to achieve a majority in Parliament increase the likelihood of the United Kingdom ending up asking for an extension to the negotiations beyond the date of Brexit (29 March). They also open up the possibility to a large number of alternatives, ranging from the ratification of an amended Withdrawal Agreement to a softer Brexit (for instance, with a permanent customs union) or even a second referendum. On the other hand, the events of the past few weeks (such as the approval in the House of Commons of several amendments) suggest that there is a clear majority in the British Parliament in favour of avoiding a no-deal Brexit.

Slowdown in the growth of euro area economic activity. Specifically, the GDP of the euro area registered a 0.2% quarter-on-quarter growth (1.2% year-on-year) in the last quarter of the year, in line with CaixaBank Research’s forecasts and that adds to the gradual growth slowdown of recent quarters. For 2018, the economy expanded by 1.8%, a steady pace but far from the exceptional growth registered in 2017 (2.5%). In part, this reflects a less favourable external environment, the presence of temporary impediments that are proving more persistent than expected (such as the automotive sector’s slow adjustment to the new European emissions regulations) and the entry into a more mature phase of the business cycle (it is estimated that the euro area closed its output gap in 2018). However, domestic demand remains strong, supported by accommodative financial conditions and the good performance of the labour market. Therefore, over the coming quarters, the euro area economy is expected to continue to grow, albeit at a moderate pace that is more in line with its potential. Across countries, for which we have data on, Spain registered particularly strong growth of 0.7% quarter-on-quarter, as did France, with a quarter-on-quarter growth of 0.3% (a lower figure was expected due to the impact of the yellow vest protests). On the other hand, Italy’s GDP fell by 0.2% quarter-on-quarter, meaning that the country technically fell into recession (two consecutive quarters with negative quarter-on-quarter growth). Germany’s growth figure for the whole of 2018 was also released (1.5%), which implies that Q4 2018 growth laid between 0% and 0.3% quarter-on-quarter.

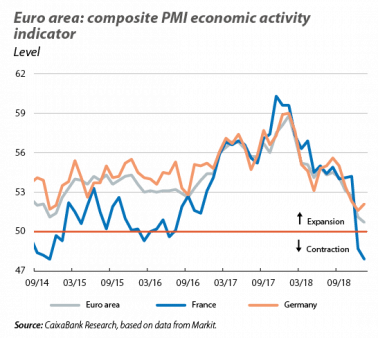

The latest economic activity indicators suggest that growth remains modest in Q1 2019. Specifically, the composite PMI index for the whole of the euro area, which measures business sentiment, fell for the fifth consecutive month in January down to 50.7 points, its lowest since July 2013 (but still above the 50-point threshold that marks the expansionary territory). By countries, the index deteriorated most notably in France, reaching 47.9 points (48.7 in December), which indicates a contraction of economic activity (having been affected by the yellow vest protests). On the other hand, Germany’s PMI rebounded slightly, going from 51.6 points in December to 52.1 points in January. The Economic Sentiment Index (ESI), meanwhile, stood at 106.2 points in January, below the Q4 2018 average for (108.8 points). Finally, consumer confidence, despite having weakened slightly over recent months, remains above its historical average. In this context, we expect private consumption to continue to grow at a good pace and support euro area growth.

Portugal: solid growth but constrained by the global slowdown

The economic outlook is positive, but not without risks. Domestic demand continues to show strength and is well supported by the buoyancy of the labour market (both in terms of job creation and income recovery), by the gradual recovery of lending and by an environment that is conducive to public investment (given that a general election will be held in October). Therefore, the prospects for growth remain favourable and the economy is expected to continue to grow at close to 2%, comfortably above its historical average of the last 20 years. However, external sources of uncertainty (geopolitical tensions, temporary factors restricting growth in the euro area, etc.) are weighing down the economic activity of Portugal’s main trading partners. If this uncertainty persists for longer than expected, or if it intensifies, it could restrict Portugal’s economic activity, given the country’s considerable trade openness. In light of this, and the revisions to global growth and that of the euro area in particular, at CaixaBank Research we have revised the forecast for Portugal’s growth in 2019 and 2020 slightly downwards, although we still expect to see healthy rates of growth (1.8% and 1.7%, respectively).

