The financial markets complete a semester of contrasts

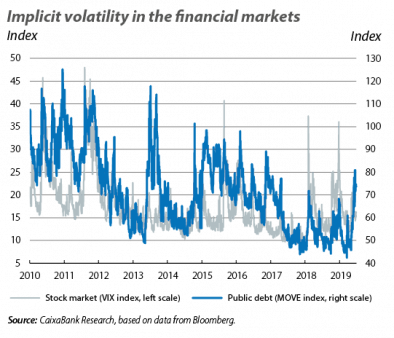

Stock markets on the rise, interest rates at minimum levels and central banks set to close an eventful semester. In June, the financial markets closed an eventful semester, marked by successive alternations between periods of calm and episodes of risk aversion and volatility, with a constructive tone. In particular, following an end of 2018 with significant stock market losses and falling interest rates, in the first months of 2019 the markets exhibited a constructive tone. This was supported by the alleviation of trade tensions, the slowdown in the tightening of monetary policy by the major central banks and some encouraging economic data. Nevertheless, the serenity and the significant stock market gains took a sharp decline in May when the trade negotiations between the US and China broke down and fears of a marked slowdown in the global economy returned. This led to a rebound in risk aversion, with the resulting stock market losses and sinking interest rates. In this context, in June the major central banks opened the door to the possibility of relaxing monetary policy as a preventive measure to combat the intensification of the risks to economic activity. Although these messages were received with a recovery of sentiment in the markets, stock prices reflect expectations of a much more accommodative monetary policy than what the central banks are currently indicating, and such an imbalance could lead to renewed episodes of volatility over the coming quarters.

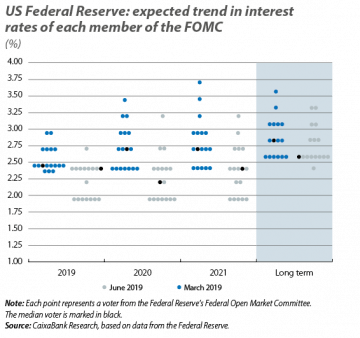

The Fed opens the door to lowering interest rates. At its June meeting, the Fed gave a positive assessment of the US economy and reiterated the favourable outlook for the economic scenario in the medium term. As such, it maintained its reference interest rates within the 2.25%-2.50% range. Nevertheless, the members of the Fed placed greater emphasis on the persistence and intensification of risks (such as the resurgence of trade tensions and the uncertainty surrounding the slowdown in the global economy). With these concerns, and in view of the fact that inflationary pressures remain moderate, the Fed opened the door to the possibility of lowering its reference rates over the coming months, stating that it is prepared to offer new stimulus in the event that the risks continue to undermine economic confidence. In particular, at the meeting the Fed also presented the quarterly update of its macroeconomic forecasts. Although this did not include any major changes to the projections for economic activity and inflation, there was a significant reduction in the interest rate forecasts: almost half of the members of the Fed now foresee at least one rate cut this year (see second chart). Therefore, stock prices reflect a 100% probability that the Fed will reduce interest rates by 25 bps in July. Although this expectation is consistent with the clues given by the Fed itself, the stock prices go even further and suggest a high probability that interest rates will have been lowered by around 100 bps by late 2020 (a much more aggressive reduction than that reflected by the expectations of the members of the Fed).

The ECB emphasises the uncertainties and stresses the accommodative message. Much like the Fed, at its June meeting the ECB maintained a relatively positive view of the medium-term outlook but stressed the need to preserve an accommodative financial environment to support domestic demand and inflation, in the face of the persistence and escalation of risks. Thus, the ECB reiterated that it will continue to be present in the markets for a long time to come through asset reinvestments, it postponed the indicative date for the first rate rise until December 2020, and it specified a more favourable-than-expected cost for the new round of TLTROs due to begin in September (which will lie somewhere between the refi rate +10 bps and the depo rate +10 bps, depending on the extent to which certain new lending targets are met). Furthermore, a few days later at the ECB’s annual conference in Sintra (Portugal), the president Mario Draghi went a step further and stated that if the risks do not subside, the ECB must intensify its monetary stimulus. In particular, Draghi pointed out that the ECB may once again delay the first rate rise, or even cut interest rates (something that would possibly be linked to measures that mitigate the potential adverse effects of negative interest rates), and/or resume net purchases of assets.

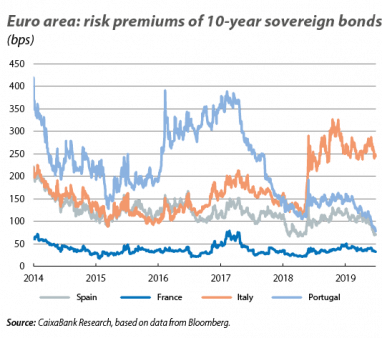

Sovereign yields remain at minimum levels. The accommodative messages from the central banks led sovereign yields to fall even further (having already reached a low point in May, due to growing risk aversion and the resulting demand for safe haven assets). Specifically, yields on 10-year US and German sovereign bonds fell by over 10 bps, reaching 2.0% (a level not seen since late 2016) and –0.3% (an all-time low), respectively. The risk premiums of the euro area periphery, meanwhile, fell sharply and the yield of 10-year debt in Spain and Portugal fell below 0.4% and 0.5%, respectively. Italy’s differential also experienced a decline, although it remains at substantially higher levels than those of neighbouring economies.

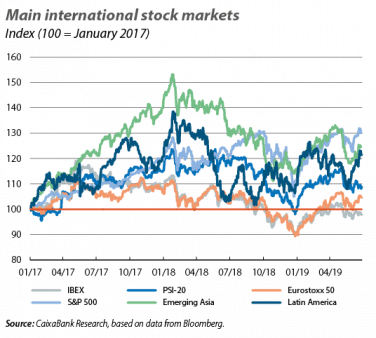

The stock markets recover. After suffering substantial losses in May, the main stock market indices rose steadily in June, propped up by the accommodative messages of the central banks and moderate optimism over the meeting between the presidents of the US and China at the G-20 summit at the end of the month. As such, in the US the S&P 500 rose by 6.9%, while in Europe the Eurostoxx 50 climbed 5.9%, with more sustained gains in the central economies than in the periphery (+5.7% in the German DAX and +6.4% in the French CAC, compared to +2.2% in the Ibex 35 and +1.9% in the PSI-20). In the emerging bloc, meanwhile, the MSCI index for all emerging economies as whole registered gains of around 6%.

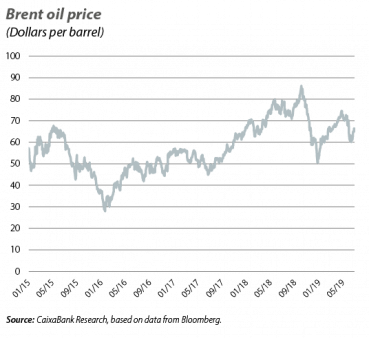

The oil price settles at around 65 dollars. In the context of a recovery in investor sentiment, and awaiting confirmation from OPEC and its partners regarding the extension of the oil production cuts for the second half of the year, the price of a barrel of Brent oil fluctuated around 65 dollars and suffered some ups and downs due to the tensions between the US and Iran (with conflicting statements regarding the sabotage of oil tankers sailing through the Strait of Hormuz, a strategic enclave through which 20% of the world’s oil passes).