The Spanish economy shows strength in a demanding semester

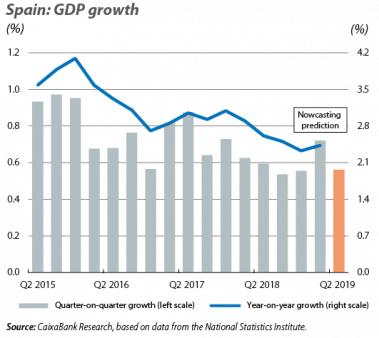

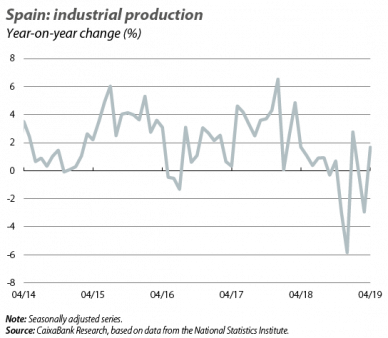

Economic activity continues to grow at a steady pace. In the more adverse external environment described in the section on the economic outlook for the international economy of this same Monthly Report, the indicators show that the Spanish economy is weathering the slowdown in the global economy better than its European partners. In particular, after growing by a solid 0.7% quarter-on-quarter (2.4% year-on-year) in Q1 2019, CaixaBank Research’s short-term GDP forecasting model suggests a quarter-on-quarter growth of 0.6% in Q2 (the first GDP estimate will be published on 31 July). This growth rate reflects the high level of job creation, the improvement in consumer confidence and the steady growth of turnover in both the services sector (+5.4% year-on-year in April, three-month moving average) and the industrial sector (+2.4% year-on-year). In addition, industrial production rebounded in April with growth of 1.7% (in March it had fallen by 3.0%, held back by the energy sector, which is especially volatile). On the other side of the scales, there has been a certain weakening of business confidence (in May, the manufacturing and services PMIs fell by 1.7 and 0.3 points down to 50.1 and 52.8 points, respectively), as well as of the foreign sector. Nevertheless, for the time being they are not holding back growth rates, which remain at considerable levels. As such, although growth continues to moderate towards levels that are more in line with the economic potential, and thus more sustainable, Spain remains one of the countries with the best growth rates in the euro area, driven particularly by the contribution from domestic demand and investment. This is also reflected in the latest macroeconomic forecasts by the ECB, which in the breakdown by country suggest that Spain’s GDP will grow by 2.4% in 2019 as a whole, a figure in line with the scenario foreseen by CaixaBank Research (forecast of 2.3%).

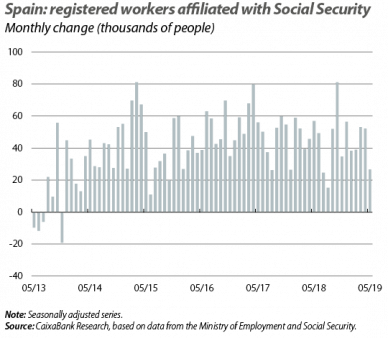

The labour market shows dynamic growth. Employment growth stood at 2.8% year-on-year in May (seasonally adjusted data). This represents a good pace of job creation, albeit slightly lower than the 3.0% registered in April (on the other hand, this moderation is consistent with the trend towards more moderate growth in economic activity discussed earlier). Thus, the total number of people affiliated with Social Security stood at 19,442,113, very close to the all-time high reached in July 2007. By sector, the increased affiliation in services was of particular note, especially in tourism (+3.4%). On the other hand, the latest quarterly labour cost survey shows that, in the first quarter, the effective labour cost per hour rose by 2.4% year-on-year. This represents a 0.5-pp acceleration compared to the second half of 2018. This can partly be explained by the increase in company contributions at the beginning of the year (increase in the minimum wage and the removal of the contribution limit). Furthermore, this trend in labour costs is consistent with the wage increases agreed in collective agreements (2.2% on average from January to May).

