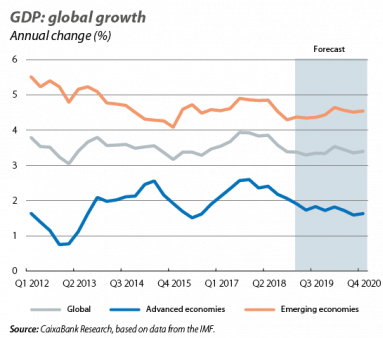

The global economy exhibits more moderate dynamics in the first part of the year. In particular, the global composite Purchasing Managers’ Index (PMI) rebounded slightly in February (from 52.1 points in January to 52.6 points in February), although it remains below the levels of 2018 (average of 53.6). The global economic activity data are reflecting the impact of temporary adverse factors in the advanced economies in the early phases of 2019 (such as the federal government shutdown in conjunction with adverse weather conditions in the US, and the difficulties experienced in the automotive sector in the euro area). Overall, the indicators reinforce CaixaBank Research’s macroeconomic outlook, which predicts a gentle slowdown in global growth from 3.7% in 2018 down to 3.3% in 2019 – still a favourable growth rate. However, the scenario is dominated by downside risk factors, such as the high global geopolitical uncertainty and doubts over the performance of China in 2019, although on a positive note the trade tensions between the US and China have begun to temper in recent months.

The stakes remain high with Brexit and uncertainty increases. The EU granted an extension to Article 50 (Brexit was scheduled to take place on 29 March). As such, the British Parliament will have until 12 April (the deadline set by Brussels) to decide what steps to take. High political tensions are therefore expected in Westminster in the first two weeks of April, with three possible alternatives: the United Kingdom asking for a prolonged extension to re-evaluate which strategy to follow (in this case, it will take part in the European elections in May), Parliament finally approving the withdrawal agreement negotiated by Theresa May (which seems somewhat unlikely, given that Parliament has already rejected it three times and it does not seem that Labour and the Northern Irish Unionists will change their minds), or a no-deal Brexit taking place on 12 April. As things stand, the first option seems the most likely, although the fragility of the government and the lack of consensus do not allow us to rule out a disorderly departure on 12 April.

EURO AREA

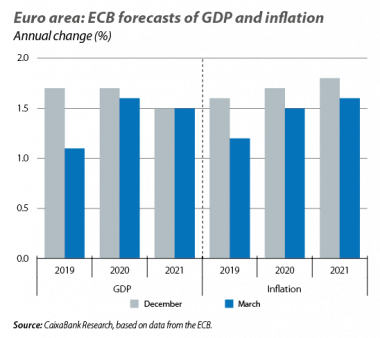

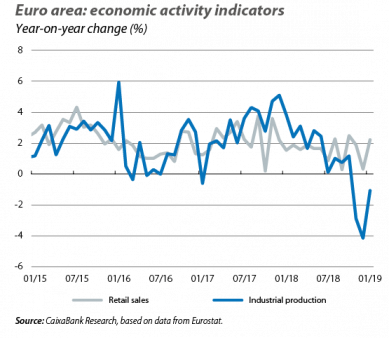

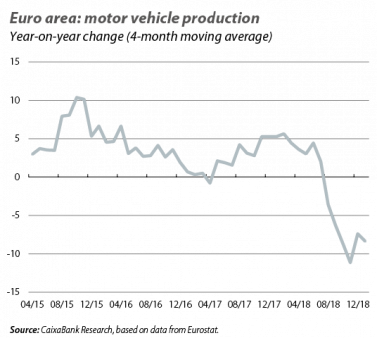

Moderation of the European economy in 2019. The economic activity and sentiment indicators for the early part of 2019 in the euro area show a slight improvement over the closing stages of 2018, and are consistent with favourable but moderate growth. In March, the divergence between sectors has been accentuated: the PMI services index continued to thrive (52.7 points) thanks to the strength of domestic demand, while the manufacturing PMI fell to levels not seen since 2012 (47.6 points) due to disruptions in the automotive sector and weaker global demand. As such, the European economy is expected to see modest growth in the first half of the year (around 1.0%), before accelerating slightly in the second half (provided that the temporary adverse shocks subside, sentiment improves following an easing of trade tensions and the automotive sector makes progress in fully adapting to the new regulations). Major international bodies such as the OECD and the ECB have lowered their forecasts for 2019 to levels of around 1.0%, but they coincide with those of CaixaBank Research in that, after passing the bump in the road in the first half of 2019, the economy is expected to get back on track.