Some indicators suffered temporary setbacks in Q4 2018. In particular, in the last quarter of the year, the automotive sector was affected by a depletion of its stocks and an extended period of strikes by dockworkers in the port of Setúbal. These events restricted the economy’s exports and may have led to a reduction in the contribution of the automotive sector (which accounts for around 7% of GDP) to growth in Q4 2018. Given these constraints, GDP in Q4 (which is published on 14 February) could be somewhat lower than expected. Nevertheless, these are temporary factors whose impact will fade over the coming quarters. Furthermore, the outlook for Portugal’s economic activity remains favourable and benefits from the structural improvements implemented in recent years (particularly in terms of increased competitiveness, a more flexible labour market and the greater weight of tradable sectors).

Inflation remained contained in 2018. Inflation in Portugal is following a moderate trend and inflationary pressures are lower than those of the euro area as a whole. Thus, headline inflation as measured by the harmonised index of consumer prices (HICP) stood at 1.2% on average in 2018 (well below the 1.7% of the euro area as a whole). On the other hand, core inflation, which excludes the components with the most volatile prices such as energy and unprocessed food, stood at 0.9%.

The labour market is entering a phase of consolidation. Whereas 2017 was marked by a significant reduction in unemployment (the unemployment rate fell by 2.2 pps to 8.9%) and a substantial rate of job creation (above 3%), 2018 was marked by the consolidation of the recovery in the labour market. This suggests that it has entered a more mature phase of the cycle, with smaller declines in unemployment rates and less pronounced employment growth (see the Focus «Portugal: have we reached the end of the golden recovery of the labour market?» in this very Monthly Report). Indeed, in November employment growth slowed to 1.6% year-on-year (1.9% in October), while in December 2018 the unemployment rate stood at 6.7%. This is the same figure as that of November and only 0.1 pp higher than the 6.6% registered in October (its lowest point since the end of 2002). Therefore, the unemployment rate for the whole year on average will have been 7.0%, its lowest annual level since 2004.

The public accounts showed improvement in 2018. According to cash flow data, the budget balance will have ended 2018 at –1.0% of GDP, which is an improvement on the –1.3% of 2017 thanks to the greater buoyancy of revenues (5.2% year-on-year, based on data up to December) compared to expenditure (4.5% year-on-year). This improvement was favoured by the business cycle, which facilitated the growth in tax revenues and contributory receipts (5.3% year-on-year), two components that together account for almost all of the increase in revenues seen in 2018. In light of these figures, which are based on cash flow criteria, it is worth recalling that the European Commission assesses countries’ public accounts on the basis of national accounting criteria, which are due to be published on 26 March.

The banks are taking advantage of the economic outlook to clean up their balance sheets. The non-performing loan rate fell to 11.3% in Q3 2018, a 0.4-pp reduction compared to the previous quarter. This placed the total of non-performing loans in absolute terms at 31,171 million euros in Q3, which is 19,288 million euros below the high-point reached in Q2 2016. However, despite the improvement, this rate remains high and above the euro area average (3.4% in September). On the other hand, thanks to strong growth in consumer lending (11.7% year-on-year) and a recovery in residential lending (–1.1% compared to the –2.2% of November 2017), in November 2018 the total balance of lending to individuals stabilised following three months of moderate increases (which had brought an end to eight years of contraction). The stock of lending to companies, meanwhile, continued to decline (–4.3% year-on-year) due to the sales of non-performing loan portfolios that the banks are carrying out in order to clean up their balance sheets (correcting for this effect, the company loans portfolio increased by 1.1% year-on-year).