Spain comes out of the excessive deficit procedure, after reducing its deficit to below 3% in 2018 (specifically, to 2.5%), and enters the preventive phase of the Stability and Growth Pact. This entails a change in the European Commission’s approach to monitoring the public accounts, shifting towards medium-term goals such as the structural deficit, which allows the long-term fiscal position of the general government to be assessed (regardless of where the economy currently lies in the business cycle). Thus, the European Commission has requested from Spain a reduction in its structural deficit of 0.65% of GDP by 2020, slightly greater than the adjustment planned by the government in the Stability Plan (0.5% of GDP). As part of the reforms, the European authorities recommended reducing the duality of the labour market, maintaining the sustainability of the pension system and reducing regulatory fragmentation. The Commission also recommended that any one-off tax revenues should be used to reduce the level of public debt, which remains high (98.7% in Q1 2019).

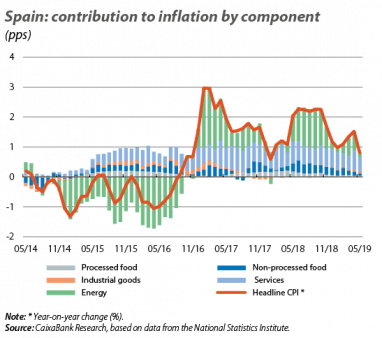

Inflation remains very contained and in June moderateto 0.4% (0.8% in May). Although the breakdown by component is not yet known, the fall in fuel prices suggests that the energy component would explain the bulk of the reduction. Core inflation, meanwhile, stood at 0.7% in May (the figure for June is not yet known), representing a 0.2-pp slowdown relative to April. This is partly the result of the fall in the prices of tourist packages and the calendar effect of Easter.

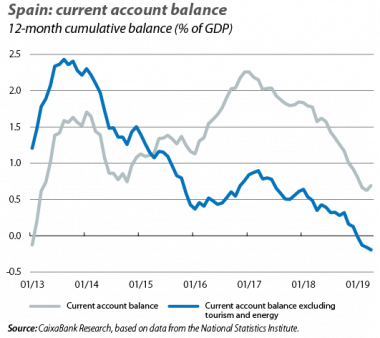

Respite in the deterioration of the current account balance. The current account balance improved in April, climbing to 0.7% of GDP (12-month cumulative balance), versus 0.6% in March. However, compared to April 2018 this figure still represents a reduction in the surplus of 0.9 pps. This deterioration is mainly attributable to the balance of non-energy goods (0.4 pps), the balance of services (0.3 pps) and, to a lesser extent, the energy balance (0.2 pps). The net international investment position (NIIP), meanwhile, stood at -77,7% of GDP in Q1 2019, which represents a slight deterioration compared to the previous quarter. All in all, over the past 12 months there has been a substantial improvement (of 6.1 pps), largely thanks to the revaluation of instruments in the debt portfolio.

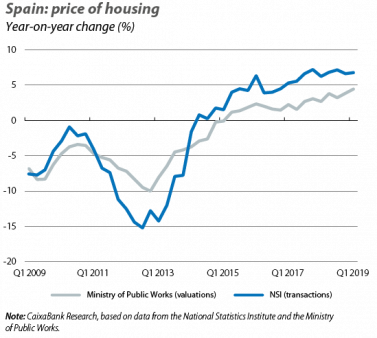

The real estate sector, in a more mature phase of the cycle. The price of housing based on transactions (published by the NSI) grew by a considerable 6.8% year-on-year in Q1 2019, driven by the rise in the price of new housing (10.4%, compared to 8.0% in Q4), while second-hand housing slowed its pace of growth (6.2% in Q1, 6.4% in Q4). Over the coming quarters, the growth in housing prices will remain high, albeit with a slight moderation (around 5% on average in the period 2019-2020, according to CaixaBank Research) due to the real estate sector entering a more mature phase of the cycle. In line with this trend, the growth of home sales moderated in April, standing at 5.7% year-on-year (in 12-month cumulative terms), following four years of double-digit growth. As is the case in housing prices, sales of new and second-hand homes are following different trends. In particular, new home sales continued to go from strength to strength, registering 10.7% growth in April, compared to 4.6% growth in the case of second-hand homes (12-month cumulative figures).