The German locomotive is running out of steam. The problems experienced by the automotive sector in adapting to the new emissions regulations have combined with sluggish global demand for cars (in the US and the euro area due to the reduced cyclical momentum, and in China because consumers have decided to wait in case the government offers them tax incentives), thus affecting the country’s exports and industrial production in Q1 2019. As a result, we have lowered our forecasts for Germany in 2019 by 0.3 pps (down to 1.0%) and those of 2020 by 0.1 pps (1.6%). This, in turn, implies a technical revision of the forecast for the euro area of –1 decimal point, down to 1.3% in 2019.

Portugal: making good progress

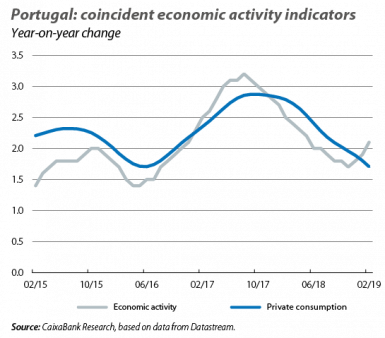

Economic activity performs well at the start of the year. The Bank of Portugal’s coincident economic activity indicator rose to 2.1% in February (1.9% in January), while the National Statistics Institute’s activity indicator showed 2.4% year-on-year growth in January (having remained at 2.2% since October). In addition, retail sales accelerated in January and February compared to the average in Q4 2018, while other indicators, such as cement sales and commercial vehicle sales, have also given off positive signals. However, these figures coexist with other, not so positive dynamics. On the one hand, in February, the Bank of Portugal’s private consumption coincident indicator fell slightly (to 1.7%, compared to 1.8% in January) and the consumer confidence index decreased once again (–8.3 points in February compared to –7.2 in January), reflecting lower optimism among households about the economic outlook for the next 12 months. In the foreign sector, meanwhile, in January the trade balance in goods fell once again (with a 3.3 billion euro widening of the trade deficit, up to 17.9 billion, for the cumulative balance of the past 12 months), faced with higher growth in imports (8.5%) than in exports (4.8%). Overall, therefore, the indicators suggest that the growth rate lies at nearly 2% in Q1 2019.

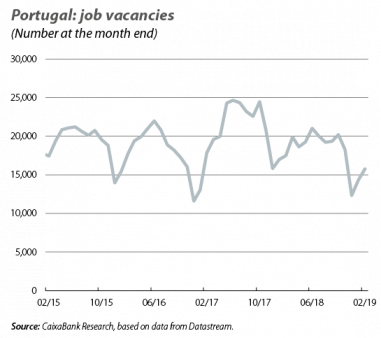

The recovery of the labour market continues in a more mature cyclical context. In February, the unemployment rate stood at 6.3% (–1.3 pps compared to February 2018), with 64,600 fewer people in unemployment (–16.5% year-on-year). The population in work, meanwhile, reached 4,844,600 people, representing an increase of 62,700 over February 2018 (1.3% year-on-year). However, in both cases the improvement was more moderate than that registered in 2018 (a 20.8% fall in unemployment and a 2.3% rise in the number of people in work). Coupled with the decline in job vacancies on offer (–12.8% year-on-year on average for January and February 2019), this points towards more moderate growth in the labour market. Thus, although the labour market continues to perform well, it is showing signs of a slowdown compared to the past two years, and this trend is expected to continue over the coming quarters, consistent with more moderate GDP growth.

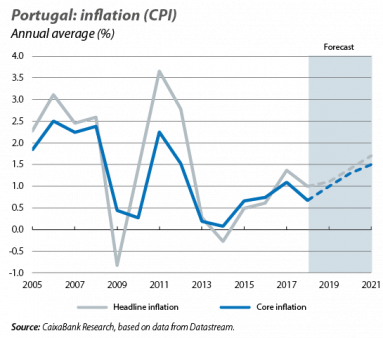

Inflation remains stable in March. According to the non-harmonised consumer price index (CPI), headline inflation remained at 0.9% year-on-year in March (the same figure as in February). This stability was the result of the balance between the acceleration in energy prices (+1.3%, following a fall of –0.7% in February) and the moderation in core inflation, which stood at 0.7% in March (1.0% in February). However, over the coming quarters, a slight acceleration in inflation is expected, given the strong performance of the labour market and the resulting greater buoyancy in wages.

