The pace of growth moderates and pockets of risk remain

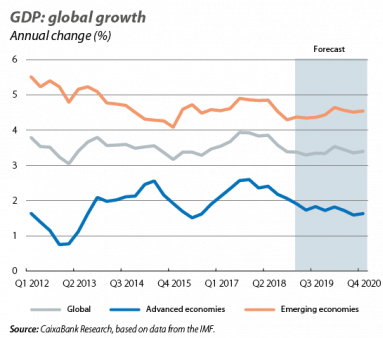

The global economy exhibits more moderate dynamics in the first part of the year. In particular, the global composite Purchasing Managers’ Index (PMI) rebounded slightly in February (from 52.1 points in January to 52.6 points in February), although it remains below the levels of 2018 (average of 53.6). The global economic activity data are reflecting the impact of temporary adverse factors in the advanced economies in the early phases of 2019 (such as the federal government shutdown in conjunction with adverse weather conditions in the US, and the difficulties experienced in the automotive sector in the euro area). Overall, the indicators reinforce CaixaBank Research’s macroeconomic outlook, which predicts a gentle slowdown in global growth from 3.7% in 2018 down to 3.3% in 2019 – still a favourable growth rate. However, the scenario is dominated by downside risk factors, such as the high global geopolitical uncertainty and doubts over the performance of China in 2019, although on a positive note the trade tensions between the US and China have begun to temper in recent months.

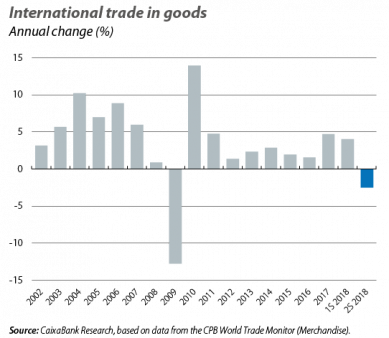

New green shoots emerge in the sphere of trade. Despite the fact that the trade tensions have already begun to take their toll, as reflected in the fall in real trade volumes at the end of 2018, negotiations between the US and China continue to offer a constructive tone and suggest that there will be a reduction in this particular source of global uncertainty over the coming months. Recently, China has announced a new foreign investment law that incorporates some of the US’ demands on trade (in particular, those related to the transfer of technology and greater ease of access for foreign companies to operate in the Chinese market). This has raised expectations that the two powers will reach a basic trade agreement in the near future, thus avoiding a renewed escalation of protectionism and allowing trade flows of certain products between the two countries to increase.

The stakes remain high with Brexit and uncertainty increases. The EU granted an extension to Article 50 (Brexit was scheduled to take place on 29 March). As such, the British Parliament will have until 12 April (the deadline set by Brussels) to decide what steps to take. High political tensions are therefore expected in Westminster in the first two weeks of April, with three possible alternatives: the United Kingdom asking for a prolonged extension to re-evaluate which strategy to follow (in this case, it will take part in the European elections in May), Parliament finally approving the withdrawal agreement negotiated by Theresa May (which seems somewhat unlikely, given that Parliament has already rejected it three times and it does not seem that Labour and the Northern Irish Unionists will change their minds), or a no-deal Brexit taking place on 12 April. As things stand, the first option seems the most likely, although the fragility of the government and the lack of consensus do not allow us to rule out a disorderly departure on 12 April.

US

The US economy is entering a phase of deceleration. Economic activity in the US will slow down in 2019, as the momentum of the fiscal measures introduced in late 2017 and early 2018 will gradually dissipate over the coming quarters. However, this slowdown is expected to be moderate and the economy should grow at just over 2% in 2019. Some of the biggest risks to growth this year are those of a fiscal nature: it is plausible that there could be further government shutdowns, there is a risk that significant spending cuts will be required if the Democrats and Republicans fail to reach agreements on the new spending ceiling, and it seems increasingly unlikely that the current administration will obtain sufficient support for greater infrastructure investment (for an exhaustive analysis, see the Focus «What will be of US fiscal policy? Whatever will be, will be», in this same Monthly Report). Besides the total for the year as a whole, it is worth mentioning that three factors may have weighted down the GDP growth data in the first quarter. On the one hand are two temporary factors, namely the partial government shutdown in January and the extreme cold that struck the north of the country and left many large cities paralysed. On the other hand are the traditional problems of seasonal adjustments in the GDP series in Q1, which tend to weigh down the figures in the first quarter of each year.

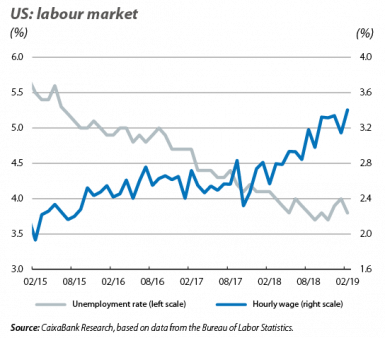

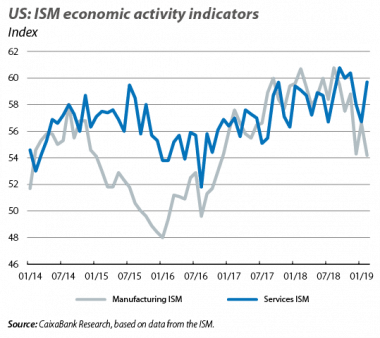

The economic activity indicators remain at notable levels, but the fiscal risks are not to be ignored. In particular, the ISM business sentiment indices remained strong in February (54.2 points for the manufacturing sector and 59.7 for the non-manufacturing sector, both comfortably above the 50-point threshold that separates the expansive territory from the recessive), while other economic activity indicators such as retail sales rose considerably (+2.3% in January). Data for the labour market, meanwhile, proved more moderate in February, but this can be put down to temporary factors and was preceded by an exceptional figure in January.