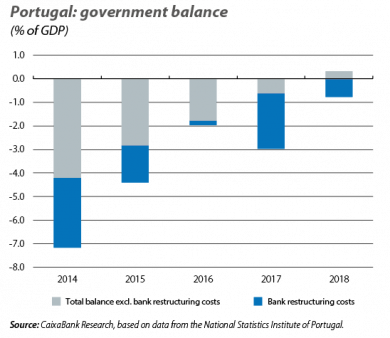

The correction of the budget deficit continues. In particular, the general government deficit stood at 913 million euros in 2018, representing –0.5% of GDP (in 2017 it was –3.0%, or –0.9% excluding the recapitalisation of Caixa Geral de Depósitos). This improvement reflects both strong revenue growth (5.5% year-on-year) and a 0.3% reduction in public expenditure (a decrease that is due to the base effect of the recapitalisation of Caixa Geral de Depósitos, since total expenditure would have increased by 4.4% if we excluded it). The good performance of economic activity and the labour market contributed to the increase in tax revenues (5.9% year-on-year), while the low interest rate environment (coupled with the more favourable financing conditions, after the rating agencies increased Portugal’s credit score several times in 2018) contributed to a 6.5% year-on-year drop in interest payments (–481 million euros). Last but not least, in March S&P raised its credit rating for Portugal’s sovereign debt from BBB– to BBB.

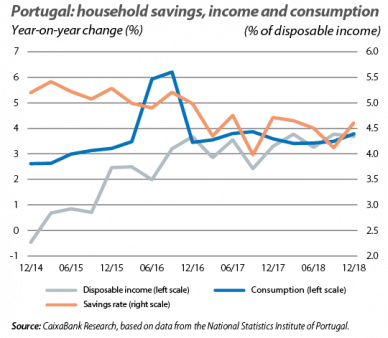

The external lending capacity deteriorates. In particular, the external lending capacity of the economy as a whole slipped to 0.2% of GDP in 2018 (1.1% in 2017). This was particularly due to the greater funding needs of the non-financial business sector (which went from –0.8% in 2017 to –2.0% in 2018, a deterioration largely driven by the greater investment in the sector). In addition, the financial sector registered a net lending capacity of 1.9% of GDP, marking a clear deterioration compared to the 3.8% registered in 2017. The lending capacity of households, meanwhile, declined more moderately (from 1.0% in 2017 to 0.7% in 2018), while the central government reduced its funding needs to –0.5% of GDP (–3.0% in 2017, or –0.9% if we exclude the recapitalisation of Caixa Geral de Depósitos). Also of note in the households sector was the slight reduction in the savings rate, dropping from 4.7% of disposable income in 2017 to 4.6% in 2018.

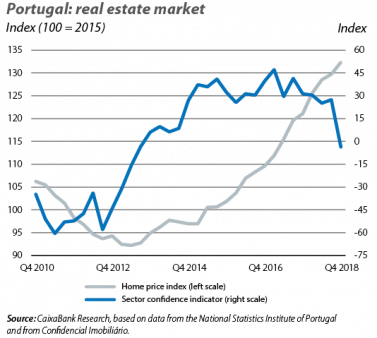

The real estate sector ended 2018 on a strong note. In the last quarter of 2018, the home price index grew by 9.3% year-on-year (0.8 pps more than in Q3), with an increase of 9.5% in existing home prices and of 8.5% in the case of new homes. Thus, for 2018 as a whole, the home price index rose at an average annual rate of 10.3% (an acceleration of 1.1 pps compared to 2017). Furthermore, 178,691 homes were sold in 2018, 16.6% more than in 2017. Over the next few quarters, the real estate market is expected to remain buoyant, supported by demand for housing that will continue to be favoured by accommodative financial conditions and tourist activity that is still thriving despite some slowdown. Nevertheless, the recovery in the construction of new homes will contribute to a moderate deceleration in price growth.