EURO AREA

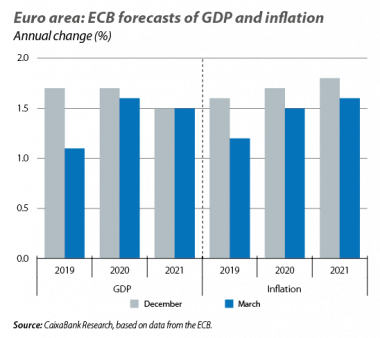

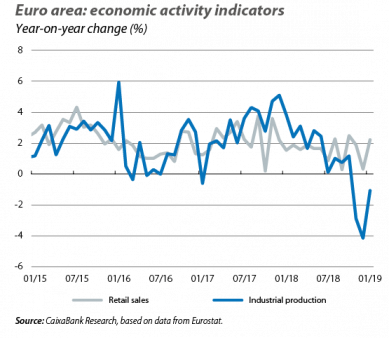

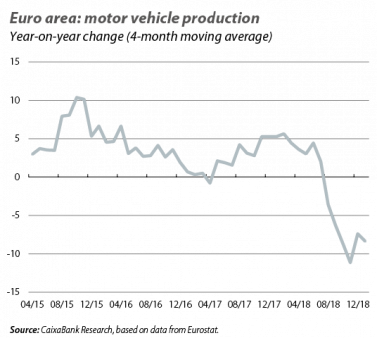

Moderation of the European economy in 2019. The economic activity and sentiment indicators for the early part of 2019 in the euro area show a slight improvement over the closing stages of 2018, and are consistent with favourable but moderate growth. In March, the divergence between sectors has been accentuated: the PMI services index continued to thrive (52.7 points) thanks to the strength of domestic demand, while the manufacturing PMI fell to levels not seen since 2012 (47.6 points) due to disruptions in the automotive sector and weaker global demand. As such, the European economy is expected to see modest growth in the first half of the year (around 1.0%), before accelerating slightly in the second half (provided that the temporary adverse shocks subside, sentiment improves following an easing of trade tensions and the automotive sector makes progress in fully adapting to the new regulations). Major international bodies such as the OECD and the ECB have lowered their forecasts for 2019 to levels of around 1.0%, but they coincide with those of CaixaBank Research in that, after passing the bump in the road in the first half of 2019, the economy is expected to get back on track.

The German locomotive is running out of steam. The problems experienced by the automotive sector in adapting to the new emissions regulations have combined with sluggish global demand for cars (in the US and the euro area due to the reduced cyclical momentum, and in China because consumers have decided to wait in case the government offers them tax incentives), thus affecting the country’s exports and industrial production in Q1 2019. As a result, we have lowered our forecasts for Germany in 2019 by 0.3 pps (down to 1.0%) and those of 2020 by 0.1 pps (1.6%). This, in turn, implies a technical revision of the forecast for the euro area of –1 decimal point, down to 1.3% in 2019.

REST OF THE WORLD

Japan: a pleasant surprise. In quarter-on-quarter terms, the second estimate for Q4 2018 suggested a GDP growth of 0.5% (first estimate: 0.3%). This follows the 0.7% drop in the previous quarter, which was affected by temporary disruptions such as floods and a heatwave. Thus, for 2018 overall, GDP grew by 0.8% (compared to the 0.7% estimated previously).

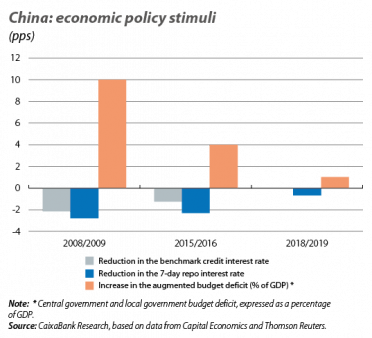

In China, the government makes moves and gives a reassuring message. The Chinese Government has approved tax cuts, which will help the private sector, as well as measures to encourage municipal expenditure on infrastructure. Overall, this fiscal stimulus estimated to represent around 1.0% of GDP. Although far smaller than fiscal support measures adopted in previous episodes, such as during the turbulence of 2015-2016 or the global financial crisis of 2008-2009 (since there is now less room to implement fiscal measures and the current slowdown is less abrupt), the announcements have nevertheless reassured the markets. This is because they reflect the Chinese cabinet’s unequivocal willingness to intervene in order to implement measures that prevent the economy from making a hard landing.

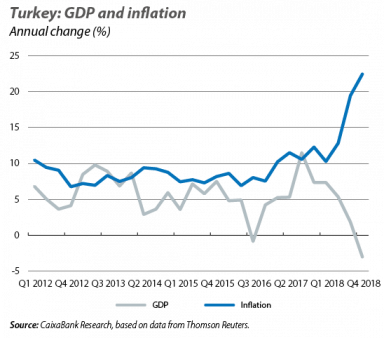

The Turkish economy fails to raise its head. In 2018, Turkey’s GDP growth stood at 2.9%, its lowest since the recession of 2009, due to the economic crisis that has been ravaging the country since last summer. After growing just 1.8% year-on-year in Q3, in Q4 GDP fell by 3.0% year-on-year due to the significant contraction of domestic demand, with sharp declines in consumption and investment. In addition, the negative growth dynamics are likely to continue over the coming quarters, so all the indicators suggest that 2019 will be a difficult year for the Ottoman economy.